Post-accounting is the process where you post your business transactions in relevant accounts maintained. To regularly track your balances, profits and expenses you need to verify and record transactions to keep track of where the money is coming from and where it is going.

Posting in accounts will help you keep the financial data organized which will help your business stay compliant for reporting and also help you in better decision making.

In this article, we define what post-accounting is and provide its best practices and benefits.

What is a Post-Accounting?

Post-accounting refers to the systematic process of finalizing and reconciling financial records after the end of an accounting period.

It includes all your activities performed after transactions have been initially recorded but before your financial statements are finalized.

This includes the closing process, verification of accounts, and preparation of the post-closing trial balance.

To be more specific, post-accounting involves the following procedures:

- Reviewing and adjusting all your recorded transactions

- Making necessary correcting entries

- Reconciling all accounts to ensure accuracy

- Closing temporary accounts (revenues, expenses, and dividends)

- Transferring net income or loss to retained earnings

- Preparing a post-closing trial balance

- Ensuring compliance with accounting standards and regulations

You can think of post-accounting as the “quality control” phase of the accounting cycle.

It’s when accountants verify that all transactions have been properly recorded and that the books accurately reflect the company’s financial position at the period’s end.

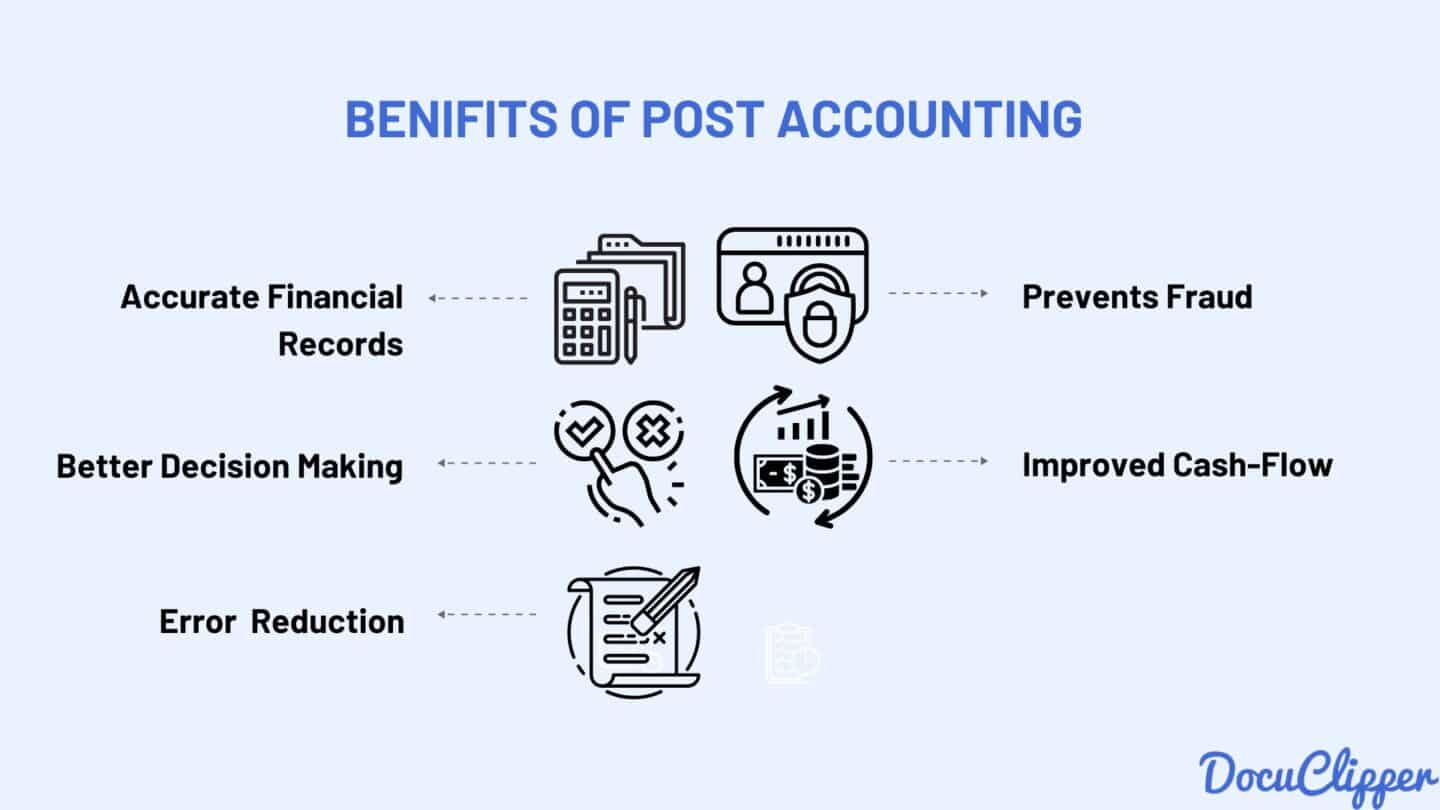

Benefits of Post-Accounting

Post-accounting process includes verifying and recording transactions in your books. It plays an important role in maintaining the integrity of your financial data.

It ensures compliance with regulations and provides valuable insights for better decision-making.

With that, here are the most important benefits of post-accounting:

- Accurate Financial Records: For the past years, over 150% increase in companies reporting errors in their accounting, mainly due to internal control. Post-accounting will ensure that every transaction in your business is correctly recorded in the books.

- Better Decision-Making: When your financial records are up-to-date, you can rely on them to make strategic decisions like budgeting, investing, or cutting costs. This is especially important when 70% of professionals don’t trust their data while 90% of companies say information and analytics are crucial for business success.

- Error Reduction: Human error alone makes up 41% of inaccurate numbers. By verifying transactions before recording them, such as checking if an Invoice matches the Purchase Order and Goods Receipt, you reduce the risk of errors like double entries, incorrect amounts, or improper account allocation.

- Prevents Frauds: The annual losses due to fraud amount to over USD 4.7 trillion worldwide! By verifying transactions before recording them, you can identify errors like duplicate payments or unauthorized expenses. For example, spotting a mismatch between an Invoice and a Purchase Order could help you prevent fraudulent billing.

