Before diving into bookkeeping, there’s an important step you can’t skip:

Pre-accounting. It’s all about organizing your financial documents receipts, invoices, and statements before they’re entered into your books.

Why? Because it saves time, reduces errors, and makes bookkeeping much easier.

In this blog, I’ll explain Pre-accounting and why it’s a game-changer for managing your finances. Let’s get started!

What is Pre-Accounting?

Pre-accounting is collecting, organizing, and verifying financial data before financial transactions are officially recorded in a business’s accounting system to ensure it is accurate and complete for bookkeeping and accounting recording.

The pre-accounting process can help you streamline the accounting workflow, reduce errors, and provide a clear picture of your financial activities for many businesses, it’s a preparatory step that’s essential for ensuring the accuracy and reliability of accounting records.

Pre-Accounting Example 1: Invoice Processing

Imagine your company receives a monthly invoice from a logistics provider for shipping services. In pre-accounting, you extract key details like the invoice number, date, vendor name, and amount using tools like an invoice parser.

You verify the charges against the shipping contract and categorize the expense under “Logistics Expenses” before uploading it to your bookkeeping system. This ensures accuracy and timely processing.

Pre-Accounting Example 2:

Your marketing team submits a receipt for a business lunch with a client. In pre-accounting, you record the vendor name, date, and amount using automated tools.

You tag the expense under “Client Entertainment Expenses” and cross-check it with the reimbursement request. This keeps records organized and compliant for audits or tax filings.

Pre-Accounting Example 3:

Your finance team downloads the monthly bank statement. In pre-accounting, you match bank transactions to invoices, expenses, and payments.

Any unmatched entries, like bank fees, are flagged, investigated, and categorized under “Bank Charges”. This ensures your records are accurate and ready for month-end reconciliation.

