There is not a single invoice format that is traded by businesses all over the world. There are some with their purpose and own advantages.

But this can be confusing when you are still starting out a business and cannot distinguish all of them

Fortunately, in this article, we’ll talk about the 15 types of invoices that you will encounter when doing some accounting for your business.

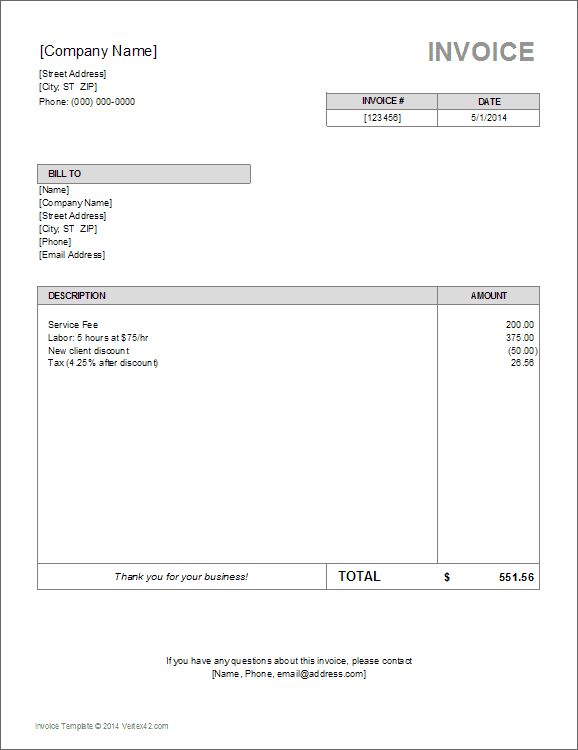

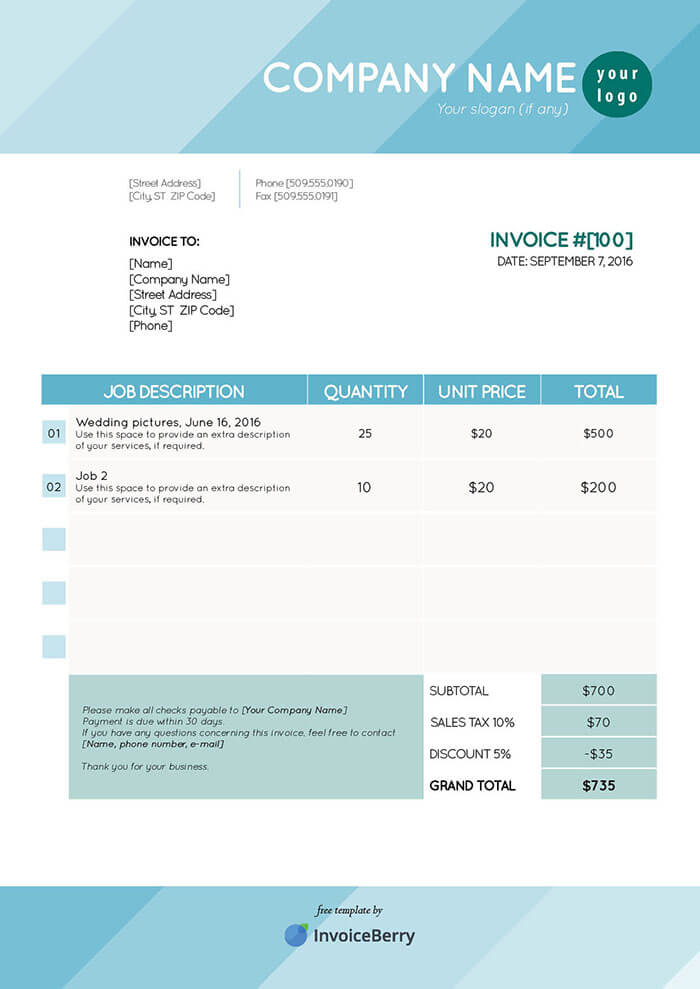

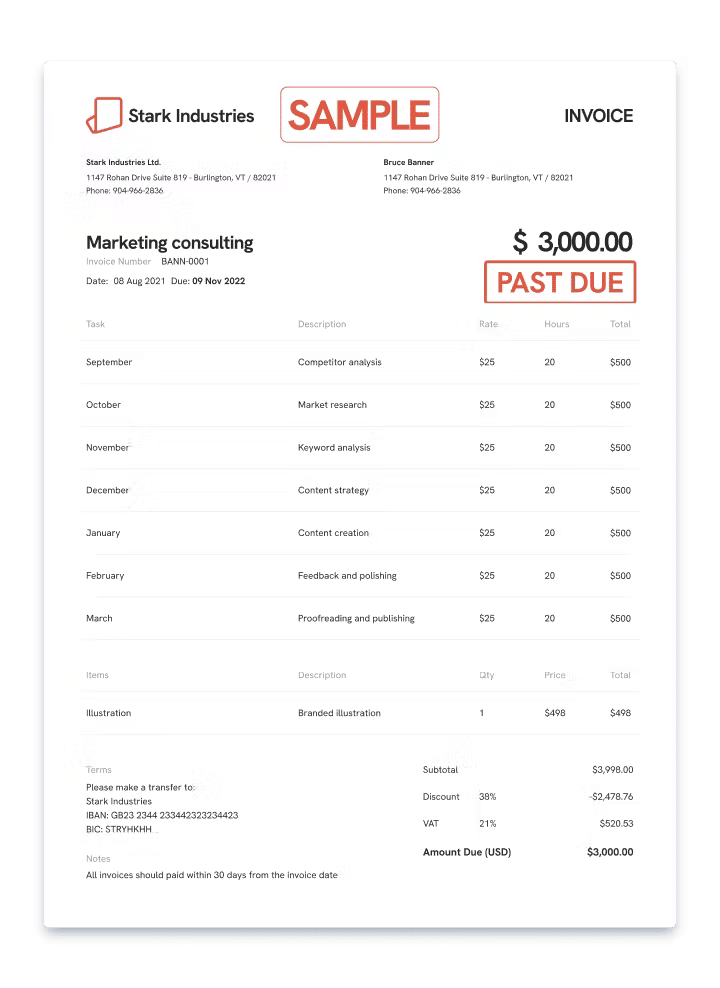

1. Standard Invoice

A standard invoice is the most common type of billing document used by businesses. It is issued to clients to request payment for services or products provided.

This flexible format is widely applicable across various industries and billing cycles.

Many businesses use an invoice generator to streamline the creation of standard invoices, ensuring accuracy and consistency while saving time.

