Managing accounts payable manually can be time-consuming, error-prone, and inefficient. While Tipalti automates payment workflows, it may not be the best fit for every business due to its pricing, integration limitations, or feature restrictions.

If you’re looking for a Tipalti alternative, several platforms offer robust automation, better flexibility, and cost-effective pricing.

This guide explores Tipalti alternatives that streamline accounts payable, invoice processing, and global payments.

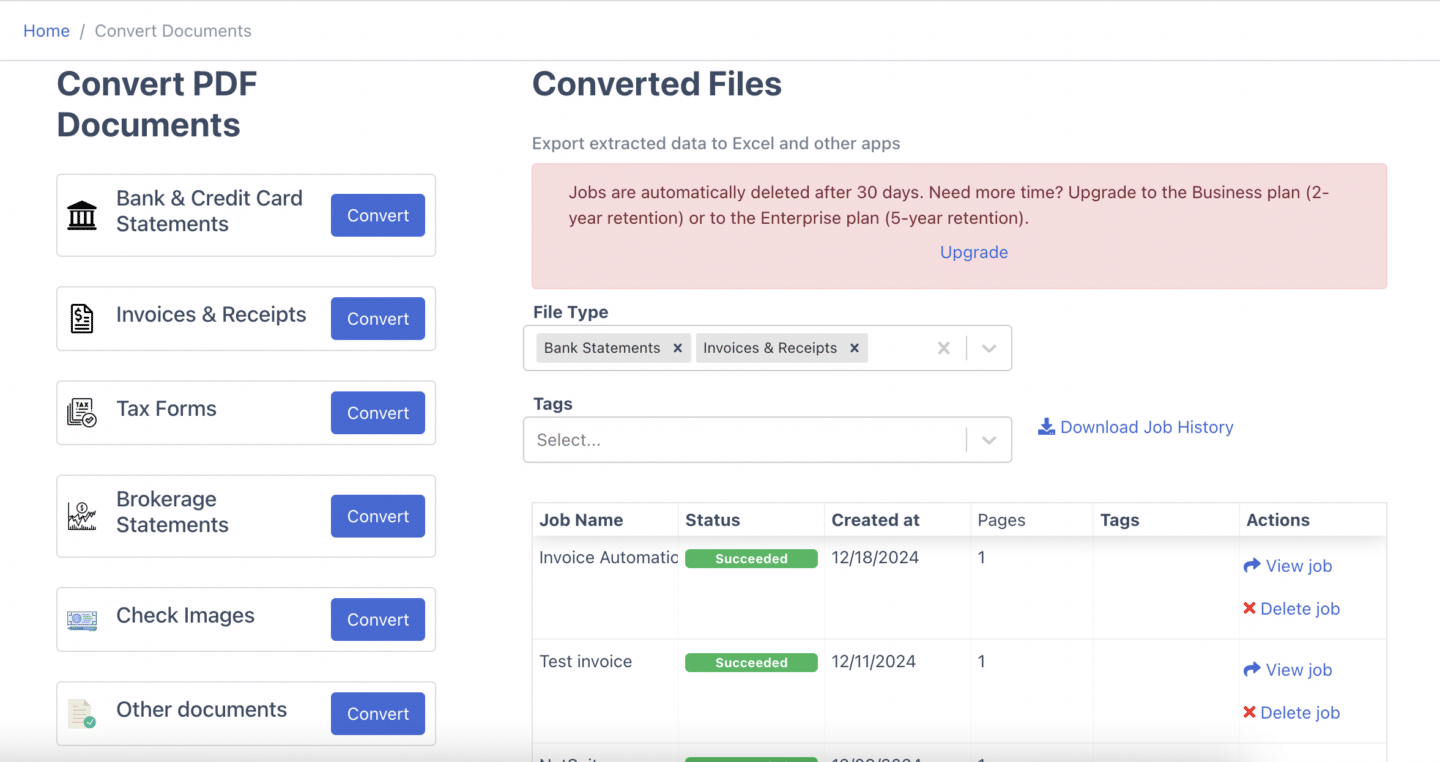

1. DocuClipper

DocuClipper is a powerful invoice data extraction solution that converts invoices, receipts, and financial statements into Excel, CSV, and QBO formats. Automating data capture and organization minimizes manual data entry and reduces errors.

Equipped with advanced OCR technology and specialized financial document processing algorithms, DocuClipper delivers high accuracy and fast processing speeds. Whether you’re managing a few invoices daily or processing bulk financial statements, it optimizes extraction, enhances efficiency, and ensures data accuracy in your workflow.

Pros

- User-Friendly Interface: DocuClipper’s web-based platform is intuitive and easy to navigate, making invoice data extraction seamless and efficient.

- Affordable Pricing Model: With a page-based pricing structure, it offers a budget-friendly option for small businesses, unlike competitors that charge per line item.

- High Accuracy: Using advanced OCR technology, DocuClipper precisely extracts invoice data and converts PDFs into Excel, CSV, or QBO with minimal errors.

- Rapid Processing Speed: The platform processes hundreds of invoices within minutes, reducing the time spent on manual data entry.

- Secure Cloud Storage: All financial data is encrypted and securely stored in the cloud, ensuring compliance with privacy and security standards.

Cons

- No Mobile App: DocuClipper does not have a mobile application with camera scanning, requiring invoices to be converted to PDFs before processing.

- Limited Direct Integrations: While it integrates seamlessly with Sage, Xero, and QuickBooks, connecting to other accounting platforms requires API setup.

Pricing

- Starter: $39/month for 200 pages per month.

- Professional: $74/month for 500 pages per month.

- Business: $159/month for 2000 pages per month.

- Enterprise: Custom pricing for a custom number of pages per month. Contact DocuClipper for more details.

