Automating tedious tasks is essential in today’s world to achieve high precision and efficiency is paramount.

Transaction categorization is no exception. As the financial industry becomes increasingly complex with every growing number of transactions happening every second, the manual approach to sorting and categorizing them becomes both cumbersome and prone to error.

In this digital age, leveraging the power of automation in this realm not only simplifies the accountant’s role but also offers invaluable insights that can be the difference between business growth and stagnation.

Let’s dive into this guide to understand why transaction categorization is important for modern financial management and how its automation is reshaping the future of accounting.

Master your money movements – Obtain our transaction categorization spreadsheet now!

What is Transaction Categorization?

Transaction categorization is the process of assigning bank transactions to categories. It involves reviewing transaction descriptions, merchants, amounts, and other data points to determine the appropriate category for each transaction.

For example, some common transaction categories businesses could create are:

- Cost of Goods Sold – Expenses directly related to producing or purchasing goods sold by the business. This includes raw materials, inventory, and production costs.

- Rent – Expenses related to renting office space, retail stores, equipment, and other needs.

- Utilities – Electricity, gas, water, phone, internet, and other utility expenses.

- Payroll – Salaries, wages, and related payroll tax and benefit expenses.

- Marketing – Advertising, promotions, branding, and other marketing costs.

- Professional Fees – Accounting, legal, consulting, and other professional services.

- Travel – Business travel like flights, hotels, meals, and transportation.

- Office Supplies – Stationery, printing, postage, and other office supply expenses.

- Insurance – Premiums for business, health, liability, vehicle, and other insurance.

- Repairs & Maintenance – For equipment, furniture, buildings, and other assets.

- Taxes – Sales tax, property tax, franchise tax, and other tax expenses.

Categorization of transactions is one of the basic accounting practices to keep track of business expenses, analyze bank transactions, and improve auditing.

Therefore it’s essential to know what business expense categories you should create so you can correctly categorize your business expenses.

Benefit of Categorizing Transactions

Transaction categorization provides the foundation for managing both personal and business finances. By assigning transactions to categorized “buckets”, transaction data can be organized, summarized, monitored, reported on, and analyzed much faster.

Without categorization, transaction information would be disorganized and much more difficult to interpret and work with.

With that, here are key reasons why you should start categorizing your transactions as well:

- Better expense tracking – Categorized transactions allow you to summarize and analyze expenses by category. This helps identify spending patterns and areas of excess spending.

- Improved budgeting – With expenses allocated to categories, you can easily track category budgets and spending against them. This supports better budget planning and control.

- Simplified reporting – Categorized transactions can be filtered and sorted to generate financial reports by customer, product, department, project, or other parameters.

- Tax planning – Expenses can be categorized as tax deductible or non-deductible to maximize deductions. Deductible expenses can be easily filtered for tax return preparation.

- Bank Reconciliation – Organized transaction data enables easier account reconciliation and audit support. Transactions are aligned to general ledger codes.

- Insight mining – Data analytics can be applied by category to identify trends and opportunities for efficiency gains and cost reductions.

- Financial oversight – Monitoring transaction categories allows management to identify anomalies and analyze areas with excessive or unauthorized spending.

And transaction categorization becomes even more important for accounting firms managing the finances of multiple clients.

Proper categorization lays the groundwork for streamlined and effective financial management across client accounts.

Methods of Transaction Categorization

When it comes to categorizing transactions, there are a few different approaches that you can take.

The method used depends on the volume of transactions, the desire for automation versus manual review, and the categorization accuracy needed, as well as available tools.

The main methods are manual categorization, rules-based categorization, and machine learning-driven categorization.

So, let’s dive deeper into each of these methods.

Manual categorization

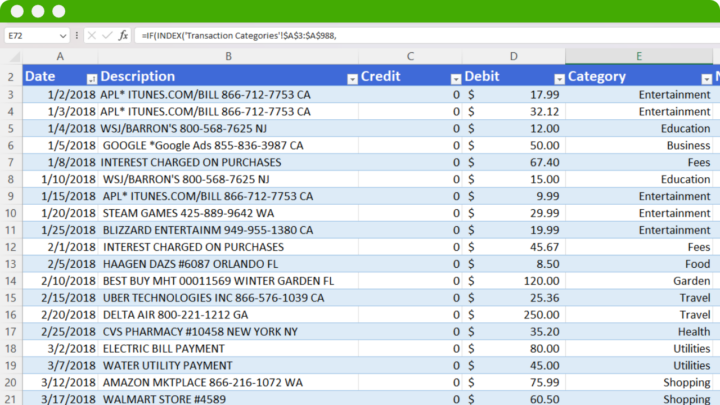

Manual categorization involves a person reviewing and assigning a category to each transaction individually based on the description, merchant, amount, and other context.