The standard invoice includes key details such as the business’s name and contact information, the client’s details, an invoice number, and the total amount owed.

Use cases with examples:

- Freelancer delivering services: A freelancer issues a standard invoice to bill for completed design work.

- Retail business: A retail store uses a standard invoice to summarize items sold and the total amount due from the customer.

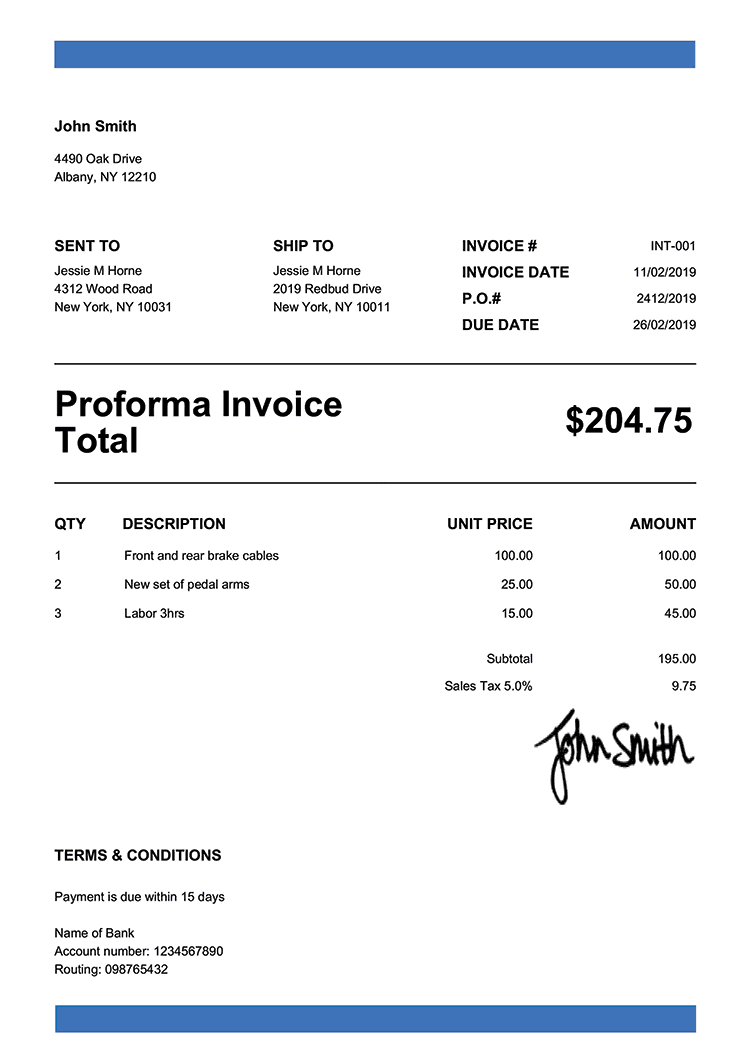

2. Proforma Invoice

A proforma invoice is a preliminary billing document issued before the delivery of goods or services, providing the buyer with an estimate of the final cost.

Commonly used in international transactions, it includes key details such as a description of the goods or services, buyer and seller information, an invoice number, shipping details, transport charges, and applicable taxes.

Unlike a standard sales invoice, a proforma invoice serves as a negotiation tool, allowing both parties to agree on terms before the final sale.

