Parsio is one of the invoice OCR tools used by thousands of people all around the world.

However, Parsio might not be for everyone.

In this article, we’ll talk about what Parsio alternatives are available and what would be great for receipt and invoice processing

The Best Parsio Alternatives at a Glance

Here is a quick overview of the alternatives of Parsio and their features and specializations:

| Alternatives | Best for | Standout features |

| DocuClipper | Financial Documents | Transaction Categorization, Batch Processing, Line Item Extraction |

| AutoEntry | Accounting Processes | Mobile Accessibility, Scalability, Easy Integration |

| Dext Prepare | Document Management | Automatic Data Extraction, High Efficiency, User-Friendly Interface |

| Nanonets | Custom Deep Learning Models | Fast Data Processing, Wide Document Type Support |

| Docsumo | Financial Sector | High Efficiency, Responsive Support |

| Docparser | Document Parsing | Custom Parsing Rules, Workflow Automation |

| Parseur | PDF and Email Processing | Dynamic OCR, AI-Powered Data Extraction |

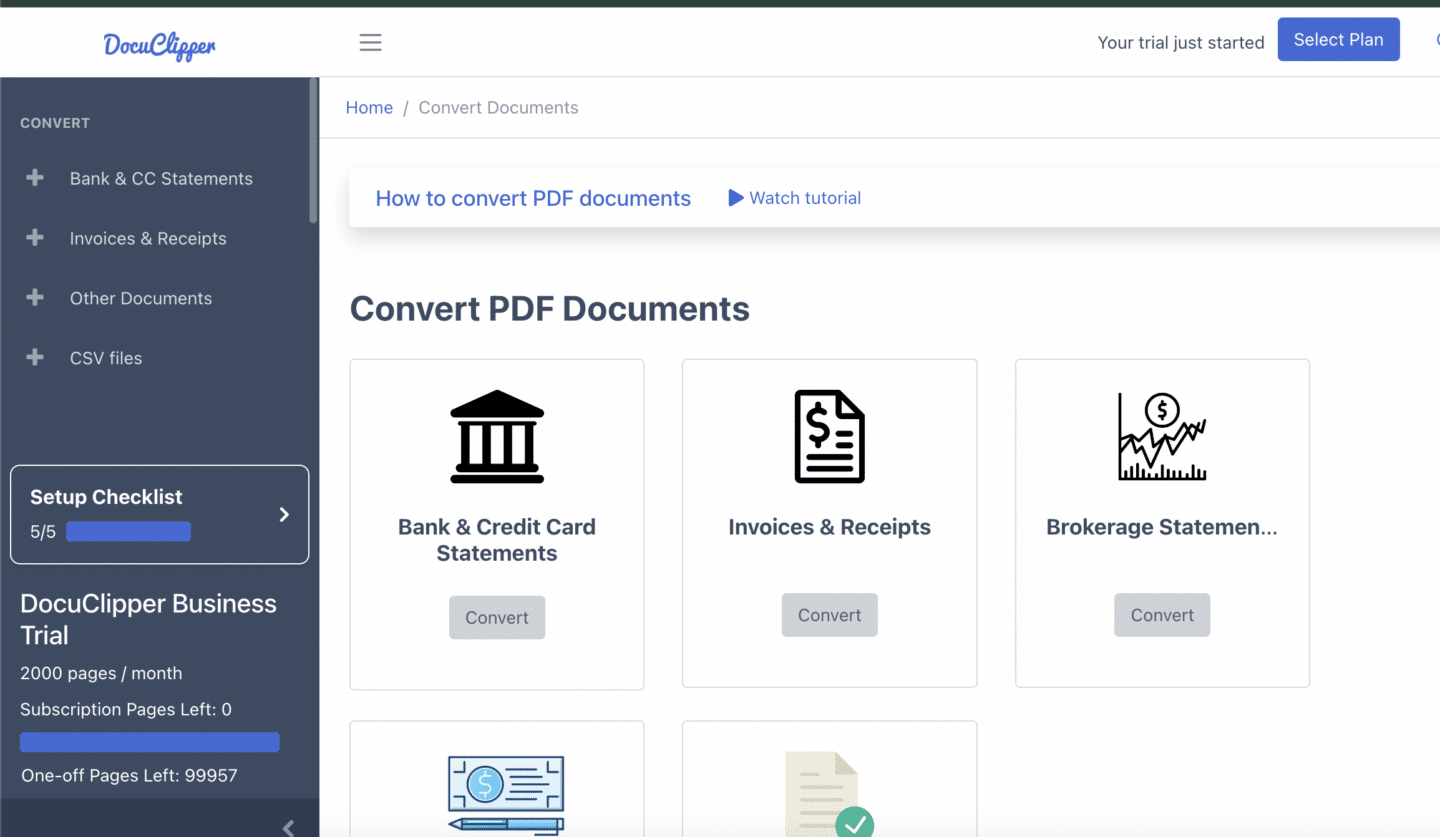

1. DocuClipper

DocuClipper is a top OCR software designed to transform receipts, invoices, tax forms, and financial statements into Excel, CSV, and QBO formats. This tool captures and organizes data from these documents, streamlining your data entry.