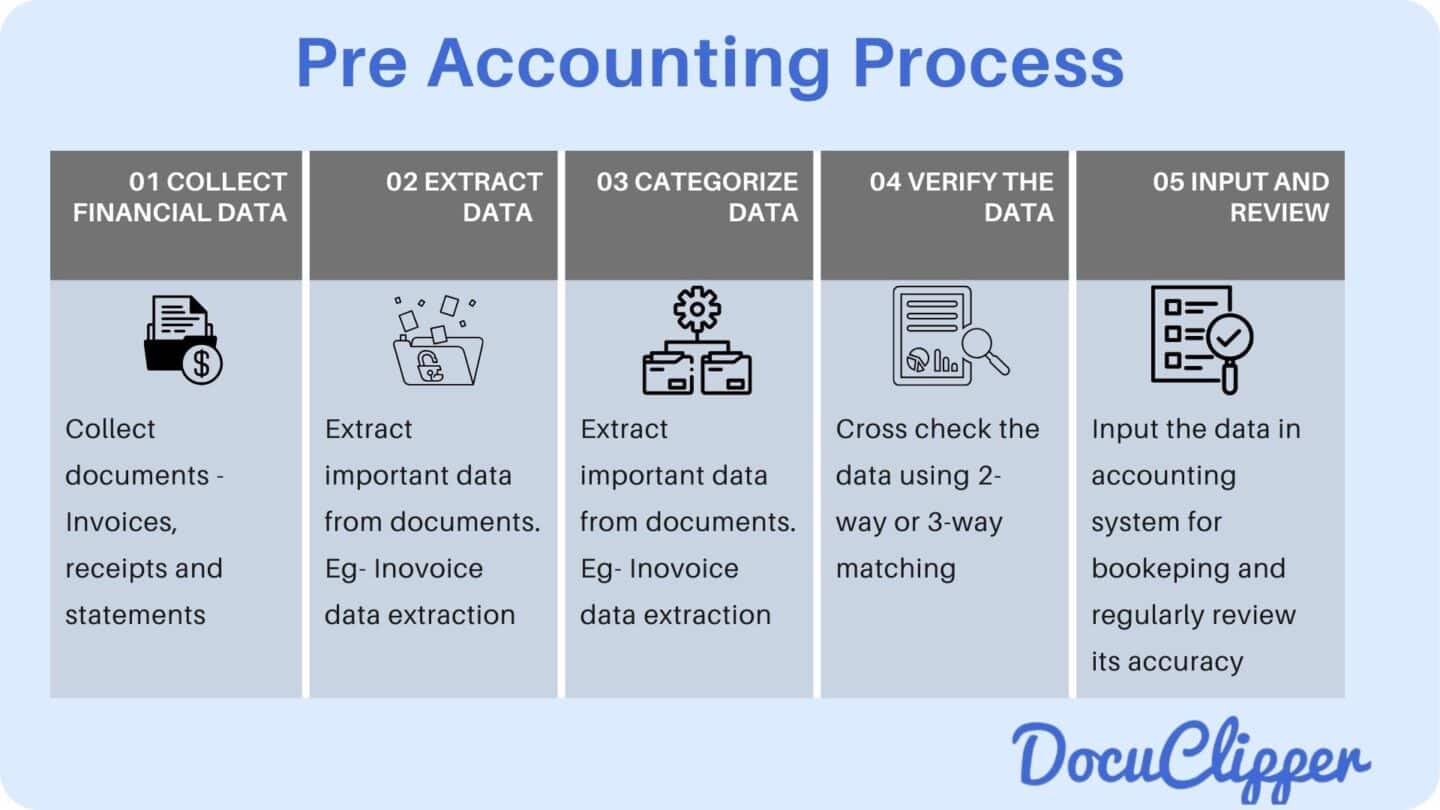

How Pre-Accounting Works?

Pre-accounting acts as a bridge between your raw financial data and organized accounting records.

It involves collecting, and verifying data like invoices, receipts, and bank statements before they enter your bookkeeping system.

Here, I am going to show you how pre-accounting works so you can better understand it:

- Collect Financial Data: Start by collecting all your relevant documents like invoices, receipts, and bank statements. This step ensures you have all the necessary information for accurate bookkeeping.

- Extract Important Information: You can either manually or automatically extract data using tools such as invoice data extraction or receipt management using tools like Docuclipper.

- Organize and Categorize: Make sure you organize your data into relevant categories, such as “Travel Expenses,” “Office Supplies,” or “Client Payments,” to streamline bookkeeping and your taxes.

- Verify Accuracy: Cross-check the data for errors or missing details. For example, use 2-way matching or 3-way matching to match your invoices to purchase orders and to goods receipt note

- Input Data into Your System: Once everything is verified, upload the data into your accounting software or hand it off to your accountant for bookkeeping.

- Review Regularly: Periodically check your Pre-Accounting process to ensure everything stays organized and accurate.

The Benefits of Pre-Accounting

Pre-accounting is a blessing for your business accounting.

By organizing your financial data before it reaches your books, you cut down on errors, speed up bookkeeping, and stay on top of your finances.

Improved Accuracy in Financial Statements

Pre-accounting ensures that all financial data is properly organized and verified before it reaches your books and it reduces errors and ensures your financial statements reflect the true state of your business.

By automating tasks like data entry, you can reduce manual errors by up to 90% Making it easier to plan and analyze your business performance.

Time savings for Accountants

By automating tasks like manual data entry and document management, you save time that would otherwise be spent on manual processes. Adopting accounts payable automation software can save an average of one hour per day.

This cuts down on labour costs, as fewer resources are needed for data handling. Pre-accounting automates repetitive tasks, allowing you to focus on higher-value work.

Better Audit Preparedness

With Pre-Accounting, all your financial records are organized and easily accessible, making audits quicker and less stressful and you can confidently provide accurate documentation without scrambling to find missing information.

This makes it even more important as 75.9% of businesses experienced serious business risk and/or compliance issues due to ineffective document processes over the past five years.