Basically, go take your bank statements and one by one you categorize your transactions.

For example, transactions from shops like Target or Walmart could be tagged as “Shopping”, while transactions from BP or Exxon would be assigned to a “Gas” category. Payments to the phone, water, electricity, and internet, companies would go under “Utilities”, and checks to the dentist categorized as “Healthcare”.

As you can imagine with large numbers of transactions, manual categorization becomes highly impractical.

For instance, categorizing thousands of transactions for an entire year could take weeks of effort. And human reviewers are prone to errors, inconsistent labels, and overlooking transactions.

Rule-based categorization

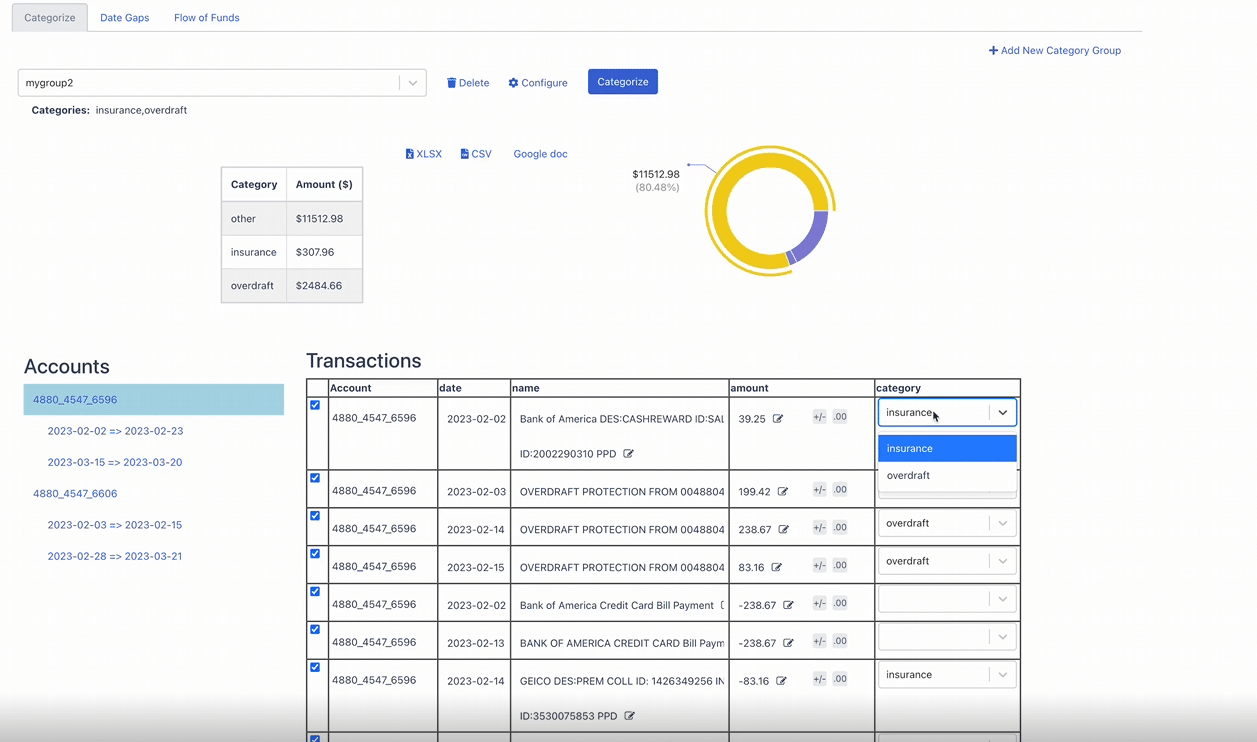

Rule-based categorization relies on creating preset rules that automatically assign transactions to categories. This removes the need to manually review every single transaction.