Using advanced OCR technology and specialized algorithms for financial documents, DocuClipper ensures high accuracy and quick data capture.

It’s an essential tool for businesses aiming to improve accuracy, reduce manual tasks, and enhance efficiency in financial document management.

Whether you’re dealing with monthly statements or daily invoices, DocuClipper automates the process, saving you time and simplifying your operations

Key Features

- Versatile Format Support: Handles all types of invoices, receipts, and financial statements.

- Automated Data Extraction: Extracts data from financial documents automatically without templates.

- Bulk Processing: Efficiently processes hundreds of documents simultaneously.

- Robust Security: Ensures data protection with SOC 2 compliance, Amazon servers, and AES 256-bit SSL encryption.

- Customizable Output: Customize spreadsheets for bank and credit card statements, selecting specific fields like dates, descriptions, and balances.

- Transaction Categorization: Automatically sorts transactions by keywords for easier analysis.

- Financial Analysis Tools: Provides insights into cash flow, spending, and P&L statements, and detects fraudulent transactions quickly.

Pros

- User-Friendly: DocuClipper’s web-based interface is simple to use. It has a simple interface with an easy-to-navigate bank statement converter, a receipt scanner app, and invoice data extraction software.

- Cost-Effective: Especially suitable for small businesses, DocuClipper offers affordable page pricing compared to others using line item pricing

- High Accuracy: With OCR technology, DocuClipper accurately converts financial documents into CSV, XLS, or QBO formats, ensuring precise data entry.

- Fast: DocuClipper processes hundreds of documents in just under a minute, significantly higher compared to traditional invoice OCR processing tools.

- Secure: Your data is encrypted and stored securely on protected servers, ensuring complete data safety.

Cons

- No Mobile App: DocuClipper lacks a mobile application with camera integration, requiring financial documents to be converted to PDF first.

- Not Many Integrations: DocuClipper only supports three native integrations with Sage, Xero, and QuickBooks. The rest needs to be integrated via API.

Pricing

- Starter: $39/month for 200 pages per month.

- Professional: $74/month for 500 pages per month.

- Business: $159/month for 2000 pages per month.

- Enterprise: Custom pricing for a custom number of pages per month. Contact DocuClipper for more details.