Around 40% of audited businesses faced issues due to insufficient audit evidence

That’s why pre-accounting is so important as it reduces the risk of non-compliance and errors in your financial reporting, saving you potentially $100,000s of thousands.

Enhanced Financial Decision-Making

Enhanced financial decision-making is a key benefit of pre-accounting as it ensures your records are kept up to date. Inefficient decision-making can lead to $250 million of wasted labour costs per year.

By organising your financial data during pre-accounting you get a clear view of cash flows, incomes and expenses. This will help you make the right financial decisions for your business.

How Pre-Accounting Software Can Help You

Pre-accounting software can be helpful in more than one way. It takes care of your reconciliation, and document categorization, making the business ready for audits and greatly simplifies your tax season.

Reconciling Information

To keep your finances in order, it’s essential to consolidate and verify all financial activities for accurate data entry. This means tracking expenses and revenue streams, and ensuring each transaction has proper supporting documents.

For example, if your company pays a vendor for supplies, you should match the Purchase Order, delivery receipt, and invoice to confirm the payment’s accuracy. By reconciling this information regularly, you can catch discrepancies early and reduce errors.

Automating Data Extraction

Automating data extraction makes pre-accounting faster and more accurate. Instead of manually entering data from invoices, receipts, or bank statements, you can use software tools that automatically capture key details like dates, amounts, and vendor names.

For example, if you receive an invoice, the tool extracts and categorizes the data under the correct expense. This reduces the risk of manual errors and saves time spent on repetitive tasks.

Document Collection

Managing employee reimbursements and business expenses is faster with the use of tools like DocuClipper. Your employees can instantly capture and submit receipts, automatically sending purchase details to the finance team in real time.

This automation ensures document data extraction and quicker processing which reduces the chances of errors.

Staying Audit Ready

As a business, you want to ensure your financial records are always accurate and ready for audit. Pre-accounting ensures that financial data is verified and organized, helping you keep everything in check. You’ll be able to easily spot and correct any mistakes, so your records are audit-ready at any time.

Time and Cost Savings

Pre-accounting software automates repetitive tasks like extracting data from invoices and receipts, categorizing expenses, and reconciling transactions.

Eliminating manual work saves valuable time, allowing you to focus on higher-priority tasks like analyzing financial data or making decisions.

Expense Reports

Manual data entry can be slow, prone to errors, and increase the risk of fraud with the help of Pre-Accounting software, you can digitize the entire expense approval process, eliminating the need for physical reports.

All expenses are automatically added to the ledger, reducing manual work and improving accuracy.

Processing Invoices

Much of the time spent in accounts payable goes toward matching and processing invoices with purchase orders, receipts, and delivery orders. With smart Pre-Accounting solutions like DocuClipper, you can automate this entire process.

This streamlines invoice management reduces human error, and ensures timely payments to vendors.

Integration and Scalability

Pre-accounting software integrates seamlessly with your existing accounting tools, ensuring a smooth transfer of data. As your business grows, the software scales with your needs. It can handle your increased transactions without extra effort and keep the entire process efficient.