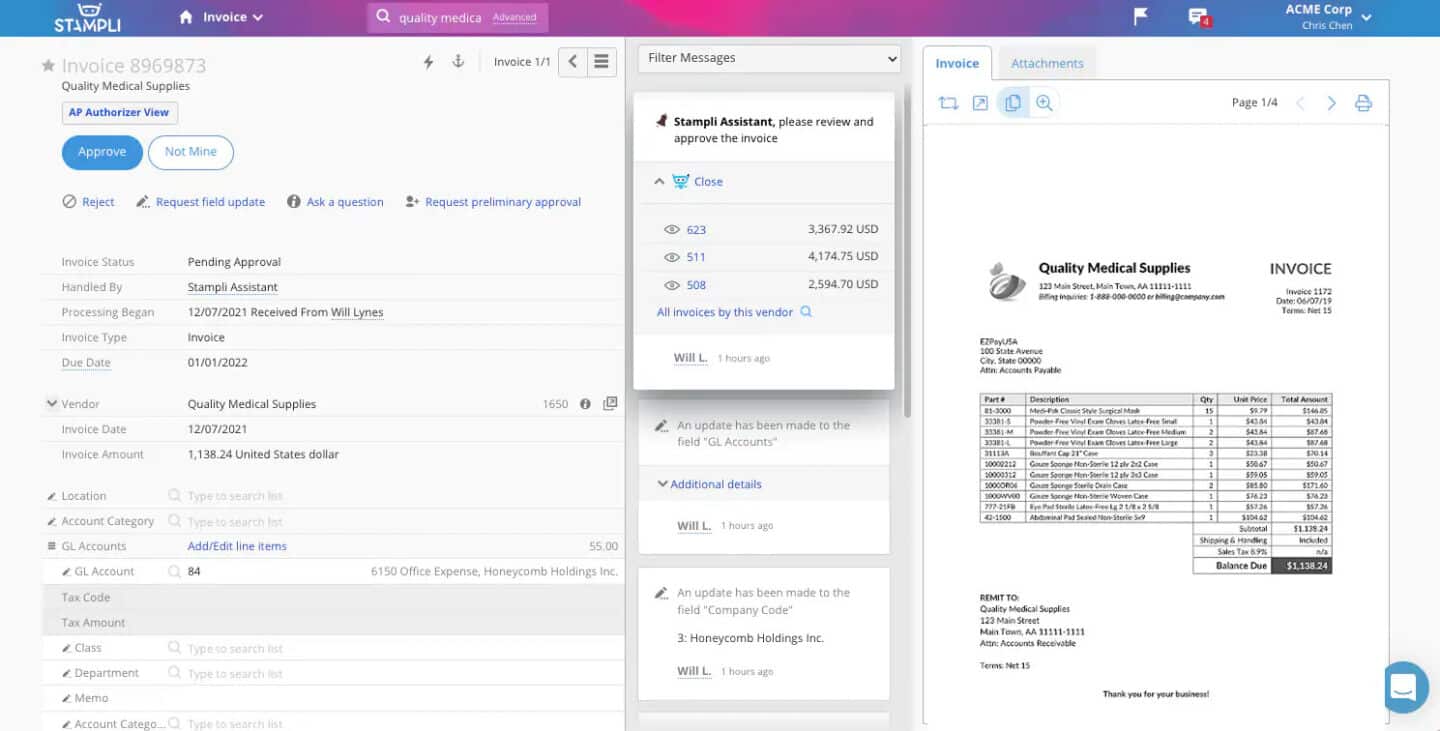

2. Stampli

Stampli is a procure-to-pay platform that simplifies procurement and accounts payable by centralizing approvals, transactions, and communication in a single system. Its AI assistant, Billy the Bot™, automates invoice processing, helping businesses manage over $90 billion in transactions annually.

With prebuilt integrations for ERPs such as Sage, Microsoft, Oracle, SAP, QuickBooks, and Acumatica, Stampli adapts to diverse financial workflows. Its rapid implementation process ensures businesses can deploy it within weeks, making it accessible to all stakeholders in the invoice lifecycle.

Pros

- Intuitive Interface: Stampli’s user-friendly design makes it easy to navigate, allowing users to manage multiple locations and switch between facilities seamlessly for efficient invoice approvals.

- Reliable Customer Support: The support team is responsive, providing quick resolutions, regular follow-ups, and monthly check-ins to improve the user experience.

- Advanced Search Capabilities: The platform’s keyword-based search function simplifies audits, eliminating the need to manually sift through invoices.

- Seamless NetSuite Integration: Unlike some competitors with complex implementations, Stampli integrates smoothly with NetSuite, reducing setup time and ensuring a faster adoption process.

Cons

- Limited Customer Support Availability: Stampli does not provide 24/7 support and remains closed on holidays, which can be inconvenient for users needing assistance outside regular hours.

- QuickBooks Sync Issues: Vendor or customer name changes in QuickBooks create duplicate entries in Stampli, preventing transaction history from merging. Without a batch update option, each invoice must be corrected manually.

- Invoice Processing Delays: Late-period invoices may not be reviewed before the QuickBooks export deadline, requiring manual date adjustments. A batch update feature for date changes would enhance efficiency.

- Prepayment Workflow Challenges: Integrating prepayments into workflows is more complex than expected, requiring additional setup and manual adjustments.

- Lack of AP Aging Report: Stampli does not include a built-in AP aging schedule, making it harder to track outstanding payables.

- Slow Issue Resolution via Chat: While chat support is available, resolving issues can take hours or days. A phone support option would improve response times.

Pricing

Stampli employs a usage-based pricing model, with specific details available upon request. For a personalized quote, potential users are encouraged to contact Stampli directly through their website.