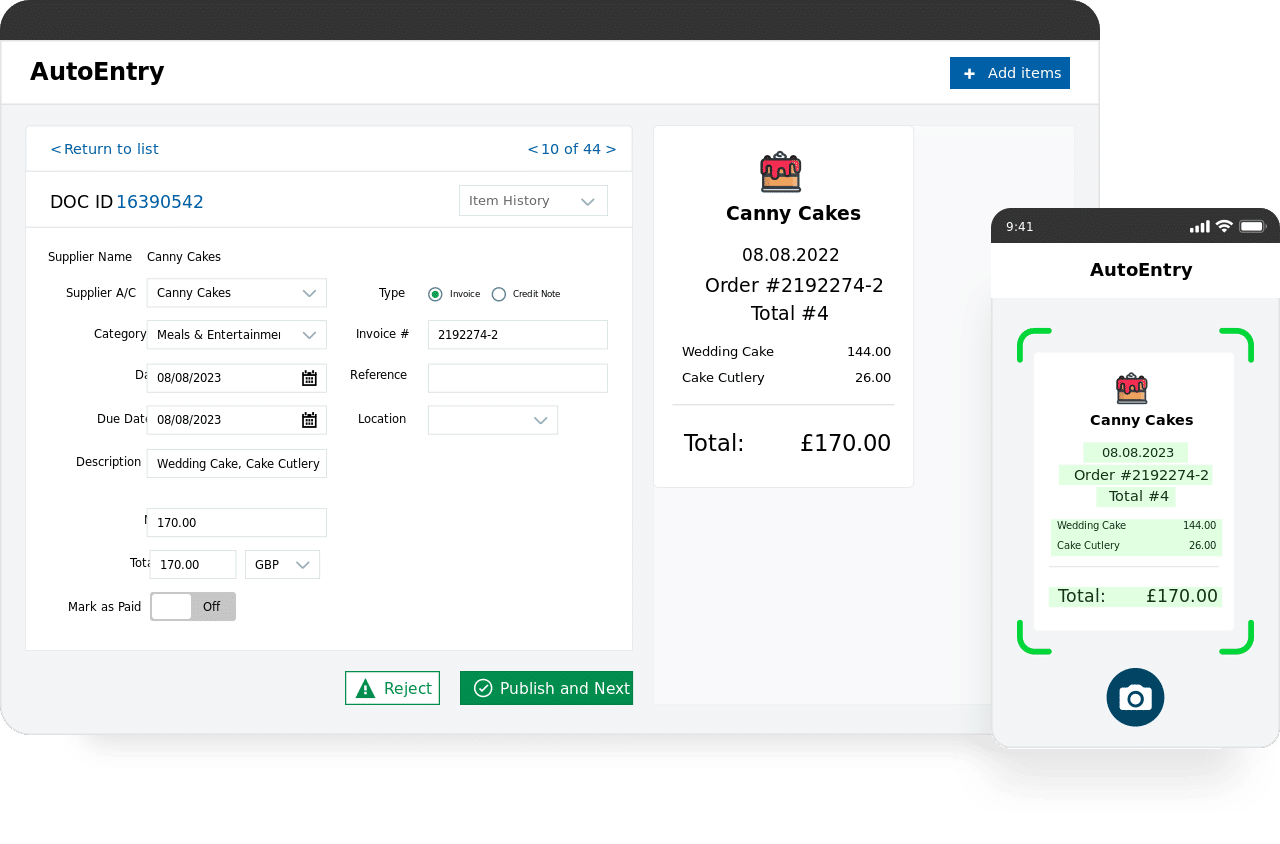

2. AutoEntry

AutoEntry is a dedicated data automation tool designed to streamline your accounting processes. It automates data extraction and seamlessly integrates with major accounting software platforms.

It is an invoice scanning software for accounting purposes, offering a flexible, contract-free solution. Its accessibility and ease of use make it an ideal choice for businesses worldwide, enhancing efficiency without long-term commitments.

With AutoEntry, you can effortlessly manage your financial data, saving time and reducing manual entry errors. This makes it a valuable asset for businesses seeking to optimize their accounting workflows.

Key Features

- Multiple Submission Methods: Submit data by uploading documents to the AutoEntry website, taking pictures via the mobile app, using unique email addresses, or the fetching module.

- Email Forwarding: Forward documents sent to your email to your unique AutoEntry email address for automatic processing.

- Mobile App Convenience: Snap pictures of paper invoices, receipts, or expenses for direct submission to your account.

- Automated Categorization: Teach AutoEntry to apply rules for consistent document categorization.

Pros

- Ease of Use: Scan or email documents like receipts and invoices, or use the mobile app to capture images quickly.

- Mobile Accessibility: The mobile app allows you to capture invoices on the go, streamlining the data entry process.

- Scalability: Supports an unlimited number of companies and users from the start, with all features readily accessible.

Cons

- Integration Issues: Some users experience difficulties integrating AutoEntry with accounting platforms like Xero, especially when publishing invoices.

- Customer Service: There have been complaints about slow response times and unresolved billing issues, even post-service cancellation.

- Software Reliability: Occasional glitches and software disruptions have been reported, affecting AutoEntry’s performance and causing user frustration.

Pricing

- Bronze: $15/month for 50 credits.

- Silver: $26/month for 100 credits.

- Gold: $48/month for 200 credits.

- Platinum: $112/month for 500 credits.

- Diamond: $315/month for 1500 credits.

- Sapphire: $494/month for 2500 credits.