Rules can be based on the merchant name, keywords in the transaction description, the amount, date ranges, or other attributes.

For example, a rule could categorize any transaction from merchant “Office Depot” as “Office Supplies”. Another rule could label any transaction on the 15th of the month for $1850 as “Rent”. Rules can also combine criteria.

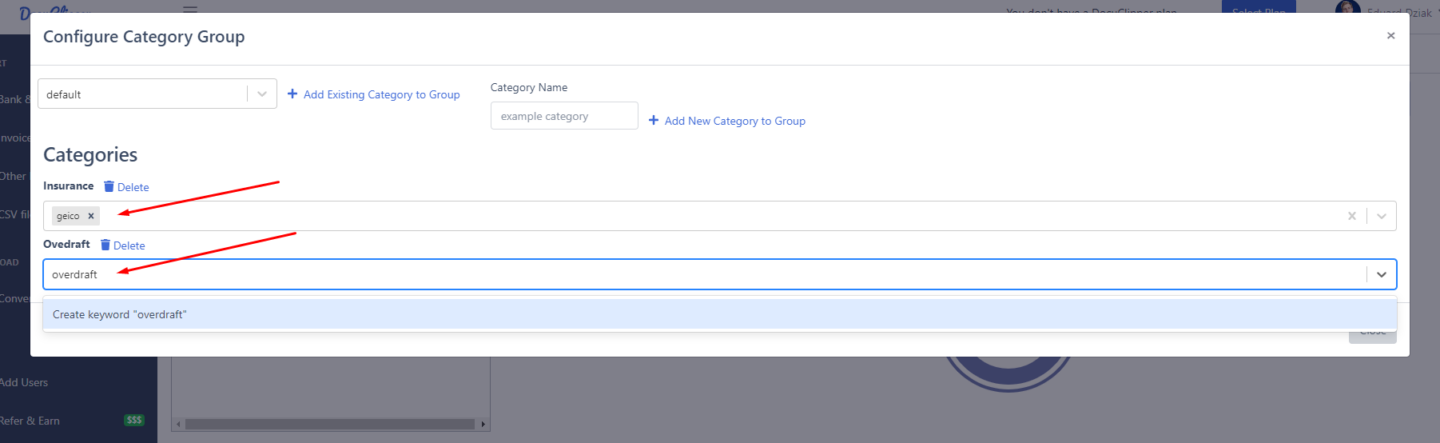

Keyword rules look for specific words in the transaction description to determine the category. Expenses with “Geico” would go under “Insurance”, while “British Airways” would be categorized as “Business Travel”.

The major benefit of rule-based categorization is increased efficiency and consistency. Once the rules are set up, transactions can be automatically categorized without human involvement. This greatly reduces the time spent on data entry.