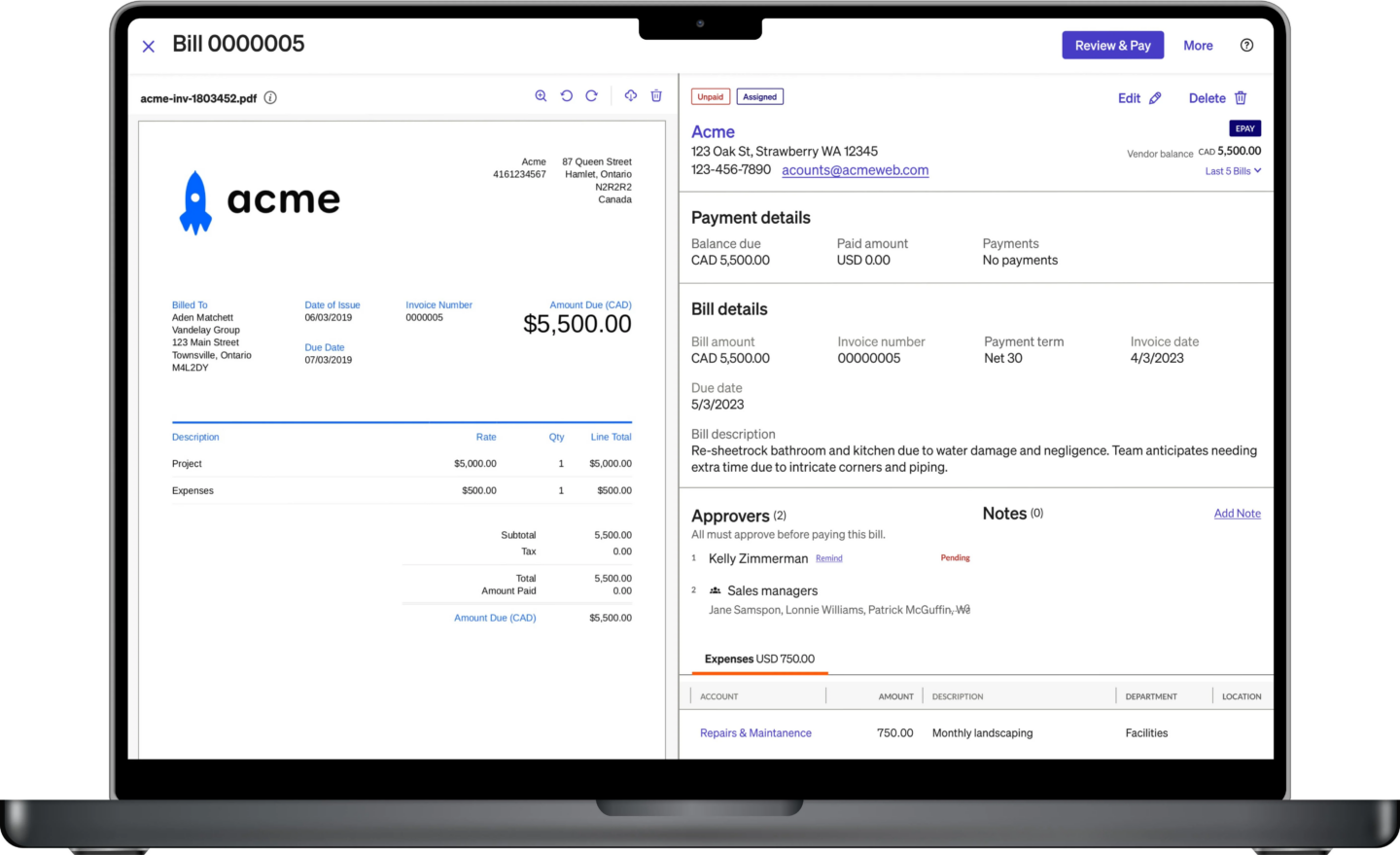

3. BILL AP/AR

BILL is a financial operations platform designed for small and midsize businesses (SMBs), offering automation for payables, receivables, and expense management. By streamlining financial workflows, it helps businesses improve efficiency and speed up transactions.

With a vast proprietary member network, BILL enables businesses to send and receive payments faster. Headquartered in San Jose, California, it is a trusted partner of major U.S. financial institutions, accounting firms, and software providers, making it a widely adopted solution for managing business finances.

Pros

- Simplified Bill Processing: BILL automates payables, reducing manual work and minimizing human errors.

- Flexible Payment Options: The platform offers multiple payment methods and an intuitive interface, making it accessible even for users with minimal accounting experience.

- Improved Cash Flow Management: Automation reduces the risk of late payments or missed invoices, ensuring better financial control.

- Seamless Integration with Intacct: Easily connects with Intacct for streamlined financial management.

- Responsive Customer Support: Users report timely and accurate support, helping resolve issues efficiently.

- Reliable for AP Management: Regular users find BILL to be a dependable solution for managing accounts payable.

Cons

- High International Payment Fees: BILL charges higher-than-average rates for international vendor payments, making it costly compared to competitors.

- Lack of User Notifications: New policies and procedural changes are introduced without notifying users, which can lead to unexpected workflow disruptions.

- Limited Reporting Features: The platform’s reporting tools lack customization, restricting in-depth financial analysis.

- Manual Data Entry for Bill Details: Certain descriptions and details cannot be copied from bills, requiring manual input and increasing processing time.

- Poor Syncing and Integration with QuickBooks: Non-PDF attachments do not sync, and there is no clear way to identify unsynced transactions without contacting customer support.

- Slow and Inefficient Customer Support: Support is outsourced, and resolving even simple integration issues often requires lengthy interactions with multiple representatives.

- No PDF or Email Export for Bills: Users can only download bills while in the inbox, limiting document-sharing options.

- Expensive User-Based Pricing: The per-user pricing model is costly for businesses with multiple department heads who use the system infrequently.

- Check Cancellation Issues: Canceling a drafted check requires a hefty stop payment fee, or businesses must wait 91 days for the funds to be redeposited.

Pricing

- Essentials: $45/month – Manage payables or receivables, manually import/export CSV files, track payment status, and process ACH, check, credit card, and international wire transfers. Includes single and recurring invoices with automated email reminders.

- Team: $55/month – Includes all Essentials features plus integration with QuickBooks Online, QuickBooks Pro/Premier, and Xero, a centralized inbox, 360-degree vendor info, and custom user roles.