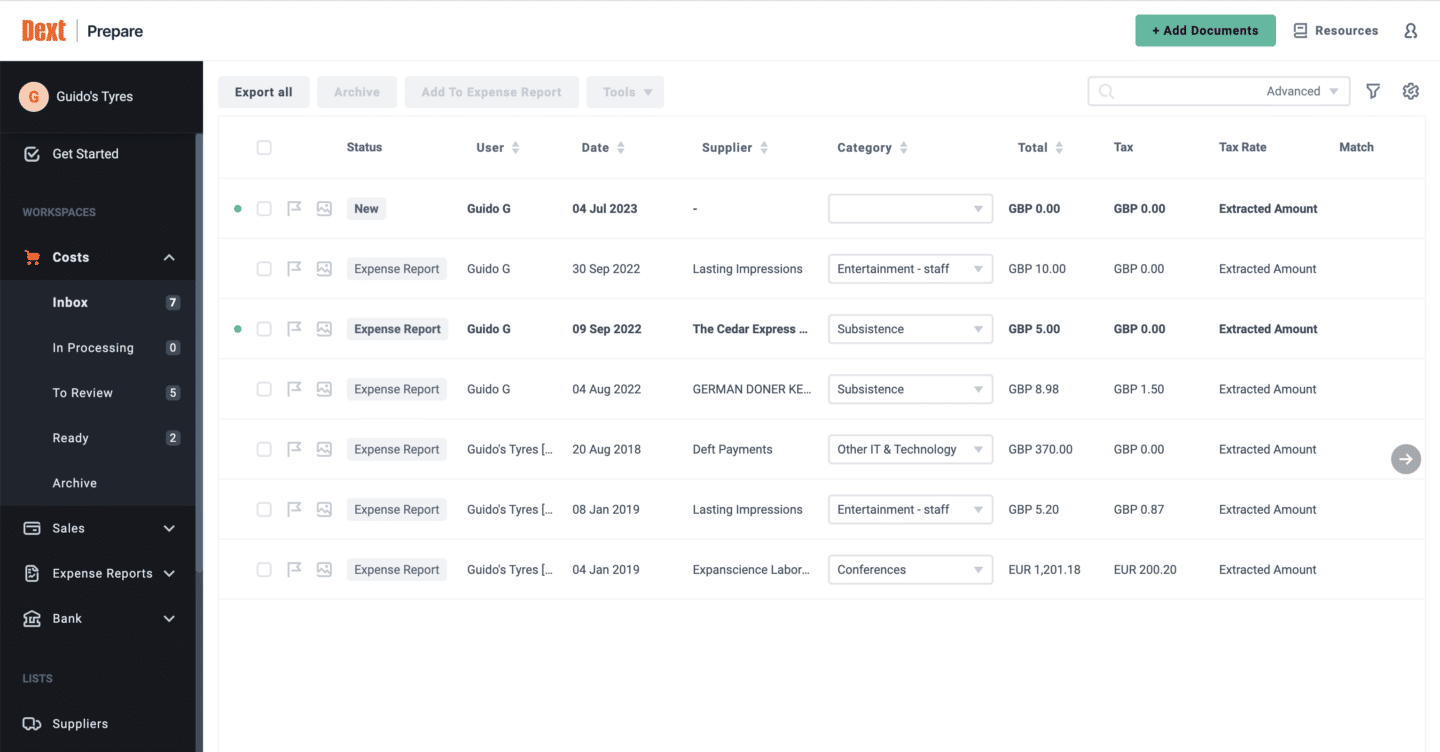

3. Dext Prepare

Dext Prepare is a cloud-based document management and automation tool designed to simplify your financial processes. With Dext Prepare, you can effortlessly capture, extract, and organize financial documents such as invoices, receipts, and expense reports.

This software can also automatically match documents to transactions in your accounting software, saving you time and reducing costs.

By automating these tasks, Dext Prepare helps businesses streamline their financial workflows, ensuring efficient and accurate document handling. This powerful tool is essential for enhancing productivity and maintaining organized financial records.

Key Features

- Automatic Data Extraction: Extract key data such as date, amount, and vendor from documents seamlessly.

- Organized Filing: Organize your documents into folders and projects for better management.

- Collaborative Access: Allows multiple users to collaborate on documents efficiently.

- Report Generation: Generate detailed reports on document data for insightful analysis.

- Integration with Accounting Software: Easily integrate with your existing accounting software for streamlined financial management.

- Versatile Document Capture: Capture documents from scanners, mobile devices, and email.

Pros

- User-Friendly Interface: Both the web platform and mobile app are designed intuitively, with comprehensive training resources to assist you.

- High Efficiency: Accurate data recognition and predefined supplier rules streamline the review and posting of bulk expenses.

- Accessible to Non-Financial Users: Simplifies processes to minimize errors, making it easy for those without a financial background to manage accounting tasks effectively.

Cons

- Not Ideal for Large Businesses: Lacks support for multi-level approval of expense reports, which can be limiting for larger organizations.

- Document Processing Delays: Sometimes there are delays in processing invoices and receipts, which can slow down workflow.

- Customer Service and Billing Concerns: Users have faced issues with misleading sales practices, billing discrepancies, and slow customer support responses.

Pricing

Monthly or annual subscription options are available, with a 13% savings on annual subscriptions. Customizable plans made to specific business needs.

Typical pricing for a plan includes:

- $199.99/month (annual subscription billed monthly): 10 clients, unlimited users.

- $214.99/month (annual subscription billed monthly): Additional features and support.