Use cases with examples:

- International trade: A company exports goods overseas and issues a proforma invoice to help customs officials determine the duties owed.

- Negotiating a large sale: A manufacturer provides a proforma invoice to a potential client during negotiations to outline the proposed terms of a bulk purchase.

- Customs clearance: A proforma invoice is used to expedite customs procedures by detailing the shipment’s contents and estimated costs.

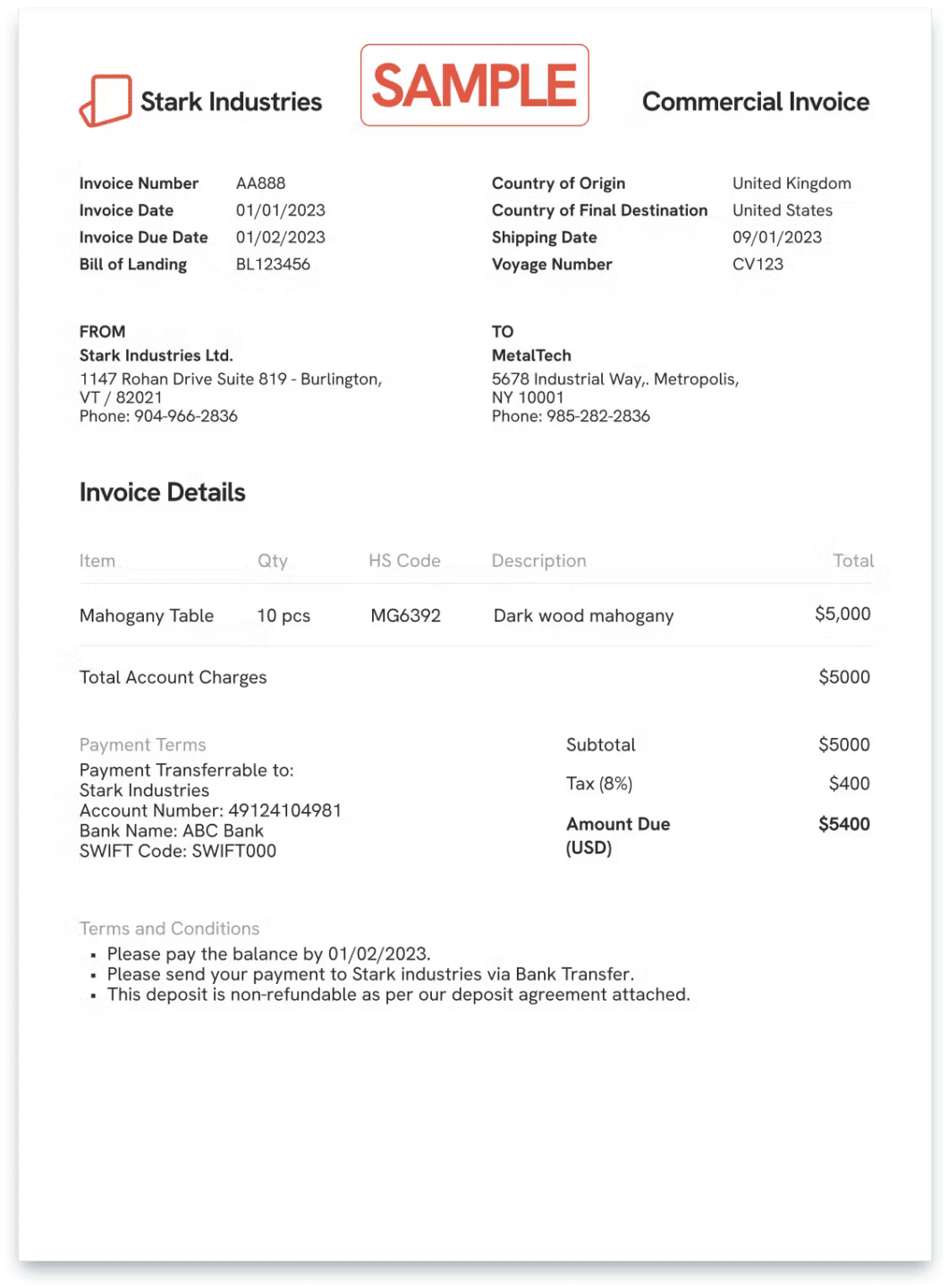

3. Commercial Invoice

A commercial invoice is a critical document used in international trade to detail the description, quantity, and value of goods being shipped.

Unlike a standard invoice, it includes additional information such as the type and reason for export, carrier details, tracking number, country of origin, and terms of trade.

This invoice is essential for customs authorities to determine the duties, VAT, and taxes owed on imported goods, ensuring proper regulation of what is being imported or exported.

It helps both the government and the company accurately assess the true cost of shipping goods internationally.

Use cases with examples:

- Exporting goods abroad: A commercial invoice helps a business provide detailed information to customs for calculating import duties.

- Importing products: An importer uses a commercial invoice to ensure all taxes and regulations are met when bringing goods into the country.