- Corporate: $79/month – Adds robust workflow options, automatic 2-way sync with QuickBooks Online, QuickBooks Pro/Premier, and Xero, access to 4M+ vendors via the BILL network, unlimited document storage, and multiple payment methods, including ACH, virtual cards, and credit cards.

- Enterprise: Custom pricing – Includes advanced integrations with QuickBooks Enterprise, Oracle NetSuite, Sage Intacct, Microsoft Dynamics, and other platforms. Offers Single Sign-On, dual control, multi-entity support, and API access. Contact BILL for a quote.

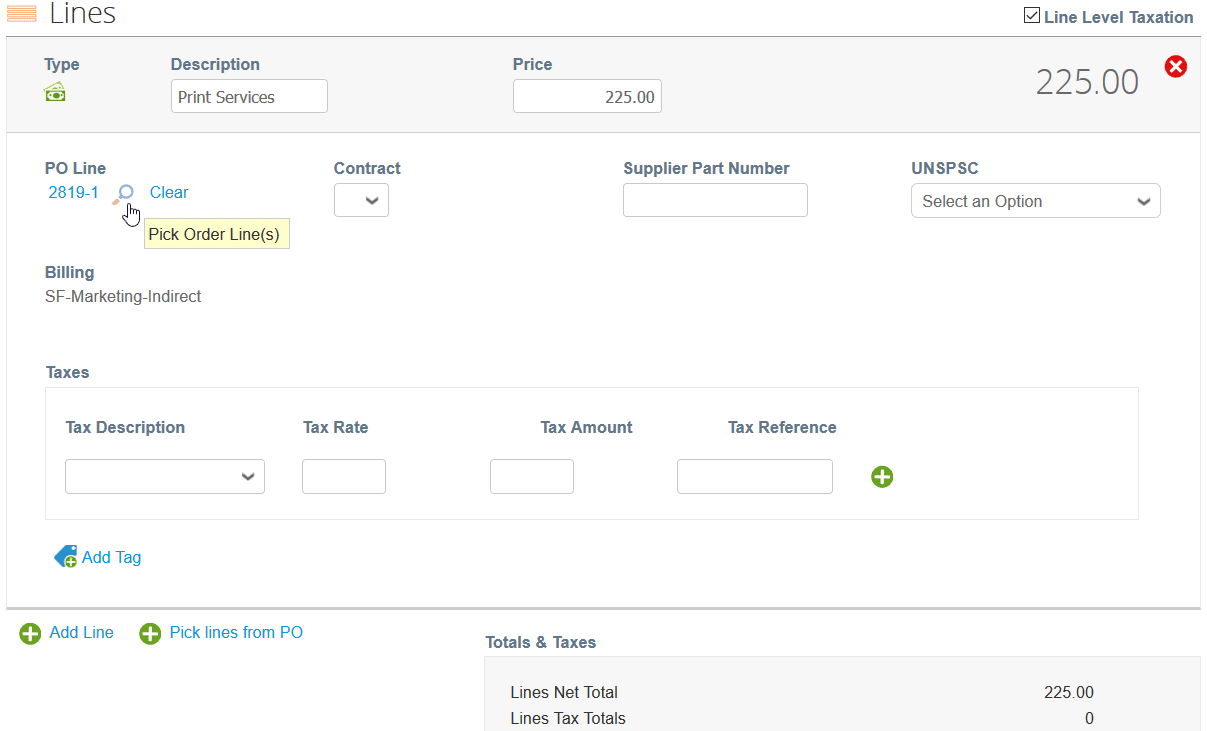

4. Coupa

Coupa is a comprehensive spend management platform designed to help businesses optimize financial operations. It provides a centralized solution for controlling expenses, enhancing visibility, and driving growth. By allowing organizations to start with their most critical spend areas and expand as needed, Coupa ensures scalability and flexibility.

With features like centralized request and approval management, Coupa simplifies procurement by offering an intuitive, guided buying experience. This ensures employees can easily find what they need while maintaining compliance and approval workflows.

Pros

- User-Friendly Interface: Coupa is designed for ease of use, making spend management simple and intuitive, even for new users.

- Seamless Implementation: The platform is easy to set up and integrates smoothly with other business tools, ensuring efficient workflow management.

Cons

- Difficult Supplier Registration: Setting up a supplier account can be challenging, often requiring client intervention to complete the process.

- Session Timeout Issues: Users are automatically logged out every 10 minutes, forcing them to re-enter information instead of benefiting from auto-save functionality.

- Lack of Address Format Verification: Inconsistent address formats can cause accounting errors, requiring users to withdraw and resubmit requests.

- Repetitive Registration Process: Suppliers must re-register for each client, which can take up to two hours per registration.

- Cluttered and Confusing UI: Excessive notices and warnings appear on login, making the interface overwhelming and difficult to navigate.

- Limited Support for Catalogs and cXML Invoicing: There is not enough public information on available supplier catalogs, making it harder for users to find relevant options.

Pricing

- Registered (Free): Allows businesses to connect with Coupa customers, manage orders, send e-invoices, access catalogs, process payments, and participate in sourcing events.

- Verified ($549/year): Includes all Registered features plus a verified badge, priority search ranking, and enhanced visibility within Coupa’s buyer community.

- Premium Support ($499+/year): Offers a minimum of 6 hours of 24/5 Zoom support, one-on-one meetings, and personalized assistance based on business needs.

- Advanced ($4,800/year): Provides advanced invoice management with customizable views, automated weekly reports, and Coupa-generated payment reminders.