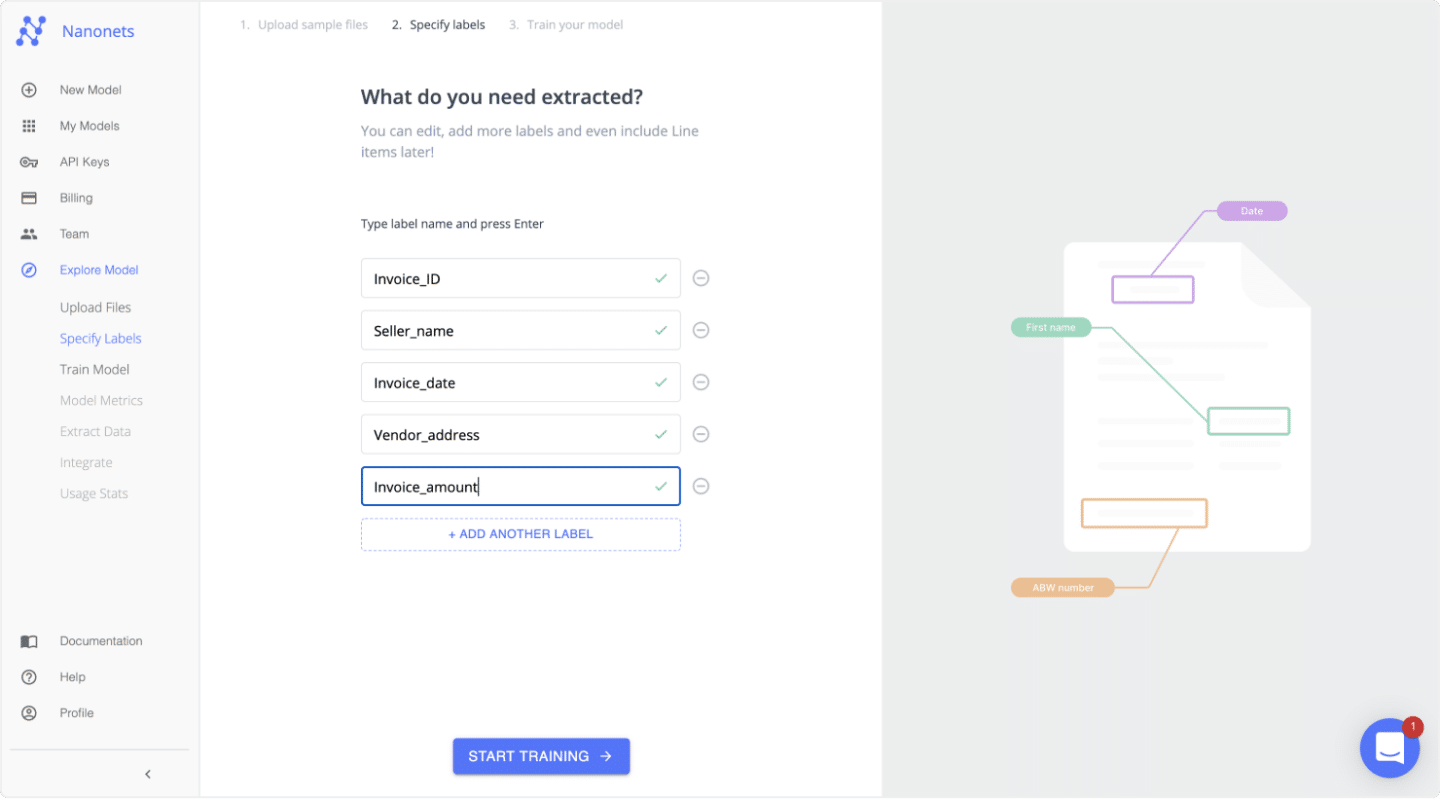

4. Nanonets

Nanonets is a machine learning platform that empowers businesses to create custom deep learning models without needing to write any code.

It’s ideal for tasks like document extraction, object detection, and image classification. Using Nanonets OCR, you can convert various data sources, such as electrical meter readings and food menus, into structured data formats.

The platform accommodates multiple document types, including ID cards, mortgage forms, invoices, income proofs, and purchase orders. This broad support makes Nanonets an excellent choice for automating data extraction and classification across diverse applications and industries.

Key Features

- Advanced Document Classification and Extraction: Easily train and deploy machine learning models to classify and extract data from invoices, receipts, contracts, and more, reducing manual data entry.

- User-Friendly Interface: Build custom models without extensive programming knowledge by defining document structures and specifying data for extraction.

- Pre-Built Models and Templates: Utilize templates and customizable pre-built models like Driver License OCR, Passport OCR, and ID Card OCR for common scenarios, supporting multiple languages and layouts.

- Versatile OCR and AI Technology: Apply OCR and AI to various documents including receipts, invoices, purchase orders, and bills of lading.

- Wide File Format Support: Work with popular file formats such as PDF, JPG, PNG, and TIFF, ensuring flexibility with existing data.

Pros

- Comprehensive Document Handling: Supports a vast range of document types, making it versatile for different needs.

- Sophisticated AI and OCR Technology: Leverages state-of-the-art AI and OCR capabilities for superior data extraction.

- Outstanding Customer Support: Provides excellent assistance to address your queries and issues promptly.

- Exceptional Accuracy: Delivers high precision in extracting data from various document formats, ensuring reliability.

- Speedy Data Processing: Ensures fast processing of documents, enhancing your operational efficiency and saving valuable time.

Cons

- Complexity for Beginners: The advanced features and wide document support can be overwhelming if you’re new to AI and OCR technology.

- Learning Curve: Despite excellent customer service, there may be a steep learning curve to fully utilize all features.

- Customization Time: Customizing models to fit specific needs can be time-consuming.

- Cost Considerations: High accuracy and fast processing come at a premium, which may not be cost-effective for small-scale users.

- System Requirements: Advanced AI processing may require robust system resources, which could be a limitation for some users

Pricing

- Starter: Free for the first 500 pages, then $0.3/page. No monthly fee, pay as you go, with 3 starter models and limited fields.

- Pro: $499/month per model, includes 5000 pages, then $0.1/page. Offers auto-capture line items, up to 20 fields, and additional features like annotation services and customization hours.