- International shipping: A logistics company includes commercial invoices to manage compliance during cross-border transportation.

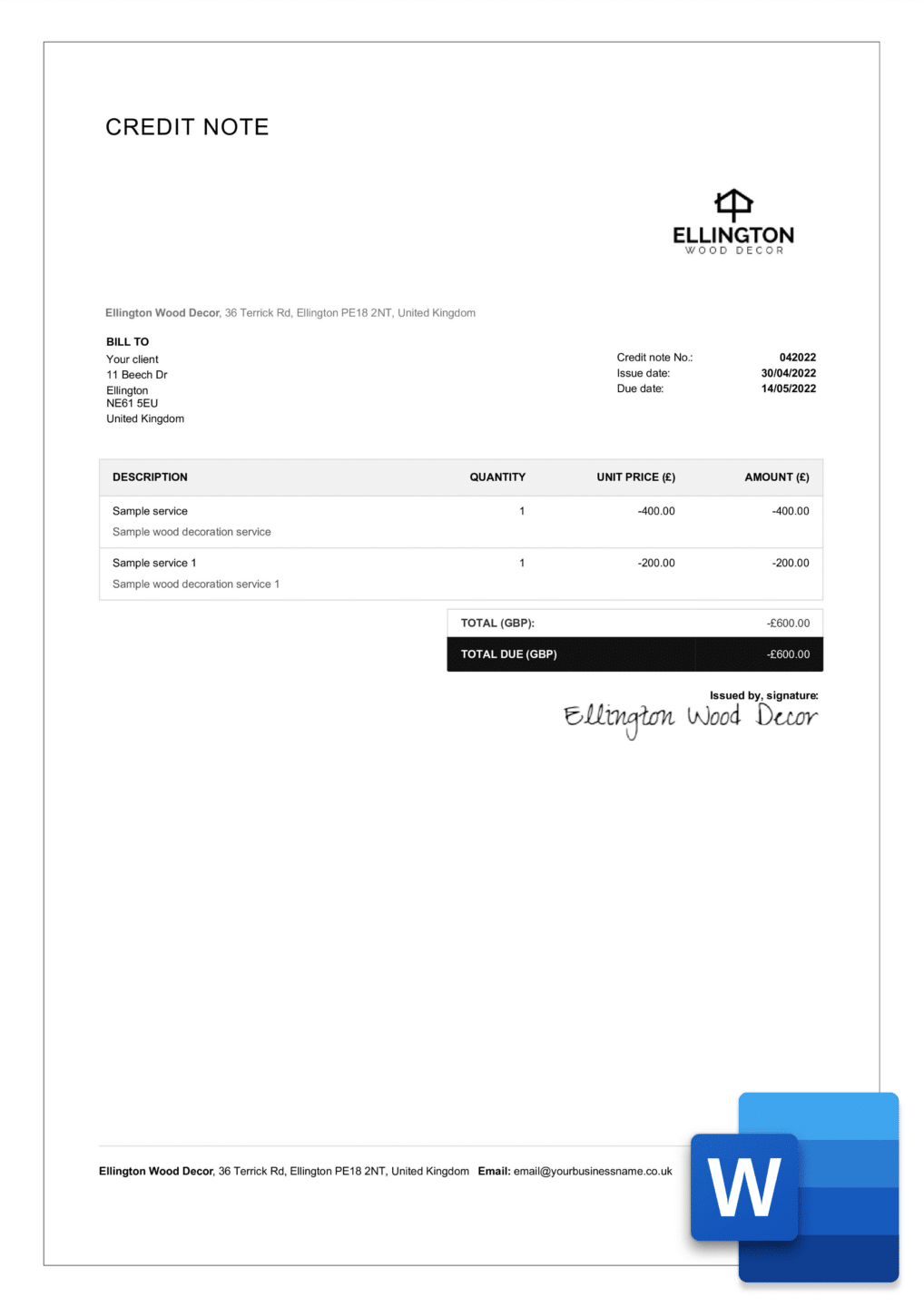

4. Credit Invoice

A credit invoice, also known as a credit memo or credit note, is issued by a business to adjust a previously sent invoice. This document reflects a negative total to indicate a refund, discount, or correction of an invoicing error.

Credit invoices are often used to correct billing mistakes, issue refunds for returned items, or account for discounts. They include a reference to the original invoice and a clear reason for the adjustment, such as incorrect pricing, an error in tax calculation, or forgotten shipping costs.

Use cases with examples:

- Refund for returned products: A retail store issues a credit invoice to a customer for returned goods.

- Correcting an invoicing error: A business sends a credit invoice to correct a mistake in the previous invoice’s total due to a tax miscalculation.

- Issuing a discount: A company provides a credit invoice to reflect a $50 discount offered to a customer on their final payment.