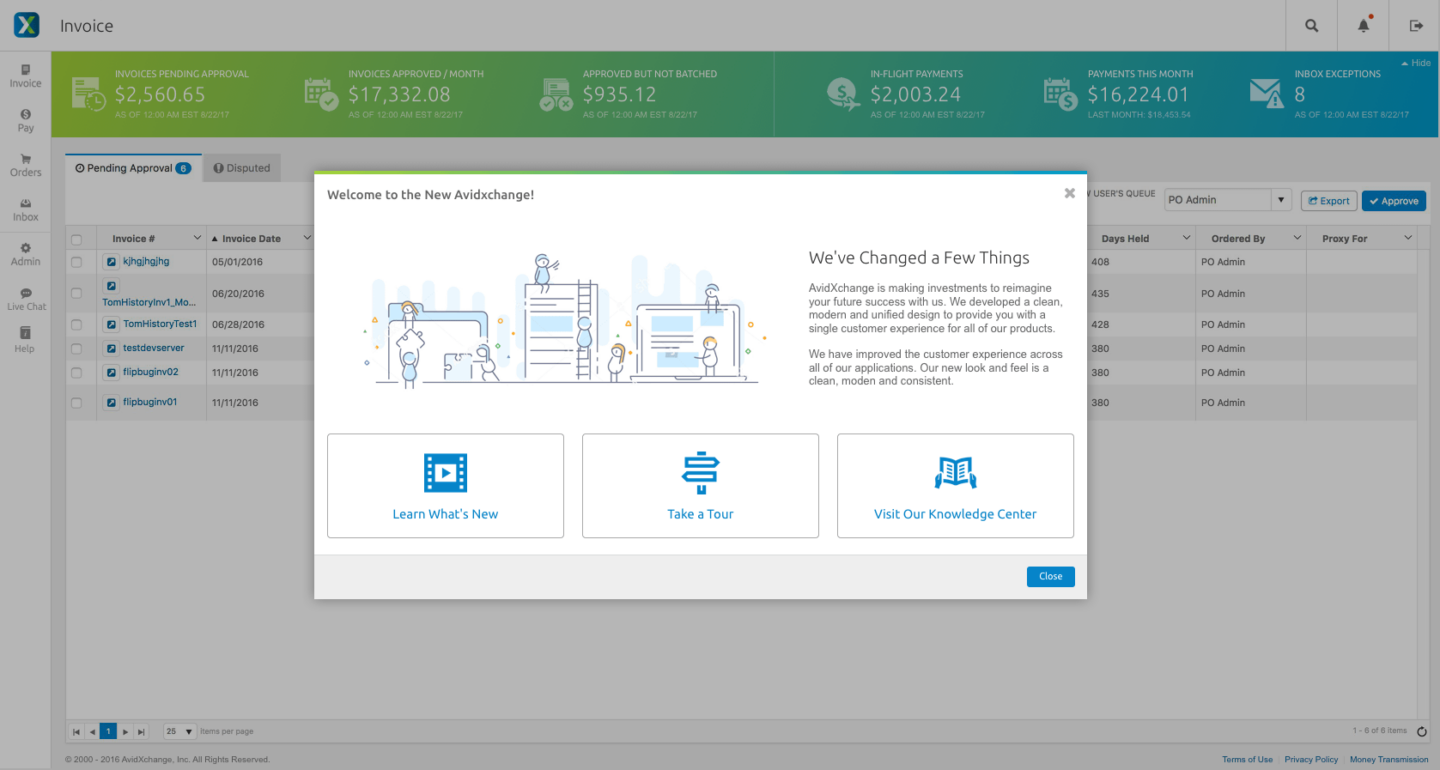

5. AvidXchange

AvidXchange helps middle-market businesses automate expense and payment management with AI-driven software and dedicated support. With over 25 years of experience, it streamlines accounts payable processes, reducing manual tasks and cutting costs.

With one of the largest supplier networks in the middle market, AvidXchange provides industry-specific expertise across sectors such as real estate, healthcare, hospitality, education, nonprofits, construction, financial services, and media. Its acquisitions of Core Associates, BankTEL, and FastPay have further expanded its capabilities.

Pros

- Efficient Invoice Management: Uploading, editing, and modifying invoices is straightforward, making accounts payable processing smoother.

- Customizable Reports: Users can generate tailored reports with ease, improving financial oversight and decision-making.

- Accurate Automated Uploading: The system ensures reliable invoice data extraction, reducing manual work and saving time on payables.

- Seamless Payment Automation: AvidXchange automates payments, reducing manual effort and enabling easy payment tracking.

- Integrates Well with Key Tools: Works seamlessly with platforms like AvidPay, TimberscanGo, and Sage 300 Construction, enhancing overall workflow efficiency.

Cons

- Payment Processing Delays: Users experience frequent delays in processing payments, leading to vendor dissatisfaction and increased manual follow-ups.

- Lack of Communication and Follow-Ups: Issues such as refunds, failed transactions, and payment delays often go unresolved due to poor communication and support response.

- System Downtime: Frequent outages, especially after the release of AvidCapture, have disrupted operations and caused productivity losses.

- Slow Payment Tracking: AvidPay’s payment tracking process can take 30 minutes to an hour, making it inefficient for users managing multiple transactions.

- Ineffective Technical Support: Support often provides generic troubleshooting steps like clearing cookies, rather than addressing underlying system issues.

- Inconvenient Vendor Payment Options: Vendors must call or email support to switch payment methods, with no self-service option, making the process cumbersome.

Pricing

Contact sales rep for pricing.

6. Nanonets

Nanonets is an AI-powered solution designed to automate invoice and financial document processing. Leveraging advanced OCR and deep learning, it extracts key invoice details and converts unstructured data into structured formats.

By eliminating manual data entry, it enhances accounts payable, invoice reconciliation, and financial workflows. With seamless API connectivity, Nanonets integrates with accounting and ERP systems, cutting manual effort by up to 90%.

Its high accuracy, scalability, and automation make it an effective tool for businesses looking to streamline invoice processing, reduce costs, and boost efficiency.

Pros

- Robust and adaptable technology: Nanonets provides precise OCR-driven invoice extraction with a user-friendly interface, making it suitable for businesses of all sizes.

