If you’re doing bookkeeping or accounting, you’re likely faced with the process of receipt data entry, which can be tedious when done manually.

Manually transferring information from paper or scanned receipts into accounting software is slow, error-prone, and expensive. Even a small mistake can lead to costly errors.

But there’s a better way. By automating receipt data entry with tools like OCR and AI, you can save time, reduce costs, and improve accuracy.

In this guide, you’ll learn how to set up automation for receipt data entry and why this upgrade is a game-changer for businesses and accounting professionals.

What is Receipt Data Entry?

Receipt Data Entry is the process of converting information from physical or digital receipts into a structured digital format that can be stored and analyzed in spreadsheets, accounting, or ERP systems.

These records are then used for accounting, expense tracking, and financial management purposes.

There are two methods of receipt data entry: manual and automated.

Manual receipt data entry involves copy-pasting information from paper or scanned receipts into a spreadsheet or accounting system by a human, often by a data entry clerk,

Automated receipt data entry uses tools like Optical Character Recognition (OCR) and AI to extract information accurately, with minimal human intervention.

Challenges in Manual Receipt Data Entry

So manual receipt processing is getting more outdated and businesses are gradually moving away from this method, here is the reason why:

- High employment costs: You need to hire somebody solely only for data entry when dealing with a high volume of receipts, a receipt data entry personnel has a daily rate of around $130.00. This adds up quickly when you need to hire an extra hand.

- Costly inaccuracies: Manual data entry is prone to human error and it is very costly. A single when dealing with a receipt error can lead to 10x extra cost based on the 1-10-100 rule of data entry.

- Data Security and Fraud Risks: Manual processes often lack safeguards, creating opportunities for fraud. As an example, Amazon has reimbursed $350,000 in nonexisting expenses to an employee.

- Limited Scalability: Manual processing is significantly slower and a person can only process 32 to 40 daily. This will then force you to hire another person when your personnel reaches its limit.

Benefits of Automating Receipt Data Entry

With all the challenges mentioned, here are the good sides and the major reasons why businesses are gradually transitioning:

- Cost Reduction: A basic subscription for receipt data entry software is likely below $100.00 per month. This software can easily be operated by a single employee regardless of the number of documents.

- Improved Accuracy and Error Detection: Automated tools generally have an accuracy rate of up to 97%. This is significant compared to manual data entry errors in accounting the some claiming that 14% of the errors are detrimental to costs.

- Maximized Visibility: Automation allows you to easily integrate all your information into software related to processing, making it easier to track information than having piles of files on your desktop

- High Scalability: While manual processing is limited by employee capacity, automated software can handle hundreds of receipts. simultaneously, efficiently scaling with your business growth.

How to Automate Receipt Data Entry

After reflecting on the benefits, you might think that it is difficult to set automation up. But it’s very easy, here’s the steps:

Step 1: Prepare & Digitize the Receipts

Start by preparing your receipts for digitization. Flatten any wrinkled paper receipts and ensure they are smooth for clear scanning.

Use only a scanner to capture high-quality images, ensuring proper lighting and alignment. Avoid using Smartphones as there are a lot of avenues for human errors like tilts and shadows. Be thorough, include all corners and details of each receipt.

For your receipt errors to be more efficient, consider batch scanning multiple receipts and save them in common formats like PDF.

Step 2: Establish a Digital Filing System

Make a digital filing system. This can be very basic where you can organize them according to the clients or businesses you are working for assign them according to time and have a proper naming system. You can organize like “YYYY-MM-DD – Vendor”.

Organize your files into a folder structure that suits your workflow. For instance, you can create separate folders for each client or project, with subfolders for different periods.