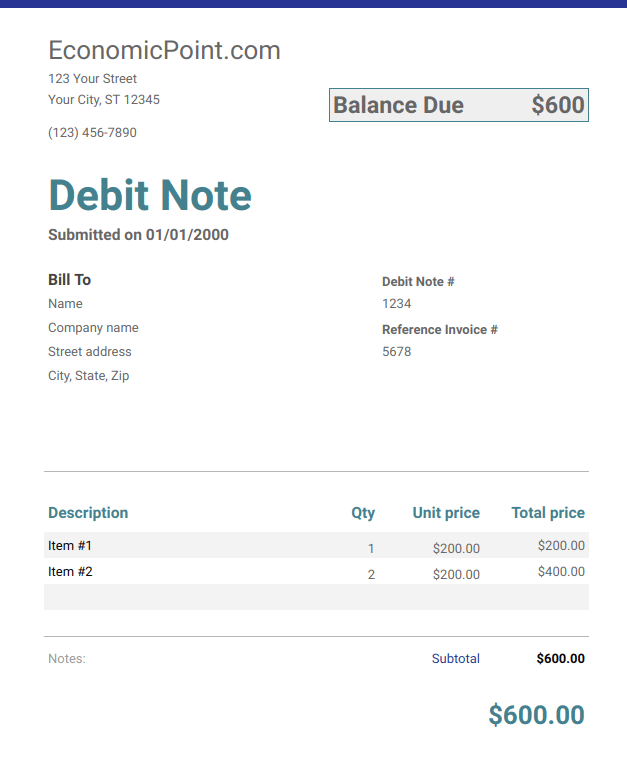

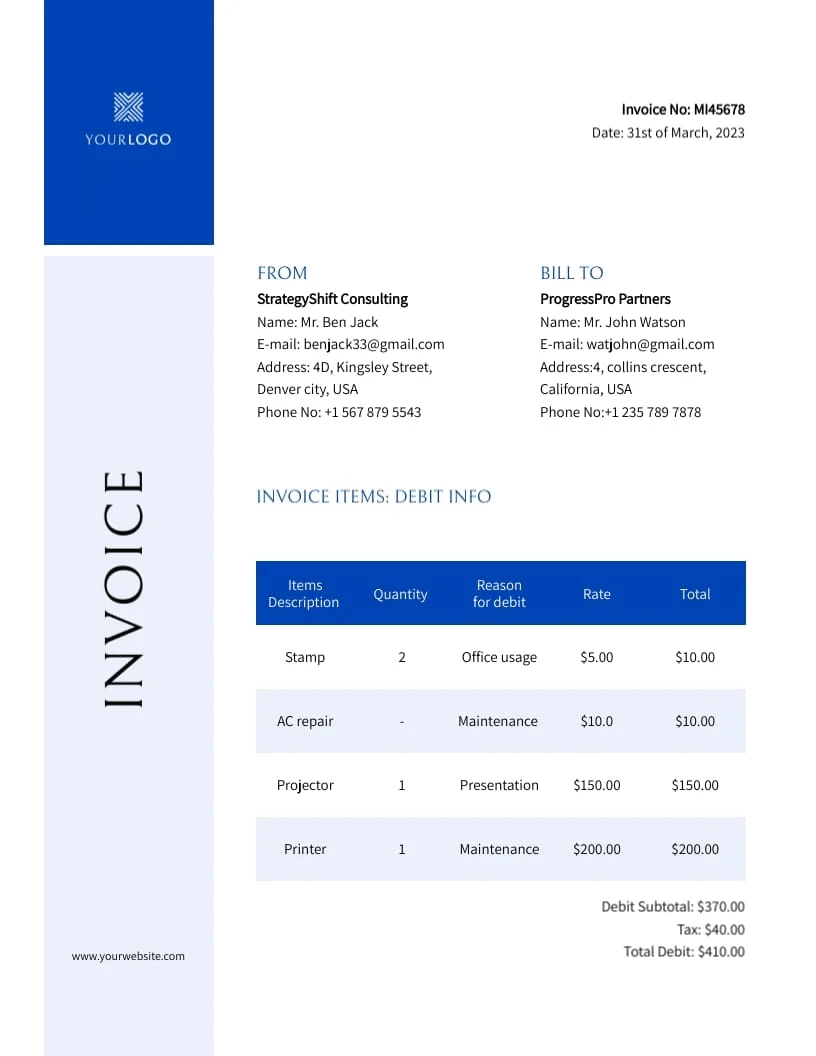

5. Debit Invoice

A debit invoice, also known as a debit memo or debit note, is issued when a business needs to increase the amount owed by a client.

This document is typically used when there has been an undercharge on a previous invoice or when additional services have been provided.

For instance, if you initially invoiced a client based on estimated hours but ended up working more than expected, you could issue a debit invoice to cover the extra hours.

Debit invoices are always written as positive amounts and are the opposite of credit invoices, which reduce the amount owed.

Use cases with examples:

- Freelancer billing extra hours: A freelancer sends a debit invoice for additional work hours that were not included in the original estimate.

- Late fee charge: A business issues a debit invoice to a client to cover late payment fees.

- Correcting undercharges: A supplier sends a debit invoice after realizing they were undercharged for a previous service.