- Enterprise: Custom pricing. Includes everything in Pro, plus features like SSO/SAML Login, SLAs, a dedicated account manager, and custom integrations.

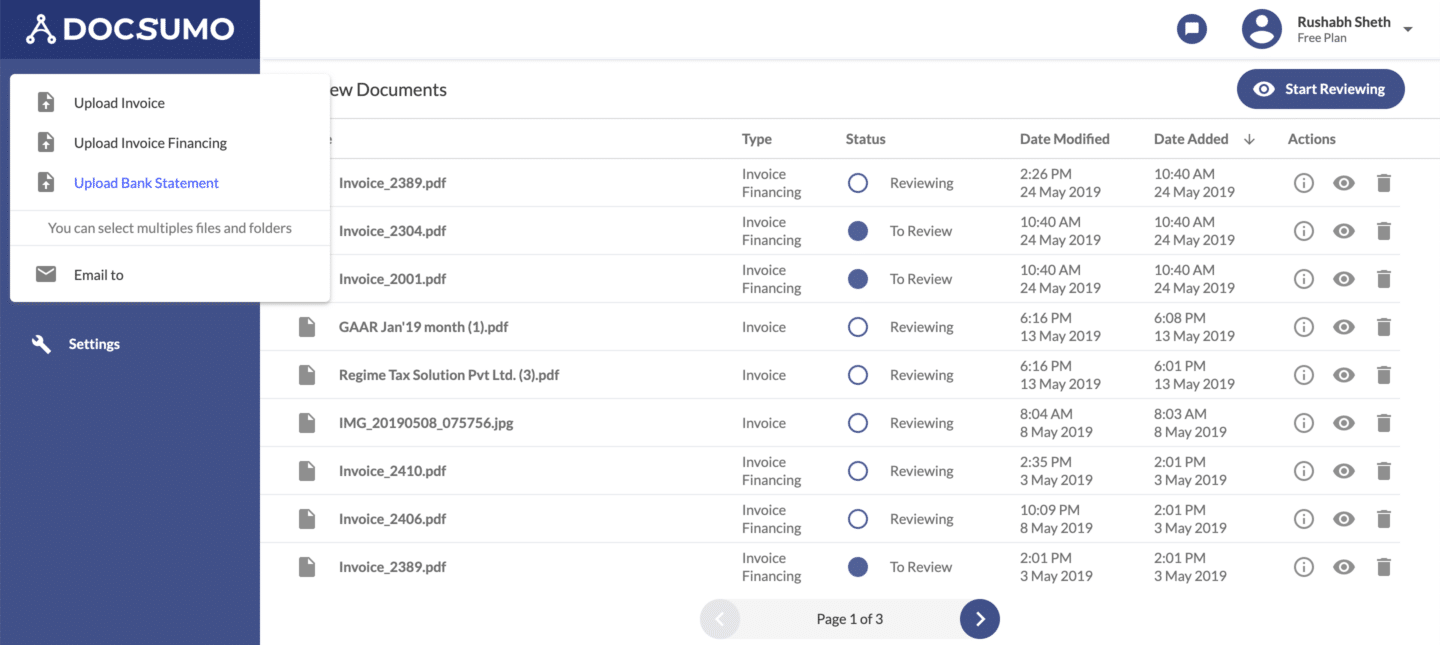

5. Docsumo

Docsumo is a top Intelligent Document Processing (IDP) solution, particularly for financial documents. Originally designed to automate invoice processing, it has evolved into a comprehensive data extraction platform.

Docsumo serves the entire financial sector across the USA, offering end-to-end solutions that streamline data handling and improve efficiency. This robust tool is essential for businesses looking to enhance their document management processes and reduce manual effort in financial data processing.

Key Features

- One-Click Upload and Sort: Easily upload, classify, and sort all your documents with a single click.

- Automatic Categorization: Documents are automatically organized into logical folders for quick access and data extraction.

- Accurate Table Extraction: Automate table extraction from single or multi-page PDFs and images with over 90% accuracy.

- Customizable AI Model: Adapt Docsumo’s AI to your specific needs, including column mapping, row reordering, field editing, and data pruning.

- Label Verification: Verify missed labels and uncertain extracts with reviewers before transferring data to target systems.

- Embedded Review Screen: Approve and verify extractions directly from your own system by embedding Docsumo’s review interface.

Pros

- Responsive Support: Benefit from a flexible, solution-oriented support team and an efficient onboarding process.

- High Efficiency: Possesses significant improvements in accuracy and speed for invoice and receipt extraction, enhancing overall customer outcomes.

Cons

- Model Retraining: Minor process changes require retraining models, which can be time-consuming.

- Timezone Challenges: Scheduling meetings across different time zones can be tricky, although the support team is accommodating.

- System Limitations: Formatting issues and system timeouts can occur with large file batches or depleted credits, halting processing.

- Data Conversion Limits: Encounter difficulties when converting invoices with multiple accounts or if credits run out.