Step 3: Use Receipt OCR for Data Extraction

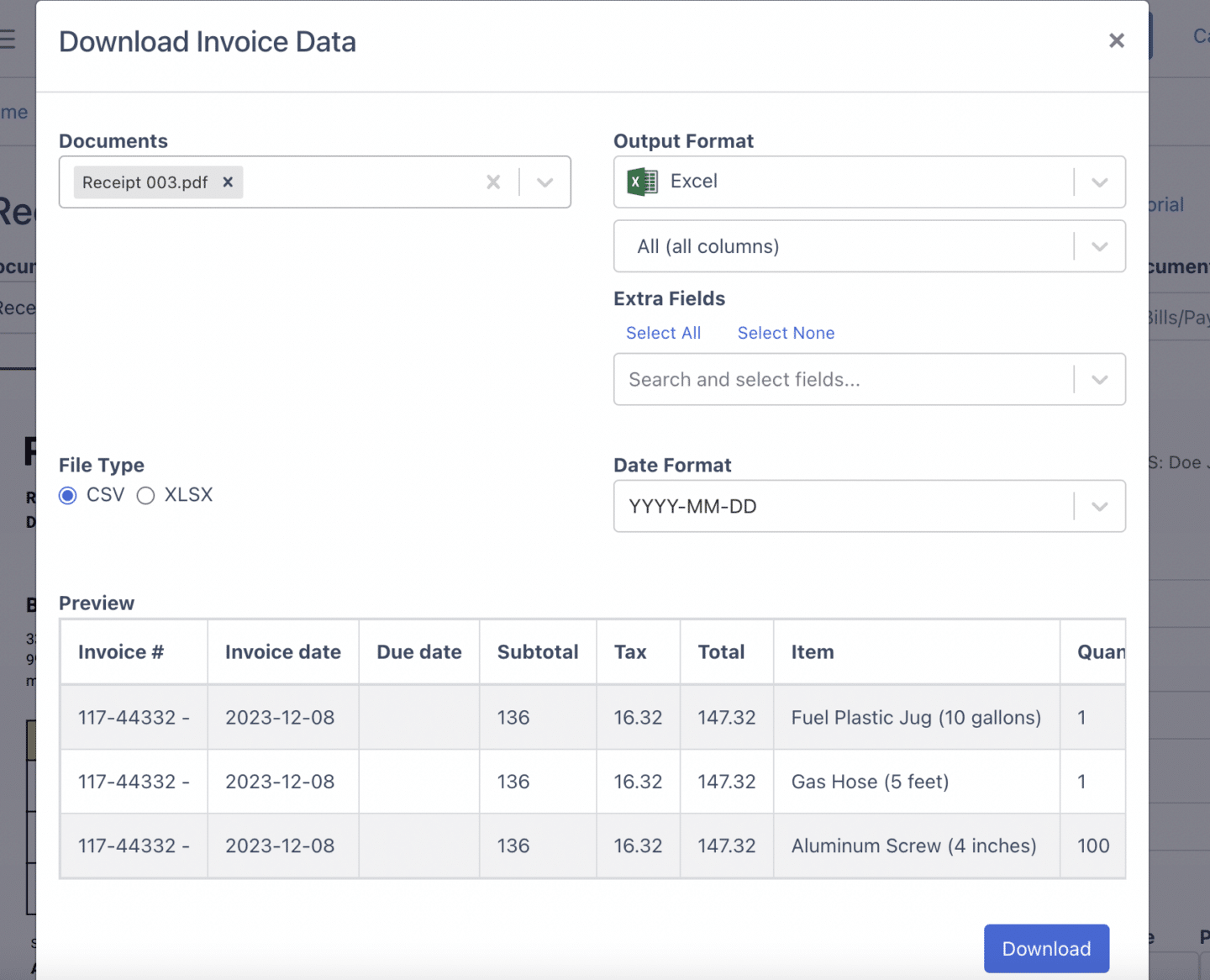

Use a recept OCR data extraction tool that will help you capture the data from the PDF files of receipts that you have. These tools will convert the PDF receipts into CSV or XLS which you can easily then import to your accounting or ERP software.