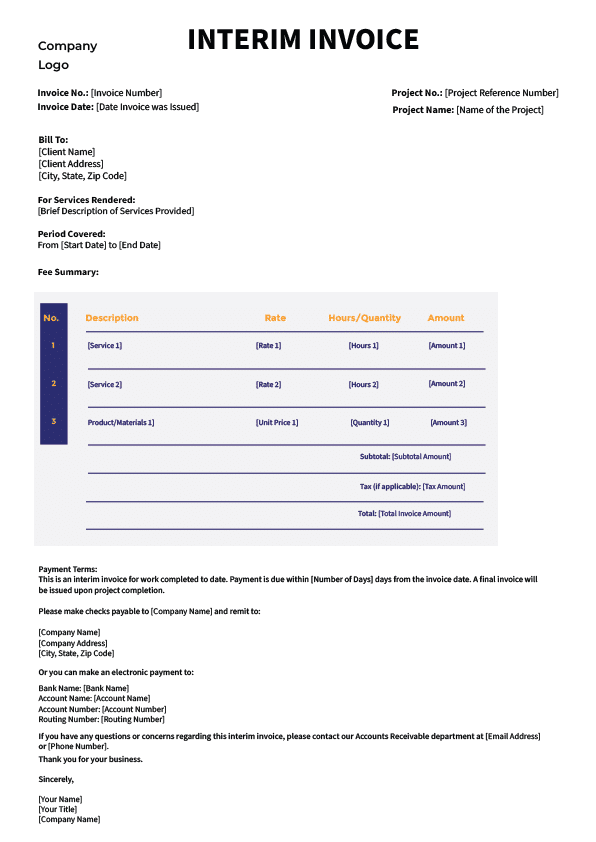

6. Interim Invoice

An interim invoice, also known as a progress invoice, is used to request partial payment for work completed on long-term projects.

It is issued at pre-determined milestones, allowing businesses to manage their cash flow while working on lengthy, complex projects.

This invoice helps ensure payments are received throughout the project’s duration rather than waiting for completion.

Interim invoices are particularly useful in industries like construction, consulting, and IT, where projects can span several weeks or months.

By invoicing in stages, businesses can reduce the risk of bad debt, track progress, and set clear milestones with clients.

Use cases with examples:

- Construction project: A contractor sends an interim invoice to request payment after completing the foundation stage of a building project.

- Marketing campaign: An agency bills their client after achieving a specific milestone, such as launching an ad campaign.

- Consulting services: A consultant invoices mid-project to maintain cash flow during a multi-month engagement.