- Dedicated customer support: The support team actively helps users maximize the platform’s capabilities, offering setup assistance and best practice recommendations.

- Customizable workflows: Nanonets collaborates with users to refine processes and implement tailored solutions, improving operational efficiency.

- Superior OCR accuracy: Users report that Nanonets excels in precision, processing speed, seamless integration, and scalability compared to other solutions.

Cons

- Slow initial support response: While customer service has improved, early users reported delays in receiving assistance.

- Costly for low-volume users: Businesses with minimal invoice processing may find the pricing less justifiable, especially for additional model usage.

- Limited batch processing control: Large invoice uploads lack an efficient tracking system, requiring manual reprocessing of individual pages for corrections.

- Complex setup process: Configuring workflows and automation can be time-consuming and may require technical knowledge.

- Unclear pricing structure: The cost breakdown isn’t always transparent and may not be as budget-friendly as other invoice extraction tools, particularly for smaller businesses.

- Potential need for manual review: Despite automation, some extracted data may still require verification, reducing overall efficiency gains.

Pricing

- Starter Plan: Ideal for individuals or small teams, this pay-as-you-go option charges $0.30 per processed page with no fixed monthly fee.

- Pro Plan: This plan is suitable for growing teams and costs $999 per month for 10,000 pages, with additional pages at $0.10 each. It includes team collaboration tools, custom AI for data capture, and integrations with Microsoft Dynamics, Salesforce, and SAP.

- Enterprise Plan: Designed for large organizations handling high-volume processing, it provides custom solutions, including dedicated account management, flexible data retention, and personalized onboarding. Pricing is available upon request.

New users receive $200 in free credits upon signing up to explore the platform before committing to a paid plan.

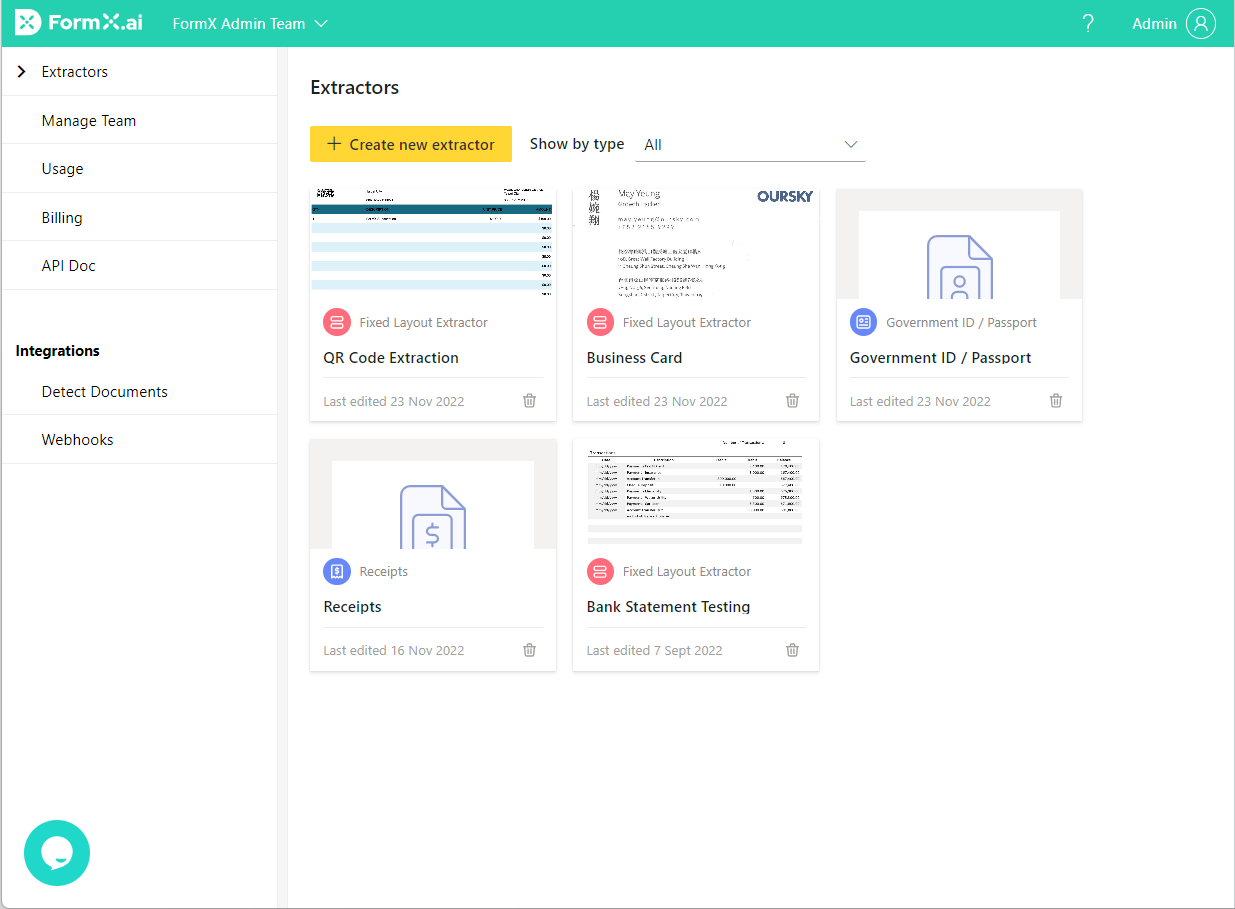

7. FormX

FormX is an Intelligent Document Processing (IDP) solution that automates data extraction from various documents, including IDs, passports, receipts, invoices, and bank statements. It streamlines workflow automation and enhances data analytics by eliminating manual data entry.

In addition to pre-built extractors, FormX enables users to create custom extractors using machine learning—without requiring any coding. By reducing manual processing costs by up to 90%, businesses can improve efficiency and enhance customer experience.

Pros

- Easy to Use: FormX features a user-friendly interface that allows even beginners to handle document processing without extensive training.