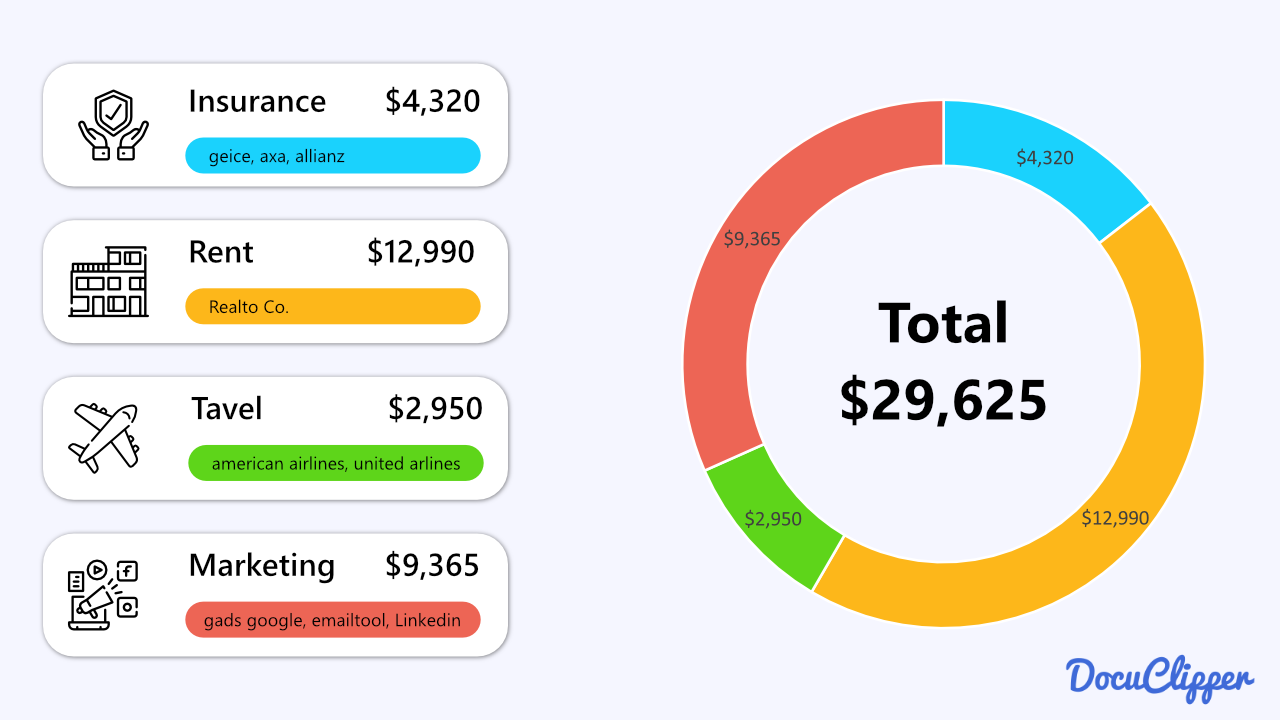

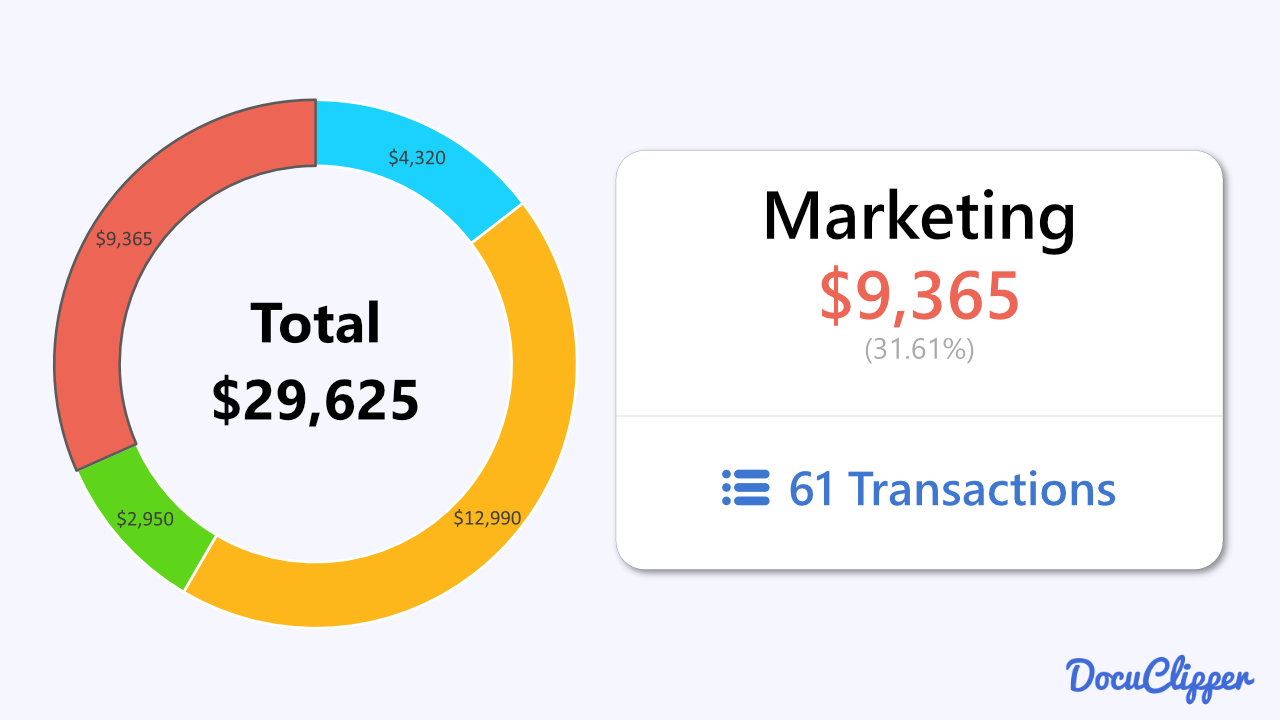

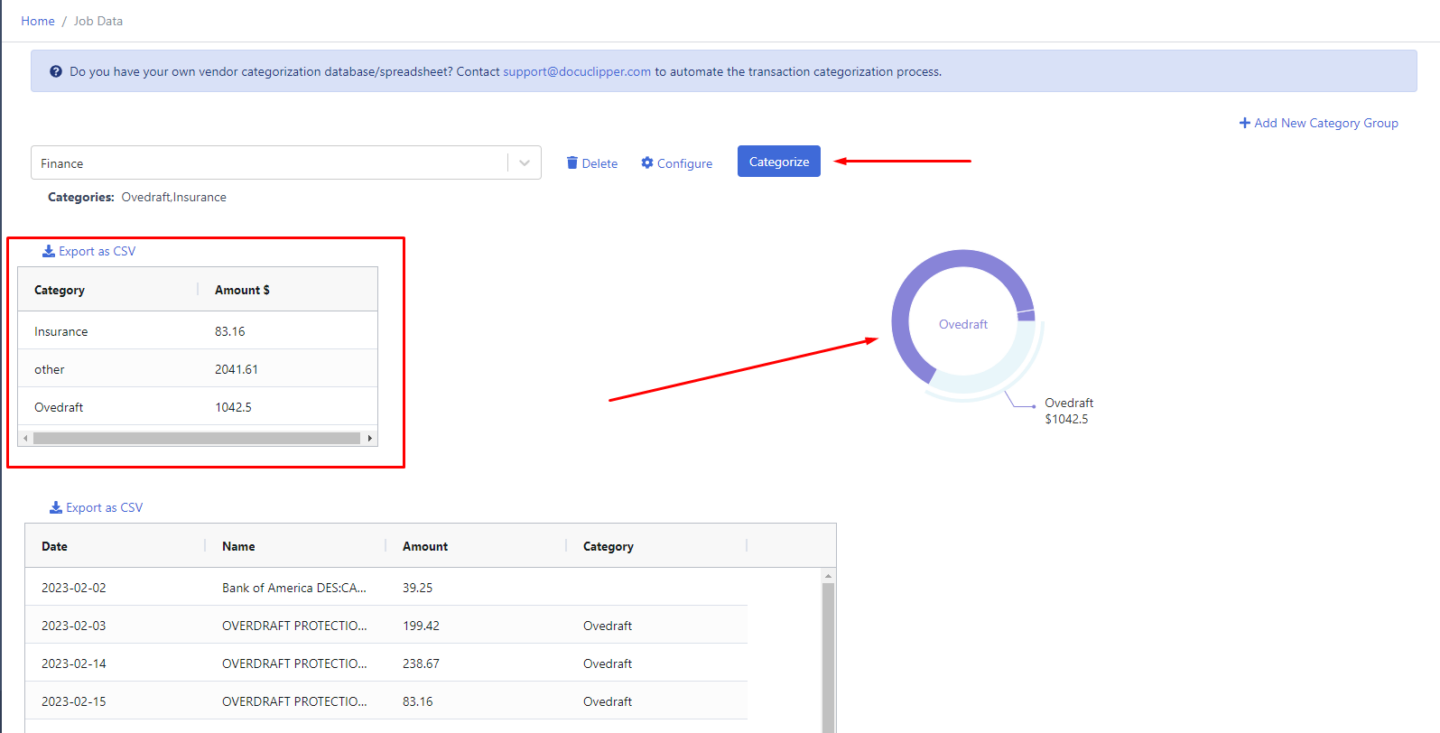

For example, DocuClipper Transaction Categorization feature allows you to quickly categorize transactions from PDF or scanned bank and credit card statements based on keywords to streamline with bank statement analysis and data analysis.

Overall, using your accounting software together with a bank statement converter to categorize all digital and physical bank transactions can streamline your accounting processes.