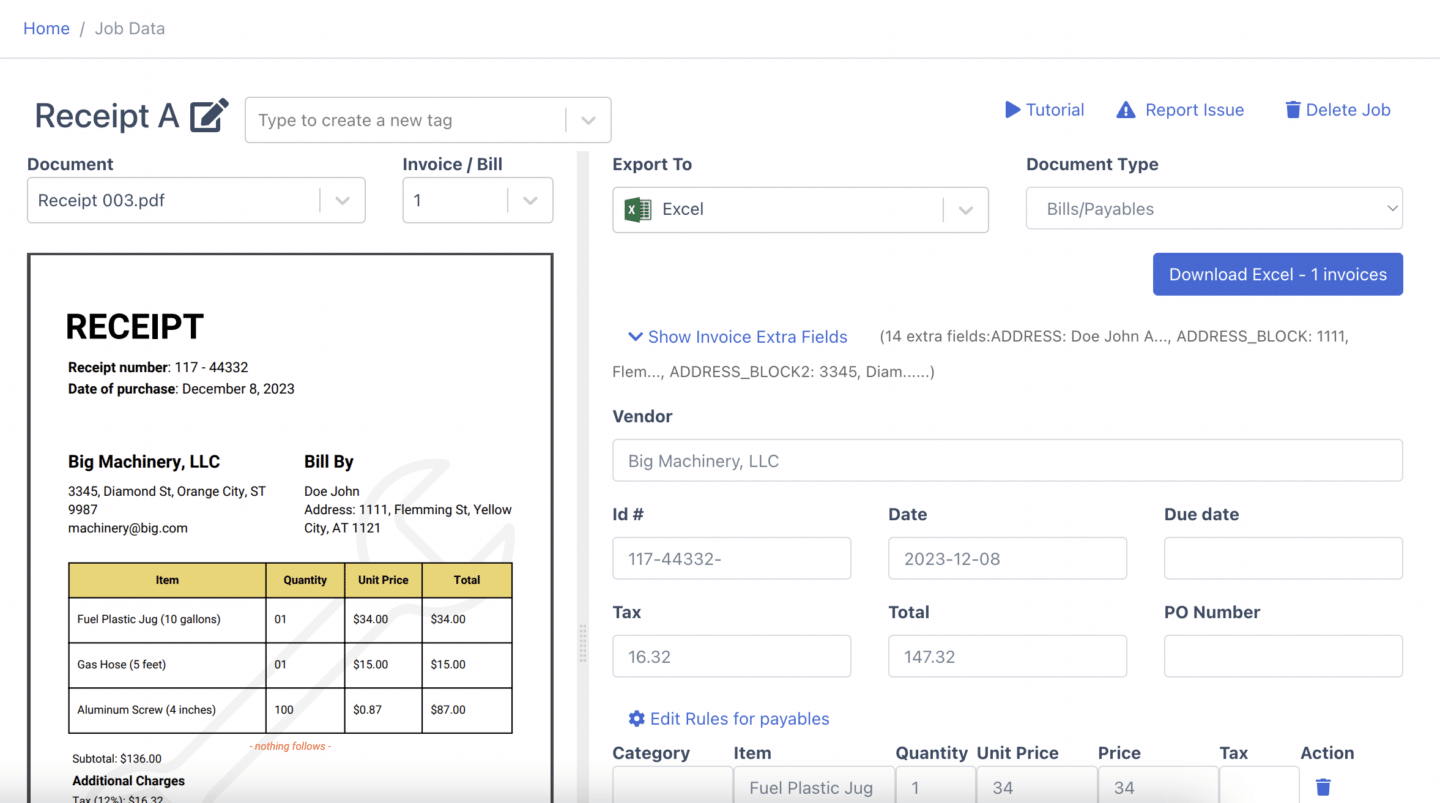

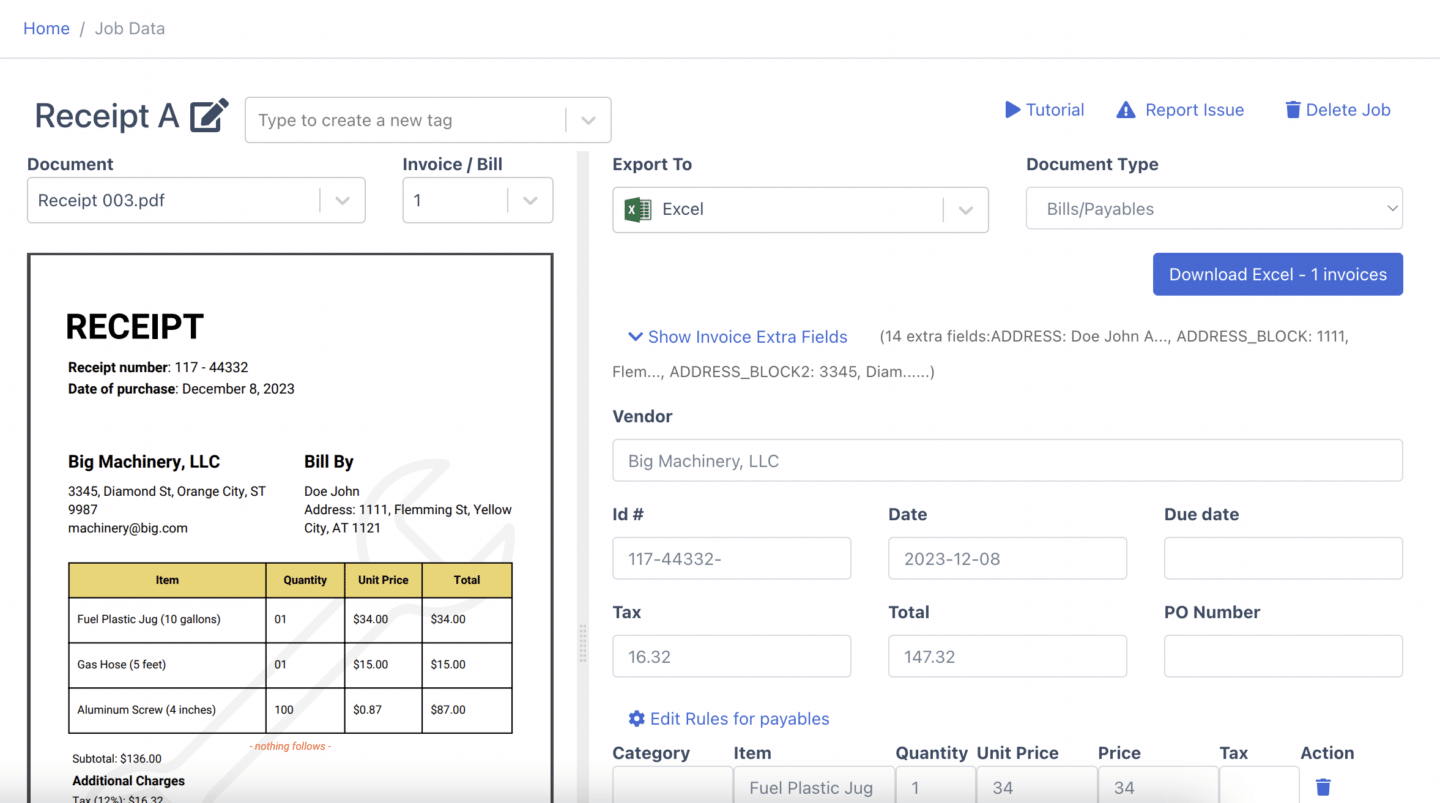

As an example, we are going to look at DocuClipper. In this tool, you can upload as many PDF Receipts as you can and this tool will scan all the necessary data that you will need for automated receipt processing. Then it’ll start converting to a spreadsheet where you can personalize or modify.

Step 4: Import or Export the Data Into Your Accounting or ERP Software

When you already have the CSV format of the receipts, you can easily then upload them to your software, from here your team can start the process like verification and evaluation.

In DocuClipper, you can directly connect it to QuickBooks if you have it. For other software, you can opt for downloading it to CSV, as CSV formats are the most versatile. Just be sure to look at their preferred column organization so you can modify it within DocuClipper’s interface.

Step 5: Archive Your Receipts

After the processing, you can preserve the original records of the receipts because this will be helpful during tax time as auditors will ask for some references of the information you presented them.

The best way to keep this is to store the information on a hard drive. As a backup, you can also print a compilation of these receipts and keep them in organized folders according to chronology.

Best AR Software for Receipt Data Entry

So once you think it’s actually easy to automate your receipt data extraction process, here are the leading software out there.

- DocuClipper: DocuClipper is a financial data extraction OCR tool that converts PDF receipts into formats like Excel, CSV, and QBO with the highest accuracy. It has batch processing for bulked conversions and integrates seamlessly with QuickBooks, Xero, Sage, and other ERP platforms through its API functionality.

- Dext: Dext enhances productivity by automating receipt and invoice management. It helps accountants and businesses organize, sort, and publish financial data effortlessly, reducing manual data entry.

- Veryfi: A tool for capturing and organizing documents into structured data. With APIs and mobile capture technology, It offers fast, accurate, and secure document data extraction for businesses, reducing the need for human intervention.

- Taggun: A real-time OCR software made for scanning and extracting data from receipt documents. Taggun is for expense reporting and integrates easily into process workflows.