- Seamless Integration: The platform integrates smoothly with existing workflows, ensuring efficient data extraction and minimal disruptions.

- Time-Saving Automation: Automates data extraction, significantly reducing manual data entry and improving operational efficiency.

- Responsive Customer Support: The support team is quick to assist, ensuring users receive timely help when needed.

Cons

- Limited Customization for Complex Data Extraction: While FormX offers strong automation, some complex use cases require additional setup time and lack flexibility.

- No Offline Access: The platform requires an internet connection, as there is no offline mode available for document processing.

- Inconsistent Accuracy for ID and Passport Data: Some extracted data, such as names or place of birth, may be incorrect, requiring manual verification.

- Processing Delays for High-Volume Data: Large data batches may experience slower processing times, affecting efficiency.

- Expensive for Startups: Pricing may be on the higher side for small businesses with limited budgets.

- Lack of Advanced Customization: Users may find it challenging to tailor the system to specific needs beyond the pre-built extraction models.

Pricing

- Pay-as-You-Go: $0.30 per page – No monthly commitment, ideal for low-volume users. First 100 pages are free.

- Starter ($299/month per extractor): Best for small businesses and individual users, includes 3,000 pages per month. Additional pages cost $0.10 per page. Comes with community forum support and one extractor.

- Enterprise (Custom Pricing): Designed for high-volume processing, offering tailored solutions, seamless integration, and scalable data extraction. Contact FormX for a custom quote.

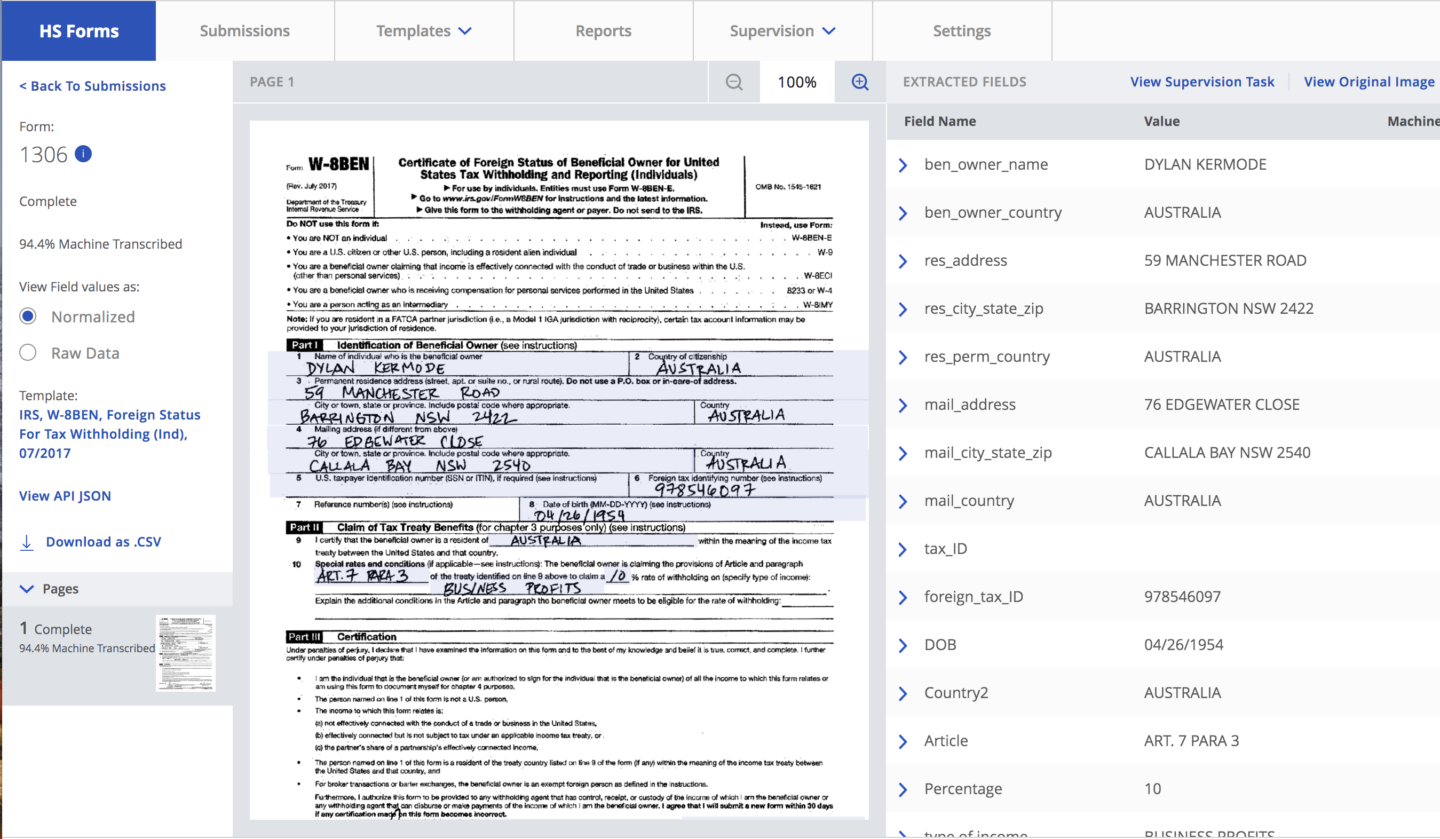

8. Hyperscience

Hyperscience leverages AI and machine learning to automate invoice data extraction, significantly reducing manual entry and errors. It processes both structured and unstructured documents with 99.5% accuracy, ensuring high precision.

Designed for seamless enterprise integration, Hyperscience enhances financial workflows by streamlining data capture and accelerating invoice processing, improving overall efficiency.

Pros

- High Accuracy: Processes both handwritten and digital invoices with 99.5% accuracy, minimizing the need for manual corrections.

- Seamless Integration: Easily integrates with various enterprise applications, ensuring smooth adoption.

- Task Restriction Feature: Supports multiple business operations while maintaining audit compliance and data security.