Machine learning and AI-driven categorization

Machine learning and artificial intelligence take automated transaction categorization to the next level. Machine learning systems can analyze large volumes of transaction data and learn to categorize new transactions with a high degree of accuracy.

Of course, you first need to train the system with extensive samples of already categorized transactions to train the machine learning model. This teaches the system the patterns associated with each category.

However, once that’s done, the powerful self-learning algorithms enable the system to gain an understanding of the correlation between transaction details and the appropriate categories.

For example, the system may identify that transactions with the words “plane”, “hotel”, or “rental car” tend to be Travel expenses. Transactions on weekends above $200 are usually Dining.

Of course, while this technology is becoming more accessible and better, it’s still requires significant investment to run these systems, resulting these tools being more expensive.

How to Categorize Transactions Effectively

While the specific methods vary, there are some best practices that can optimize the transaction categorization process. Establishing an effective system makes categorization faster, and more accurate, and provides better data for insights.

Step 1: Sync Your Bank Feed or Convert PDF Bank Statements

The first step in categorizing transactions is getting your transaction data into a digital format suited for categorization. There are two main options here:

- Direct bank feed syncing – Many accounting software platforms allow connecting your bank and credit card accounts to automatically download transactions daily. This seamless bank feed sync eliminates manual data entry.

- PDF bank statement conversion – Alternatively, PDF paper bank, credit card statements can be converted into digital formats like CSV, Excel, or QBO files, using bank statement software such as DocuClipper.

The benefit of direct bank feeds is real-time automated updates. However, for certain account types like loans or old statements, PDF conversion may be needed.

The key is minimizing manual data entry. Automated feeds and PDF conversion optimize efficiency right from the start.

Learn more:

- How to Convert Bank Statements to Excel, CSV or QBO

- How to Convert Credit Card Statements to Excel or CSV

- How to Convert CSV to QBO Format for QuickBooks Online & Desktop

- How to Convert PDF to QBO Format Easily & Automatically

Step 2: Create Group Categories & Categories

Once you have your bank transaction data in a digital format, the next step is planning your categories and category hierarchy.

Some tips for establishing an effective categorization structure:

- Group related categories under master categories for segmentation. For example, “Office Supplies” and “Software” under “Business Expenses”.

- Create categories at the appropriate level of specificity needed for reporting. Too broad or too granular can reduce usefulness.

- Use a standard naming convention for consistency. This improves filtering and training if using automation.

- Include an “Uncategorized” group to temporarily hold transactions needing review.

- Plan categories for most common transactions, but allow flexibility to add new categories.

- For businesses, align categories with your general ledger chart of accounts for easy mapping.

- Review categories regularly and adjust as needed based on evolving needs.

Of course, these are just some of the tips, but the way you categorize your transactions will depend on the business nature, common transactions, data insights requirements, and other needs.

The DocuClipper Transaction Categorization feature allows you to define categories and automatically categorize transactions based on keywords. This can help organize and analyze your transaction data.

You can add multiple keywords per category to maximize the accuracy, save the predefined categories to be reused, and export the data into CSV.

If you’re categorizing only PDF bank statements, this is all you need to do to categorize your transactions from PDF bank statements.

Step 3: Find a Match

After you’ve entered transactions into your accounting software, the next step is matching them to the transactions from your bank feed or statements.

Ideally, your accounting software will automatically try to find matches between the transactions you created and those from your bank data. All you need to do is pick an uncategorized transaction, and your software should suggest potential matches.

For example, if you recorded a $500 expense for office supplies, your accounting platform may match it to a $502 bank transaction labeled “Office Depot”, with the $2 difference being a bank fee. You can then easily approve this as a match.

However, in the case of manual transaction categorization, you should know commonly used bank statement abbreviations so you know what some of the bank transactions with codes mean and you can categorize them correctly.

Additionally, if needed, you can adjust the transaction amounts to get a perfect match. Or if no match is found, create the transaction in your accounting system and match it manually to the bank transaction.

The goal is to match every bank transaction to a corresponding accounting transaction you’ve created. Any unmatched transactions will remain uncategorized for review.

Continuously matching new transactions to your recorded accounting data keeps everything reconciled in real time. This prevents Income and Expenses from being left uncategorized.