- SparkReceipt: A receipt-scanning app that stores financial records in the cloud. It offers easy access to receipts, invoices, and other documents anytime.

Criteria for Selecting the Best Receipt Data Entry Tool

Choosing the right invoice data extraction software is essential for streamlining your accounting processes and ensuring efficiency. Here are key criteria to consider:

- Integration Capabilities: Ensure the tool integrates seamlessly with your accounting software, like Sage or Xero. This allows for smooth data transfers, consistent workflows, and accurate financial records.

- Ease of Use: A user-friendly interface is great for new users. Look for tools with simple designs that make training easy and minimize the learning curve.

- Scalability: As your business grows, the tool should accommodate increasing volumes of receipts without added complexity or excessive costs. Scalable tools ensure long-term efficiency.

- Customer Support: Choose a tool backed by reliable, responsive support. Knowledgeable assistance can help resolve issues quickly and ensure uninterrupted operations.

- Pricing: Evaluate the pricing model, whether it’s per page, per item, or a flat subscription fee. Choose cost-effective tools where the cost remains significantly lower than manual data entry labor.

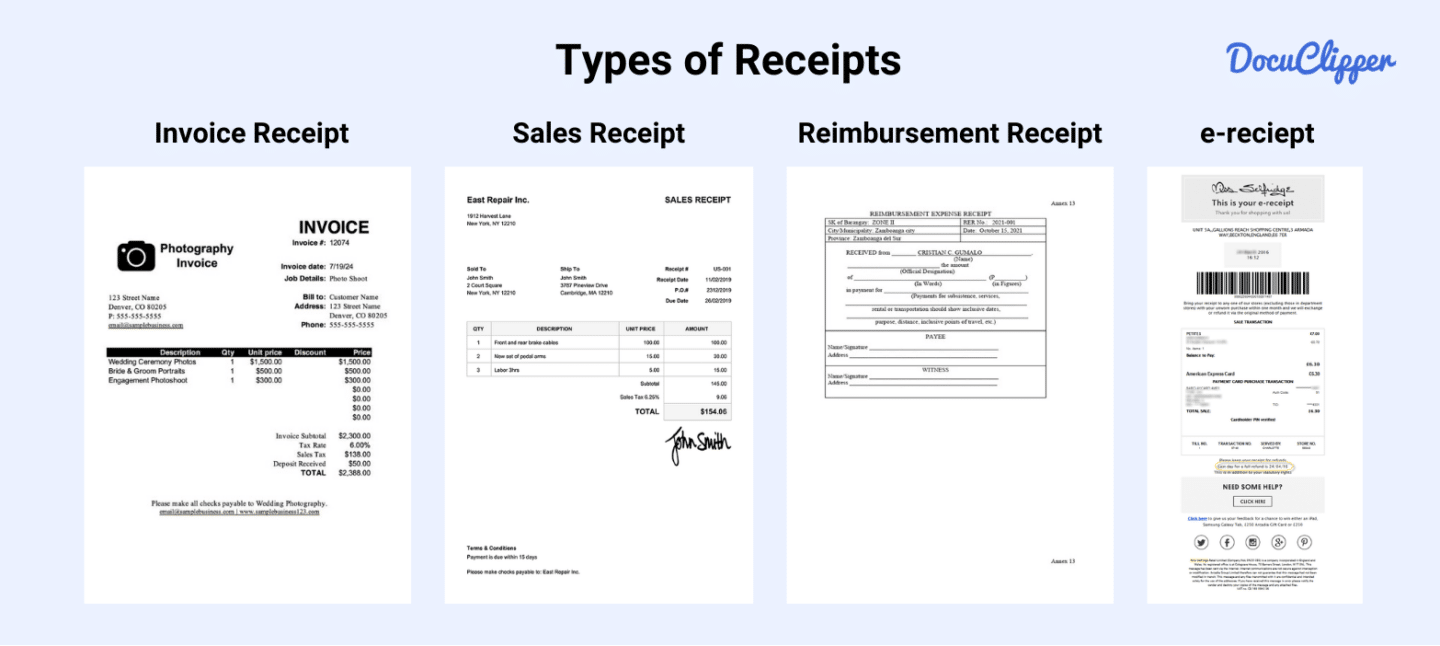

Types of Receipts

Here are some types of receipts that are being widely used today:

- Sales Receipts: These document transactions between sellers and buyers, often used in retail or online sales. They include details like items sold, prices, and payment methods.