- Improved Cash-Flow Management: 82% of small businesses fail due to cash flow problems. By recording transactions promptly, you can track cash inflows (like customer payments) and outflows (like vendor payments). This visibility helps you avoid overdrafts or missed payments. For example, timely recording of bills ensures you know exactly how much you owe and when it’s due.

How Post-Accounting Works

A structured post-accounting process ensures that every transaction is recorded accurately and that your financial data remains clear, organized, and reliable. This helps you maintain a true reflection of your company’s financial situation.

- Transaction Occurs: The process starts when a transaction occurs. For example, In your business receiving an invoice or paying a bill to your vendor will trigger the post-accounting process.

- Verify transaction Details: Before recording any information, you must verify the details of the transaction for accuracy.

- Approval Process: After verifying the transaction details, the next step is the invoice approval process. Typically, an accountant or an authorized person will review the transaction and approve it before it is officially recorded in the accounts.

- Ledger-Posting: Once the transaction is approved, it is entered into the company’s general ledger. This is where all financial transactions are compiled. The specific accounts involved for example, accounts payable, cash, or inventory are updated according to the nature of the transaction.

- Reconciliation: After the transaction is posted, you must reconcile it with bank statements or other financial records to ensure there are no differences between your company’s internal records and external documents like bank statements, helping maintain consistency and accuracy.

- Financial Reporting: Once all transactions are recorded and reconciled, you use the financial data to prepare key financial reports, such as the balance sheet and income statement. These reports provide an overview of your company’s financial position and help you make informed decisions.

- Audit Trail: At every step of the process, an audit trail is created. This provides transparency and accountability, ensuring that any future audits or reviews can trace each transaction back to its source, making the process fully auditable.

Best Practices for Post-Accounting

Your business faces challenges like a large volume of financial data, accuracy during data entry and compliance with regulations. Additionally, the manual process increases the chances of errors. during the pre-accounting process.

Implementing best practices helps overcome these hurdles by streamlining processes, reducing manual errors, and enhancing accuracy. Let’s understand these best practices in detail:

Establish a Standardized Closing Schedule

Establishing a standardized closing schedule is critical for ensuring timely and efficient post-accounting.

This involves setting fixed dates for closing your financials each month or quarter. As a result it creates consistency in recording transactions, reviewing financial data, and preparing reports.

For example, you can set the 5th of each month as the deadline for verifying all invoices and reconciling accounts from the previous month.

A well-planned closing schedule keeps your financial reporting on track and supports better decision-making.