- Reliable Customer Support: Users report strong support, making implementation and troubleshooting more efficient.

Cons

- Processing Limitations in Older Versions: Some characters may not be accurately recognized, though updates are expected to improve performance.

- Slower Processing for Large Data Volumes: High-volume document processing may experience performance lags, affecting efficiency.

- Integration Complexity: Organizations with less structured infrastructure may require additional setup for seamless integration.

- Security Considerations: Handling sensitive invoice data may require extra privacy measures to meet compliance requirements.

- Challenges with Semi-Structured Documents: The platform struggles with non-standard invoice formats, requiring further refinements for better automation.

Pricing

Contact the sales representative for a quote.

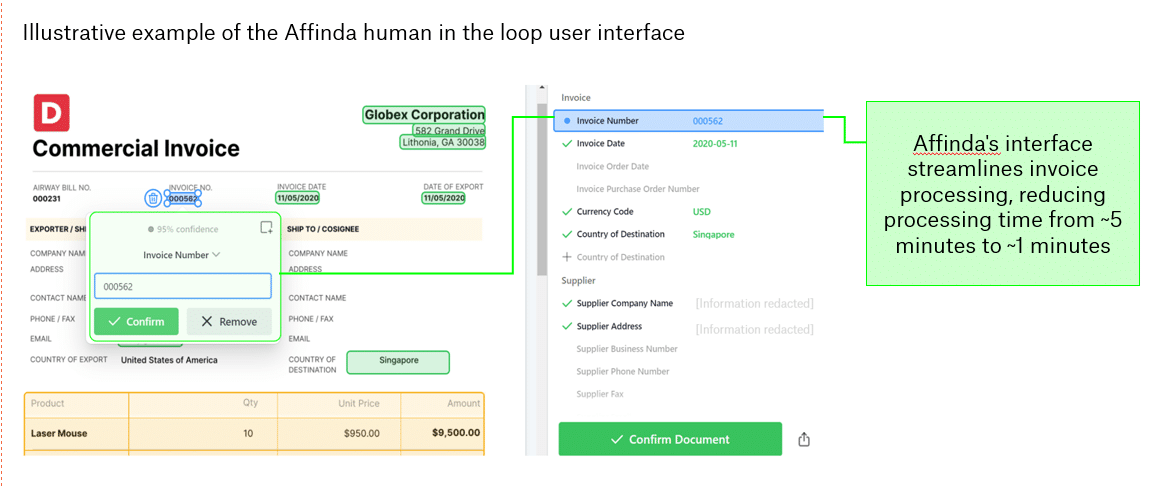

9. Affinda

Affinda offers AI-powered document automation solutions that blend human adaptability with machine precision to streamline document processing. Its AI-driven tools support Recruitment AI, Accounts Payable AI, Compliance AI, and custom models tailored to specific business needs.

By automating routine tasks, Affinda accelerates document processing, improves data extraction accuracy, and organizes information in an intuitive format. It is widely used by job boards, HR professionals, recruitment teams, accounts payable departments, ERP platforms, IT consultants, and software companies to enhance efficiency and productivity.

Pros

- Easy API Integration: Affinda’s API is simple to implement, allowing businesses to automate document processing quickly.

- Versatile Document Processing: Effectively handles various document types, including passports, insurance forms, and flight documents.

- Fast Deployment: Requires minimal setup time, enabling businesses to go live with automation swiftly.

- Custom Model Development: Can create tailored AI models with very few sample documents, improving accuracy for specific use cases.

Cons

- Limited Payment Options for API Credits: Currently, API credits cannot be purchased by credit card, though this feature may be added in the future.

- Downgrade in JD Parsing Accuracy: Version 3 requires converting job descriptions into text documents, whereas Version 2 handled text parsing more effectively.

- Inconsistent Job Title Extraction: Some job titles, such as “.Net Developer,” are not accurately parsed, leading to occasional data extraction errors.

- Limited Support for Common Programming Terms: Certain widely used technical terms are not always recognized correctly, requiring manual corrections.

Pricing

Contact sales rep for pricing.

Frequently Asked Questions About Tipalti Alternatives (FAQs)

Here are some frequently asked questions about tipalti alternatives:

What factors should I consider when choosing a Tipalti alternative?

When choosing a Tipalti alternative, consider pricing, automation capabilities, and integration with your accounting system. Evaluate payment options, especially for global transactions. Security, compliance, and data protection are essential. Customer support quality can impact troubleshooting, and a user-friendly interface ensures smooth adoption. Assess scalability to meet your business’s future financial management needs.

Are these alternatives suitable for small businesses?

Yes, many Tipalti alternatives cater to small businesses with flexible pricing, automation, and integrations. Some offer pay-as-you-go or tiered plans, making them affordable for smaller operations. Features like invoice processing, payment automation, and accounting software compatibility help streamline financial management. It’s essential to choose a solution that matches your business size, budget, and workflow needs.

Do these tools support multiple currencies?

Yes, many Tipalti alternatives support multiple currencies, allowing businesses to process international transactions efficiently. Features like automated currency conversion, global payment methods, and compliance with international tax regulations make cross-border payments seamless. However, support varies by platform, so it’s important to check if the tool aligns with your specific currency and payment processing needs.

Can these platforms integrate with existing accounting systems?

Yes, most Tipalti alternatives integrate with popular accounting systems like QuickBooks, Xero, NetSuite, and Sage. These integrations help automate invoice processing, payment reconciliation, and financial reporting. Some platforms offer direct integrations, while others require API configuration. It’s important to verify compatibility with your existing software to ensure seamless data flow and efficient financial management.

Is training required to use these accounts payable automation tools?

Most accounts payable automation tools are designed to be user-friendly, but some training may be necessary depending on the platform’s complexity. Basic features like invoice processing and payments are often intuitive, while advanced functions may require tutorials or onboarding support. Many providers offer documentation, webinars, or customer support to help users get started efficiently.