- Payment Receipts: Issued after a payment is made, these receipts confirm the amount received and the payment method, such as cash, card, or bank transfer.

- Expense Receipts: Essential for business expense tracking, these receipts detail purchases made on behalf of the business, like office supplies or travel costs.

- Tax Receipts: Provided for tax-deductible donations or purchases, these receipts are valuable during tax filing. They include the donor’s name, amount, and transaction date.

- Delivery Receipts: These confirm the delivery of goods or services, including details like the delivery date, items received, and recipient’s signature.

- Cash Receipts: Used to acknowledge cash transactions, they are common in small businesses and informal setups.

Why Receipts are Important in Business

Receipts are necessary for maintaining consistent financial records. They serve as documented proof of purchases, helping accountants and your team track expenses and determine how money is spent over time.

Receipts play a vital role in balancing budgets and verifying transactions. They can help your businesses monitor all expenses, reconcile accounts, and serve as critical documentation during tax audits.

Managing receipts effectively protects your business from discrepancies and supports informed decision-making.

Automate Receipt Data Extraction with DocuClipper

DocuClipper is the best OCR receipt software that can scan PDF receipts and extract data in formats such as XLS and CSV. This receipt scanning software is compatible with many receipt formats with consistent accuracy. It also has Receipt OCR API features that allow you to easily connect with any ERP or accounting software.

Aside from processing receipts if you want more of an all-around tool, DocuClipper can go beyond receipts, it can process bank statements, credit card statements, invoices, checks, brokerage statements, and many more. DocuClipper does not limit your potential in accounting.

Final Advice

Automation is the new wave of financial document processing for businesses and the difference between doing it manually in terms of speed, cost, and accuracy is significantly better. Setting it up is very easy and there is no

FAQs about Receipt Data Entry

Here are some frequently asked questions about receipt data entry:

How to extract data from receipts?

You can extract data from receipts manually by copying details or using automated tools like OCR software. OCR scans and converts receipt data into structured formats like CSV or Excel, which can then be imported into accounting systems. Automation saves time, reduces errors, and ensures efficiency in receipt processing.

What data is included on the receipt?

Receipts typically include key details such as the vendor’s name, date of purchase, transaction amount, payment method, item descriptions, quantities, and prices. Some receipts may also feature tax information, discounts, and the total amount paid, depending on the type of transaction and receipt format.

How do you record receipts?

You can record receipts by organizing them digitally or physically and entering the details into accounting software, spreadsheets, or ledgers. Automation tools like OCR for accounting can scan and extract receipt data into structured formats like CSV, streamlining the process while reducing errors and saving time for bookkeeping and financial tracking.

Is a receipt an example of data?

Yes, a receipt is an example of data. It contains structured information such as transaction details, vendor names, purchase dates, amounts, and payment methods. This data is essential for tracking expenses, maintaining financial records, and conducting audits, making receipts valuable in business and accounting processes.

What is receipt details?

Receipt details refer to the specific information documented on a receipt, such as the vendor’s name, purchase date, transaction amount, payment method, item descriptions, quantities, unit prices, tax amounts, and total cost. These details are essential for tracking expenses, verifying transactions, and maintaining accurate financial records.

Is a receipt personal data?

Yes, a receipt can contain personal data, such as a customer’s name, contact details, or payment information, depending on the transaction. Businesses must handle receipts carefully to protect this information and comply with data privacy regulations like GDPR or CCPA, ensuring confidentiality and secure storage.

What is receipt journal entry?

A receipt journal entry records the financial transaction of receiving payment in accounting. It typically includes debiting the cash or bank account and crediting the sales or accounts receivable account, ensuring accurate tracking of received funds in the company’s financial records.

How do I record a receipt in Excel?

To record a receipt in Excel, create a table with columns for the date, vendor, item description, quantity, price, tax, and total amount. Enter the receipt details into the respective columns. Use formulas to calculate totals and organize receipts by categories or dates for easy tracking and analysis.

How do you document receipts?

You can document receipts by scanning or photographing them for digital records. Store the images in a well-organized filing system with clear labels, such as by date, vendor, or category. Use software or spreadsheets to log key details like amount, date, and purpose for accurate financial tracking and audits.