Implement Strong Internal Controls

Implementing strong internal controls is key to preventing errors and fraud in post-accounting. This involves setting clear approval processes, separating duties, and regularly reviewing financial transactions. Firstly you should ensure that proper segregation of duty exists in your business.

For example, there should be a fixed protocol to obtain a manager’s approval before approving invoices exceeding $5,000 This ensures segregation of duty and adds an extra layer of protection.

Ensure Proper Documentation

Ensuring proper documentation is another important best practice in post-accounting. Every transaction should be backed by clear and accurate records, such as invoices, receipts, purchase orders, and contracts.

For example, when you receive an invoice, you should have the corresponding purchase order and receipt to verify the details as proper documentation helps you verify the legitimacy of all your transactions and makes it easy to trace them back to the source if needed.

Regular Account Reconciliation

Regular account reconciliation involves consistently comparing your financial records, like bank statements and general ledger entries, to ensure they align. This process helps you spot errors, or fraudulent activities early so that you can make corrections quickly.

Regular reconciliation ensures the accuracy of your company’s financial statements, supports better financial decision-making, and gives you confidence during audits or financial reporting.

Leverage Technology Effectively

Leveraging technology in post-accounting can increase the accuracy and efficiency of your bookkeeping. Using accounting software and automation tools for automated bookkeeping and invoice processing reduces any potential manual errors and speeds up transactions.

Quality Control Measures

Implementing quality control measures in post-accounting ensures your financial data is accurate and reliable. This includes regularly checking that all your transactions are recorded correctly and that no errors have been made along the way..

For example, you might cross-check an invoice against the payment record to ensure they match.

With the help of strong controls, you can prevent mistakes, ensure compliance, and produce trustworthy financial records for decision-making and reporting.

Maintain Proper Cut-off Procedures

Maintaining proper cut-off procedures ensures transactions are recorded in the correct accounting cycle.

Your business should have clear guidelines for recognizing revenues, expenses, and other transactions at every period-end. This will help you prevent errors like recording revenue expenses in the correct period.

For example, if a customer pays for a service in advance, you would recognize the revenue only when the service is provided.

By following these procedures, you avoid misstatements and ensure accurate financial reporting.

Regular Staff Training

Regular staff training ensures your accounting team stays updated with the latest processes, software, and regulatory requirements. Ongoing training also improves accuracy, reduces errors, and ensures compliance.

Well-trained staff can better handle complex transactions, spot errors, and follow best practices.

Automate Accounting Data Entry

Automating accounting data entry reduces errors and saves time compared to manual data entry. Automated systems such as bank statement converter or invoice scanning software can directly extract and input data from your invoices, receipts, or bank statements into your accounting software.

For example, when you receive an invoice, the system can automatically capture the relevant data and enter it into your records. By automating routine data entry, you can streamline operations, minimize human error, and focus on more strategic tasks.

Final Advice

In conclusion, post-accounting is essential for maintaining accurate, organized, and reliable financial records.

It ensures that all your financial transactions are properly recorded and verified which helps you in gaining better control over cash flow, reduce errors, and strengthen compliance. This process supports better decision-making and enhances audit readiness,

To maximize the benefit of post-accounting you should consider investing in the right tools like Docuclipper which can simplify this process by automating data extraction and ensuring your financial records are always accurate and up-to-date.

FAQs about Post-Accounting

Let’s explore some common FAQs to help you better understand post-accounting and its role in streamlining financial processes.

What is a post-period in accounting?

In accounting, the post period is when you finalize, review, and record transactions after an accounting period ends (such as a month, quarter, or year).

This ensures that all adjustments, reconciliations, and entries are completed before closing the books, allowing for accurate financial reporting.

Why do we post accounting?

You post accounting to ensure financial transactions are accurately recorded in the general ledger, creating a clear view of your company’s financial activities.

This process helps maintain accurate records, ensures compliance, supports reporting, and enables better decision-making with reliable financial data.

What is the difference between entry and posting in accounting?

An entry in accounting is when you record a transaction in the journal, capturing details like the date, accounts, and amounts this is called journalizing. The next step is posting, where you transfer these entries to the relevant accounts in the general ledger for analysis.

What are the three accounting concepts?

Accounting consists of three key steps: recording all transactions in journals to capture income, expenses, assets, and liabilities; classifying them into specific accounts in the general ledger; and summarizing the data into reports like the income statement, balance sheet, and cash flow statement.