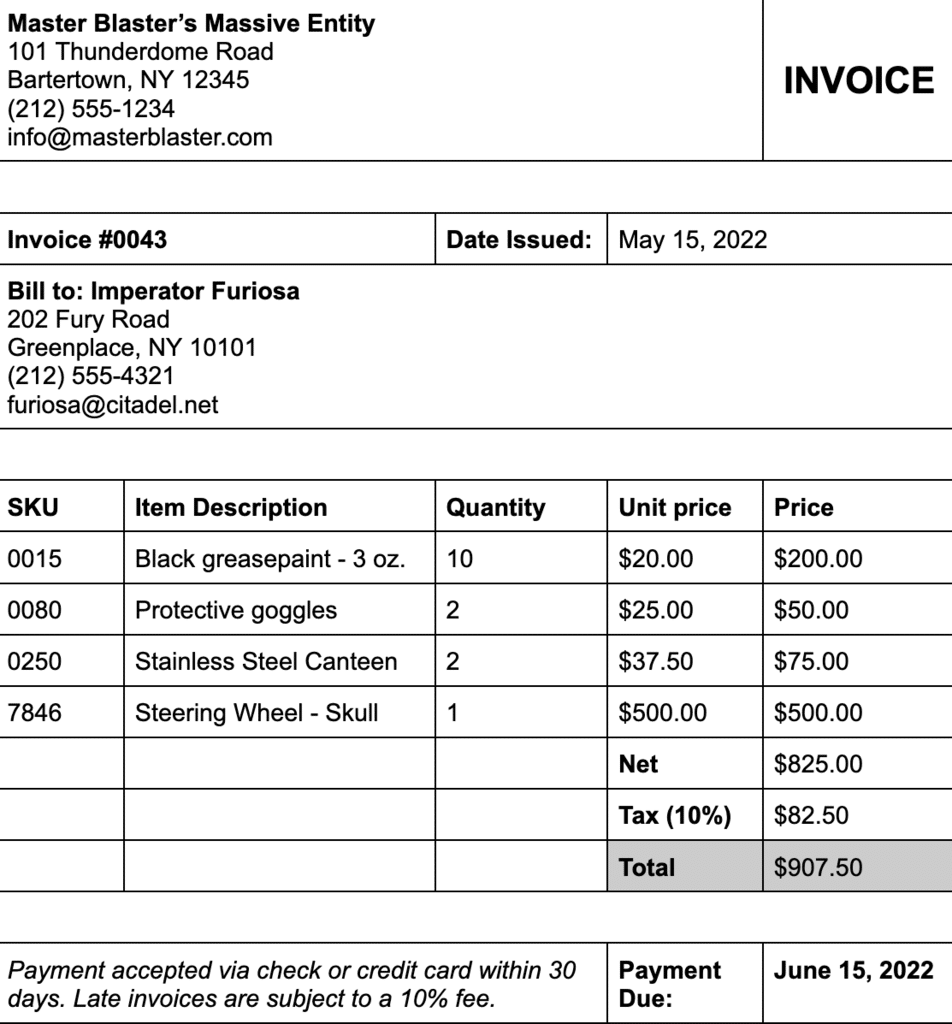

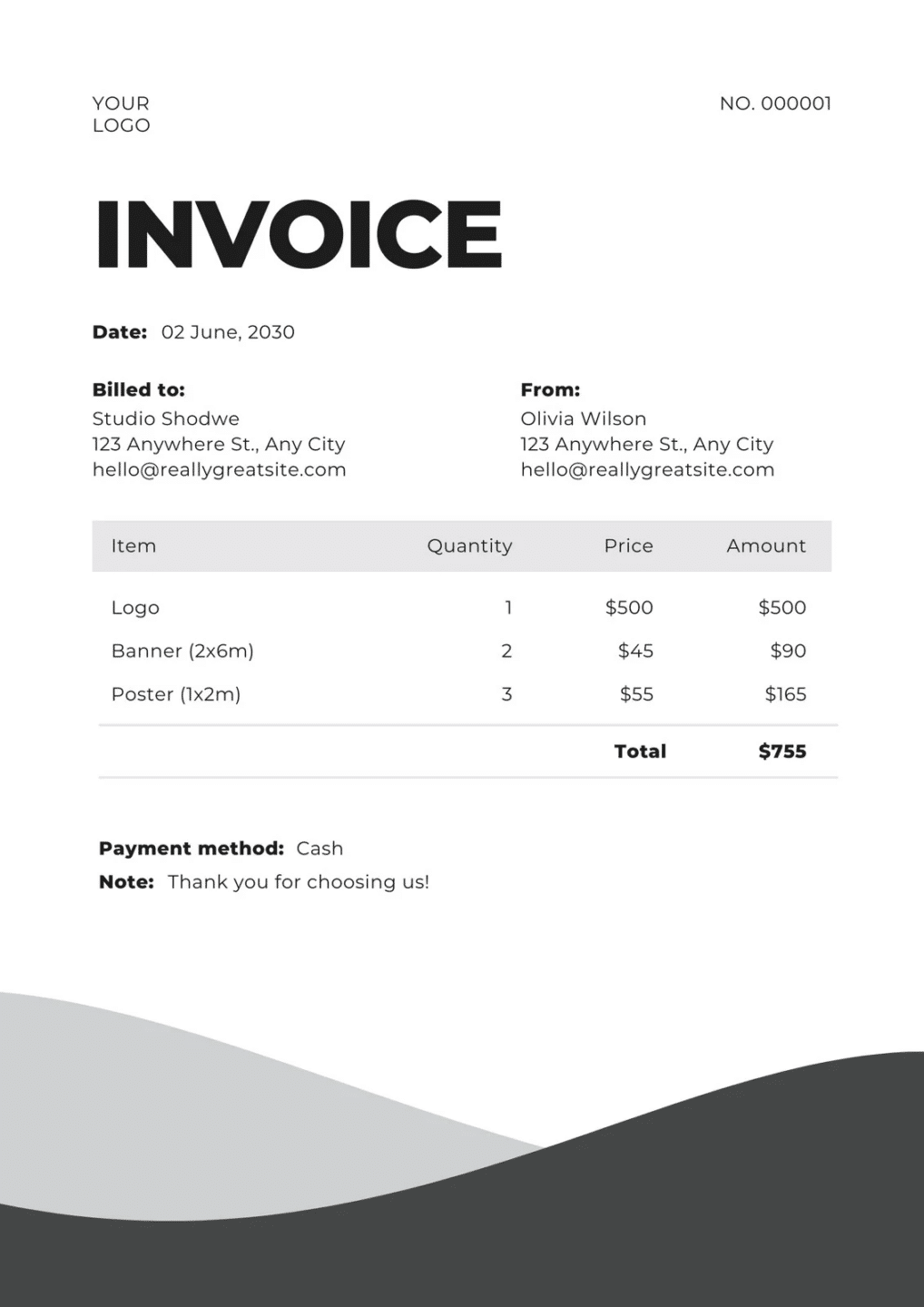

7. Sales Invoice

A sales invoice is a document issued by a business to request payment for products or services sold. It serves as an official, legally binding record of a completed sale for both the buyer and seller.

The invoice typically includes a description of the items sold, the quantity, the price per unit, and the total cost.

Sales invoices are crucial for tracking transactions, managing cash flow, and ensuring proper financial documentation.

This type of invoice is one of the most common financial documents used by businesses across all industries.