Pricing

- Start-ups and Businesses: $500+ per month. Includes APIs for invoices, purchase orders, and ID cards; supports 3 users; features machine learning and Table Vision. Excludes email parsing, validation, and custom ML training.

- Business: Custom pricing. Supports 10 users, email parsing, basic validation, and custom ML model training. Excludes table categorization and document classification.

- Enterprise: Custom pricing. Supports unlimited users, advanced validation, analytics, table categorization, and document classification. Suitable for extensive needs with multiple document types and workflows.

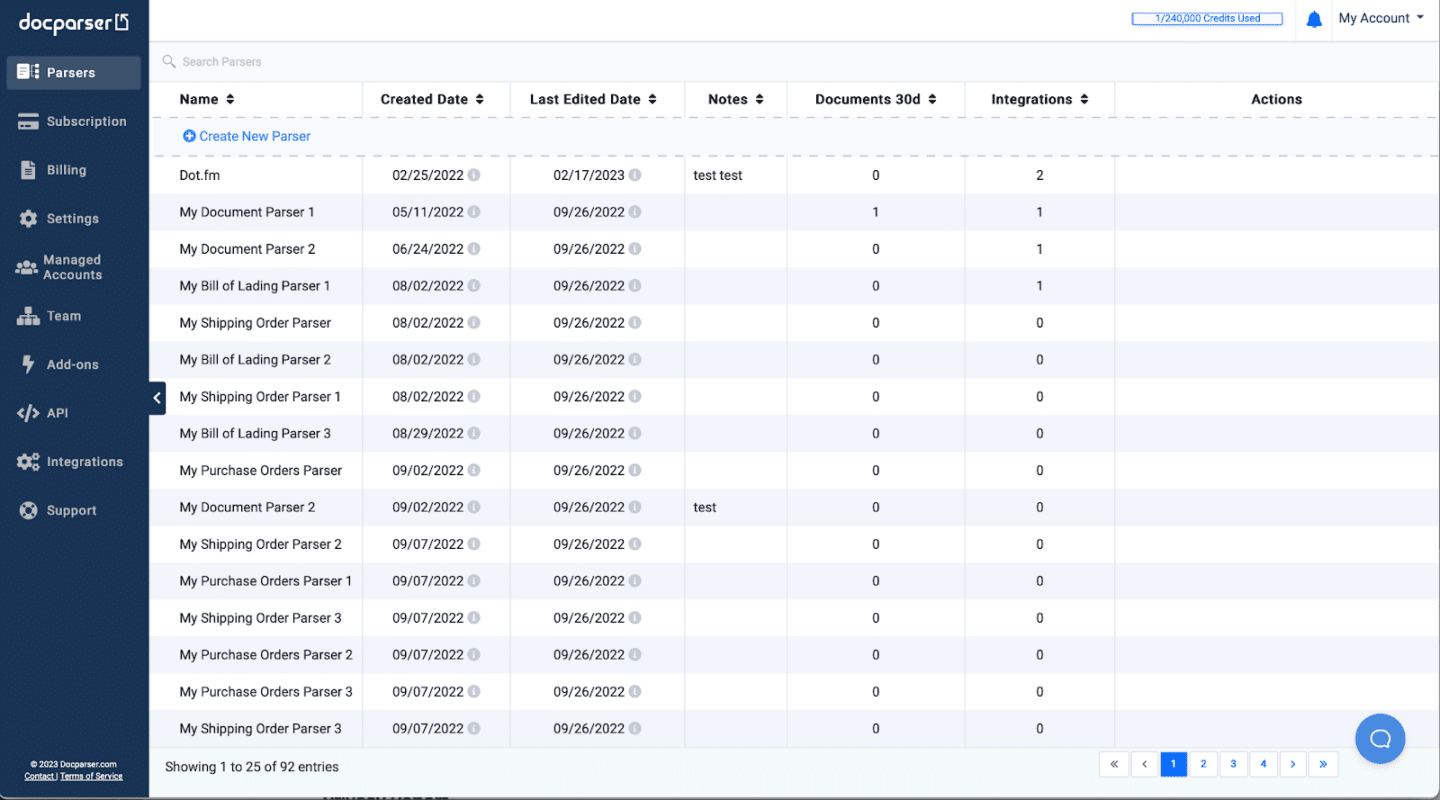

6. Docparser

Docparser is a cloud-based document parsing API that enables you to extract data from various formats, such as PDF, Word, Excel, and CSV. It’s perfect for retrieving data from invoices, contracts, purchase orders, and more. With Docparser, you can access and use the API from anywhere, ensuring flexibility and convenience in managing your document data extraction needs. This tool simplifies the process of converting document content into usable data.

Key Features

- Automatic Data Extraction: Seamlessly extract data from PDF documents.

- Advanced OCR Technology: Utilize cutting-edge OCR for superior data recognition.

- High Accuracy and Consistency: Ensure precise and reliable data extraction.