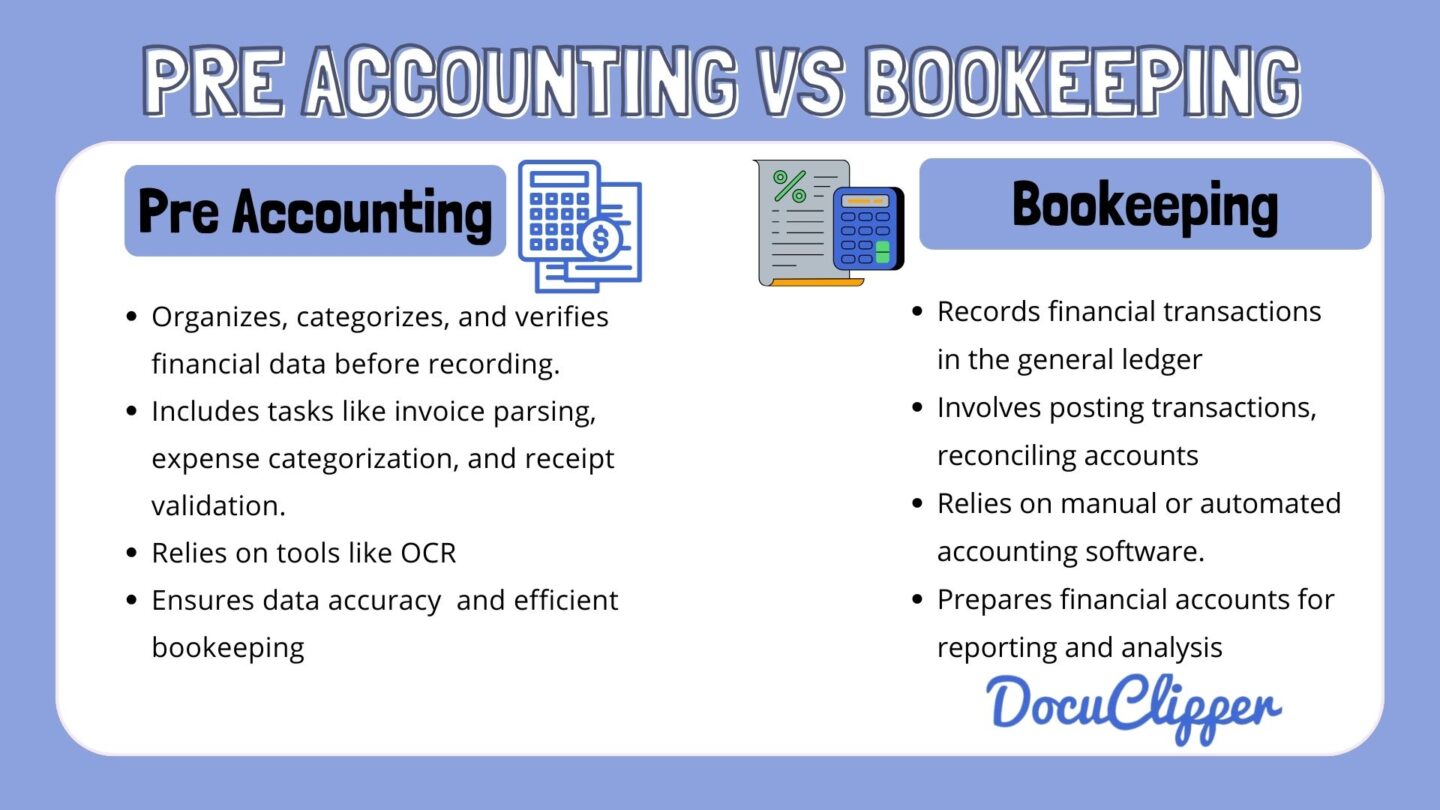

Pre-Accounting vs. Traditional Bookkeeping

Pre-accounting and bookkeeping serve different purposes in managing your finances.

Pre-accounting focuses on preparing and organizing financial data before it is entered into your books. It includes tasks like collecting invoices, extracting data, and categorizing expenses.

On the other hand, bookkeeping involves recording and maintaining these transactions in your financial system, preparing financial statements, and reconciling accounts. Think of pre-accounting as setting the stage, while bookkeeping is the detailed recording process.

Together, they ensure your financial records are accurate and ready for reporting. Understanding their differences helps you manage your finances more efficiently.

Best Practices for Pre-Accounting Processes

Effective pre-accounting relies on clear workflows, accurate data management, and the right tools. Adopting best practices ensures efficiency and reduces errors.

Standardization of procedures

Creating standardized procedures ensures consistency in how financial data is collected, recorded, and processed.

You can achieve this by setting clear guidelines for tasks like invoice submission, receipt data extraction, and expense approvals, so everyone on your team follows the same steps.