For more information we recommend to visit our following articles:

- How to Categorize Business Expenses

- How To Automatically Categorize Bank Transactions in Excel: Template Included

- How to Categorize Credit Card Transactions in QuickBooks(4 Different Ways)

- How to Categorize Expenses in Excel (Template Included)

Benefits of Automated Transaction Categorization

Automating the transaction categorization process provides significant benefits compared to manual categorization:

Speed and Efficiency

- Automated methods categorize transactions far faster than any manual process. Everything happens in seconds versus hours or days.

- This results in massive time savings and productivity gains for individuals and businesses. Time is freed up for more value-add tasks.

Accuracy and Consistency

- Automatic categorization tools have much lower error rates than manual work prone to mistakes.

- Logical rules and AI provide reliable, consistent categorization not subject to human variance.

- This improves data quality and integrity for more accurate reporting and insights.

Scalability for Businesses

- Automated solutions can scale categorization for any transaction volume from hundreds to millions. No limits.

- This enables organizations and financial institutions to efficiently manage high transaction flows and customer bases.

- Manual categorization simply cannot match the scalability of automated tools.

By leveraging automation, the transaction categorization process is transformed from a tedious chore to a streamlined, scalable driver of insights. It unlocks the power of transaction data.

Conclusion

Transaction Categorization provides many benefits especially to companies that manage large volumes of transactions such as accounting, forensic accounting companies, businesses, or even individuals who wants to better manage finances.

By leveraging the right technology, the transaction categorization process can be streamlined like never before. This saves significant time while unlocking deep visibility into transactions and cash flow.

Using DocuClipper for Transaction Categorization

Tired of manual categorization and the errors that come with it? Try automated transaction categorization with DocuClipper. Tailor your analysis to your unique requirements, assign keywords for automatic categorization, and let the system do the heavy lifting.

Whether you’re an accountant, a financial investigator, or dealing with business expenses, DocuClipper is here to simplify and streamline your workflow.

Discover the Power of DocuClipper Transaction Categorization Now!

FAQs About Transaction Categorization

In this section, we’re going to answer the following questions about transaction categorization:

What are the categories of transactions?

Transaction categories classify financial activities based on their nature. Common categories include:

· Income: Money received, e.g., sales or dividends.

· Expenses: Costs incurred, like rent or utilities.

· Transfers: Movement of money between accounts.

· Investments: Purchase/sale of assets or stocks.

· Loans: Borrowed money or repayments.

· Using distinct categories simplifies financial tracking, analysis, and reporting.

What is categorization in accounting?

Categorization in accounting is the systematic arrangement of financial transactions into defined classes or groups, such as income, expenses, assets, and liabilities. This process enhances data accuracy, simplifies financial reporting, and aids in understanding a business's financial health. Proper categorization is vital for informed decision-making and compliance with accounting standards.

Why do we categorize transactions?

We categorize transactions to streamline financial tracking, enhance reporting accuracy, and gain insights into spending patterns. Categorization aids in budgeting, tax preparation, and analyzing financial health. By grouping transactions, businesses and individuals can easily monitor cash flow, identify trends, and make informed financial decisions. Proper categorization also ensures compliance with accounting standards.

What is an example of categorization?

An example of categorization is classifying expenses in a business budget:

· Operating Expenses: Rent, utilities, salaries.

· Cost of Goods Sold (COGS): Raw materials, production costs.

· Marketing & Advertising: Digital campaigns, print ads, trade shows.

· Travel & Entertainment: Flights, hotel stays, client meals.

· Professional Fees: Legal, accounting, consultancy services.

Organizing transactions into these categories helps businesses monitor costs, optimize budgeting, and prepare accurate financial statements.

How do banks categorize transactions?

Banks categorize transactions using descriptors and algorithms. For instance:

· Deposits & Credits: Salary credits, wire transfers.

· Withdrawals & Debits: ATM withdrawals, check payments.

· Payments: Utility bills, credit card bills.

· Fees: Overdraft charges, account maintenance.

· Transfers: Between accounts or to other banks.

Automated systems, often enhanced with machine learning, analyze transaction details (like merchant names and payment codes) to assign appropriate categories, aiding in statement clarity and fraud detection.