- Workflow Automation: Streamline processes with automated workflows.

- Application Integration: Easily integrate with popular applications for enhanced functionality.

Pros

- Custom Parsing Rules: Set custom rules for different document types, ensuring accurate data extraction tailored to your needs.

- Powerful Extraction: Extract data from various documents, including invoices, contracts, and purchase orders.

- Scalable and Reliable: Handle large volumes of documents effortlessly with a dependable API.

- Flexible Data Output: Download extracted data in formats like Excel, JSON, XML, or send it to webhooks, fitting your specific usage requirements.

Cons

- Manual Rule Definition: Manually setting rules may limit automation compared to tools with automatic data recognition.

- Time-Consuming: Creating separate parsing rules for different bank statements or formats can be a lengthy process.

Pricing

- Starter Plan: $39/month, includes 1200 parsing credits per year, up to 15 parsers, and basic features.

- Professional Plan: $74/month, includes 3000 parsing credits per year, up to 50 parsers, and multifactor authentication.

- Business Plan: $159/month, includes 12000 parsing credits per year, up to 500 parsers, and all Professional features.

- Enterprise Plan: Custom pricing with custom parsing credits, extended document retention, and more. Contact for a quote.

Note: 1 Parsing Credit = 1 document with up to 5 pages.

7. Parseur

Parseur is a PDF and document processing software designed for small and medium-sized businesses. It saves you hours of manual work with its powerful Zonal OCR and Dynamic OCR engines, automatically extracting data from PDFs and emails.

This data can then be sent to hundreds of apps and databases, including Excel and Google Sheets.

Key Features

- AI-Powered Automation: Let AI handle the tedious task of data extraction, saving you time and money with greater speed and accuracy.

- Template Engine: Easily highlight text blocks in a sample document to show Parseur what data to extract, and it will apply this to similar documents.

- Extensive Training Datasets: Continuously trained with large, language-specific datasets for superior performance.

- Dynamic OCR: Adapts to fields that move or change size, ensuring consistent data extraction across various documents.

Pros

- Improves CRM: Integrates well with tools like Pipedrive, enhancing customer relationship management.

- Personal Follow-Up: They personally follow up on resolved issues to ensure satisfaction, which is a thoughtful touch.

- Time-Saving: Saves you a significant amount of time and proves to be highly useful.

- Excellent Support: The support team is great, responsive, and always helpful.

- Thoughtful Design: The service is well-designed and meets all your needs, showing a lot of thought has gone into its development.

Cons

- Limited Parsing Adjustments: Lacks options for fine-tuning parsing when it doesn’t capture exactly what you need.

- Insufficient Instructions: There are limited instructions beyond basic functionality, which can be frustrating.

- Email Limit Concerns: Worry about reaching your allotted number of emails without notification.

Pricing

Pay as You Grow: Flexible pricing model.

Cost: $0.33 per page.

What is Parsio?

Parsio is a powerful tool designed to automate data extraction from your emails and attachments, including PDFs, HTML, XML, and XLSX files.

Simply highlight the data you wish to extract, and Parsio will automatically process all similar incoming emails and attachments.

You can then download the parsed data in various formats such as Excel, CSV, and JSON.

Additionally, you can sync this data with Google Spreadsheets, send it via webhooks, or integrate it with over 4,000 apps using platforms like Zapier, Pabbly Connect, Integrately, Integromat, and KonnectzIt.

Which Parsio Alternative Should You Use?

It’s important to understand that not all data extraction tools are created equal. Parsio specializes in extracting data from emails and attachments, which means it may not perform optimally in other use cases. If you use Parsio for different types of data extraction, such as processing invoices, receipts, or tax forms, you may encounter errors and unexpected issues.

For financial document extraction, you should consider alternatives like DocuClipper. This software is specifically designed for extracting data from financial documents, offering greater accuracy and reliability for these use cases. By choosing a tool tailored to your specific needs, you can ensure better performance and fewer mistakes, ultimately enhancing your workflow and efficiency. Opting for the right software will provide you with the best results and meet your expectations effectively.

Conclusion

There are numerous alternatives to Parsio available in the market, each offering unique features suited to different needs. The best tool for you will depend on the specific tasks you need to accomplish. It’s crucial to choose software that aligns with your requirements to ensure the highest quality output. By selecting the right tool for your specific needs, you can optimize efficiency and achieve better results in your data extraction and document processing tasks.

Try DocuClipper for Free Today

DocuClipper is an exceptional financial tool designed to convert PDF receipts, invoices, bank, credit card, and brokerage statements into XLS, CSV, and QBO formats. Renowned for its top-percentile accuracy,

DocuClipper can process hundreds of documents in just seconds, compiling all the data into a single, organized spreadsheet. This efficiency and precision make it an invaluable asset for businesses looking to streamline their financial document processing.

Try DocuClipper for free today and experience the benefits of fast, accurate, and comprehensive financial data extraction.