Quality control measures

Implement regular checks to verify the accuracy of your data extraction before it enters your accounting system. You should review documents for errors, duplicate entries, or missing details.

Documentation guidelines

Make sure all financial documents such as invoices, receipts, and bank statements are properly labeled and stored in a central system. Clear guidelines for naming and filing documents will save you time and help avoid confusion during audits or reconciliations.

Internal controls implementation

Businesses must implement and maintain a strong system of internal controls. The segregation of duties would include having at least two different employees handling cash vs. recording transactions in the books.

Common Pre-Accounting Challenges and Solutions

Pre-accounting often comes with challenges like data entry errors, document mismanagement, and time-consuming manual processes. Implementing automation and structured workflows can help you overcome these issues effectively.

Missing documentation

Missing invoices, receipts, or other financial records can cause delays in your accounting. To address this, use a centralized document management system to store and organize all your financial documents. Encourage employees to upload receipts in real time to avoid gaps in records.

Data inconsistencies

Inconsistent or mismatched data, such as duplicate entries or incorrect amounts, can lead to errors in your financial reporting. To overcome this, establish clear data entry guidelines and use automated bookkeeping tools to validate and reconcile data before it enters your accounting system.

Time management issues

Manual data extraction from invoices and receipts can be time-consuming, especially during peak periods. Streamline this process by automating repetitive tasks like document data extraction. This frees up your time to focus on more critical financial tasks.

Manual processing errors

Human errors, such as misclassified expenses, are common with manual Pre-Accounting. The solution is to adopt automation like automated data entry that reduce reliance on manual inputs. With tools like DocuClipper, you can minimize errors by digitizing and automating the processing of financial data.

Conclusion

Pre-accounting is a game-changer for simplifying and improving your bookkeeping process. By automating tasks like data collection, document management, and error checking, you can save time, reduce mistakes, and ensure your financial records are always accurate.

Adopting best practices such as standardization and quality control only enhances these benefits.

As businesses rapidly turn to automation and smarter financial tools, Pre-Accounting will play an even bigger role in streamlining operations. Tools like DocuClipper are leading the way, offering practical solutions to modernize your financial workflows.

If you’re ready to make the shift, start by assessing your current process and identifying areas where automation could help. Implementing pre-accounting software is the next step to achieving greater efficiency, accuracy, and peace of mind in your bookkeeping.

Streamline Your Pre-Accounting with DocuClipper

Managing pre-accounting tasks manually can be time-consuming and prone to errors. With DocuClipper, you can automate data extraction from invoices, receipts, and bank statements, saving you hours of work. It quickly organizes and categorizes your financial data, ensuring accuracy before it reaches your bookkeeping system.

By streamlining pre-accounting, DocuClipper reduces manual effort, minimizes errors, and helps you focus on more important tasks.

FAQs about Pre-Accounting

Let’s explore some common FAQs to help you better understand pre-accounting and its role in streamlining financial processes.

What is pre-accounting software?

Pre-accounting software automates the collection, organization, and preparation of financial data before it enters your bookkeeping system. It handles tasks like data extraction from invoices, receipts, and bank statements, ensuring accuracy and reducing manual effort. This streamlines processes, minimizes errors, and saves businesses time.

What are the 4 stages of accounting?

The four stages of accounting are Recording (capturing financial transactions), Classifying (organizing data into categories), Summarizing (preparing financial statements like balance sheets), and Interpreting (analyzing results for decision-making and performance evaluation). Each stage ensures accurate financial management.

What does pre mean in accounting?

In accounting, “pre” refers to tasks completed before formal bookkeeping, like gathering, organizing, and verifying financial data. Pre-accounting ensures accurate records and simplifies the transition to detailed accounting processes.

What is post-accounting?

Post-accounting involves tasks completed after bookkeeping, like generating financial reports, performing audits, and analyzing financial data for decision-making.