Use cases with examples:

- Retail sale: A retail store issues a sales invoice to customers after a purchase, detailing the items bought and the total amount owed.

- Service provider: A marketing agency sends a sales invoice to a client after completing a social media campaign, itemizing the services provided.

- Product sale: An online business bills a customer for the items purchased through their e-commerce platform.

8. Retail Invoice

A retail invoice is a document issued by a retailer to a customer for the purchase of goods or services. It includes details of the products or services sold, the total price, any discounts or promotions, and other relevant information.

Retail invoices are typically used in business-to-consumer (B2C) transactions, whether in-store or online, and may not always include taxes like VAT or sales tax, depending on the transaction type. These invoices serve as a record of sale and proof of purchase.

Use cases with examples:

- Brick-and-mortar store: A clothing store issues a retail invoice at the point of sale, listing the items purchased and their prices.

- E-commerce shop: An online store sends a retail invoice to a customer after an order is completed, detailing the items bought and any discounts applied.

- Service provider: A spa issues a retail invoice to a client for services rendered, such as a massage or facial treatment.

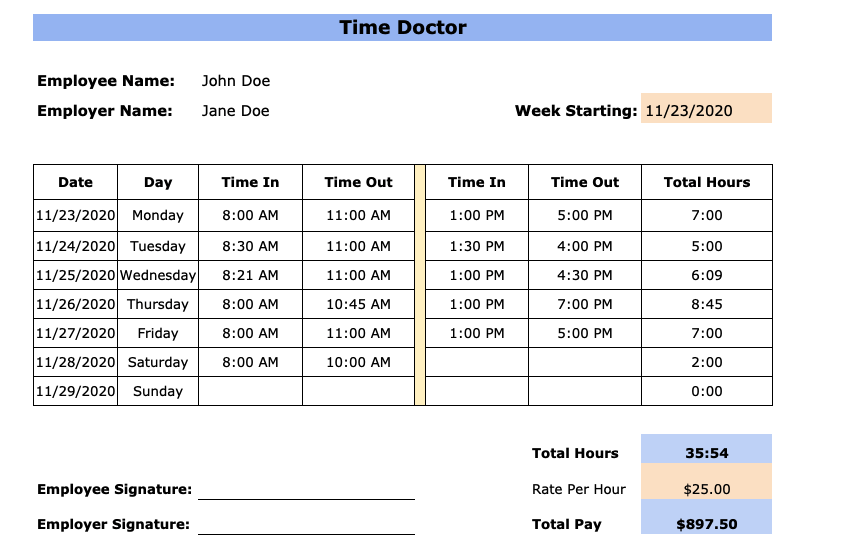

9. Timesheet Invoice

A timesheet invoice is used by businesses that bill clients based on the hours worked by employees on a specific project. This document tracks the time spent on a project or service and converts it into billable hours for invoicing clients.

Timesheet invoices are essential for accurately tracking labor costs and ensuring clients are billed for the exact amount of work completed. They are commonly used in industries such as consulting, law, and freelance services where billing is based on hourly rates.

Use cases with examples:

- Consulting firm: A consulting firm sends a timesheet invoice to a client based on the hours worked by consultants on a project.

- Freelance web developer: A freelancer uses a timesheet invoice to bill a client for the number of hours spent developing a website.

- Legal services: A law firm invoices clients based on the hours attorneys worked on a specific case, tracked through timesheets.

10. Mixed Invoice

A mixed invoice combines both credit and debit charges into a single document, allowing adjustments to a client’s balance by reflecting reductions and increases in amounts owed.

These invoices are useful when a client returns items but also makes new purchases or when a business needs to correct an error on a previous invoice while billing for additional services.

The total amount on a mixed invoice can be either positive or negative, depending on the net effect of the charges.

Mixed invoices are primarily used in B2B transactions for resolving disputes, issuing discounts, or balancing accounts.

Use cases with examples:

- Retail returns: A store issues a mixed invoice when a customer returns some products but also buys new ones in the same transaction.

- Service adjustment: A company uses a mixed invoice to issue a discount while billing for extra services provided.

- Correcting errors: A business adjusts a previous invoice’s balance and bills for additional charges on the same document.

11. Recurring Invoice

A recurring invoice is issued on a regular basis for products or services provided repeatedly over time. This type of invoice is commonly used for subscription-based businesses, such as SaaS companies, gyms, streaming services, and utility providers.

Recurring invoices are typically sent on weekly, monthly, or yearly schedules and ensure that clients continue to receive services as long as payments are made on time.

Automating the process of creating and sending recurring invoices helps businesses streamline billing for repeat customers.

Use cases with examples:

- SaaS companies: A software provider issues a recurring invoice each month for a client’s subscription to its services.

- Gyms: A gym sends recurring invoices to members for their monthly memberships.

- Digital marketing: A freelance marketer bills clients on a monthly basis for ongoing social media management services.

- Utility bills: A utility company issues recurring invoices for electricity and water usage at regular intervals, such as monthly or quarterly.

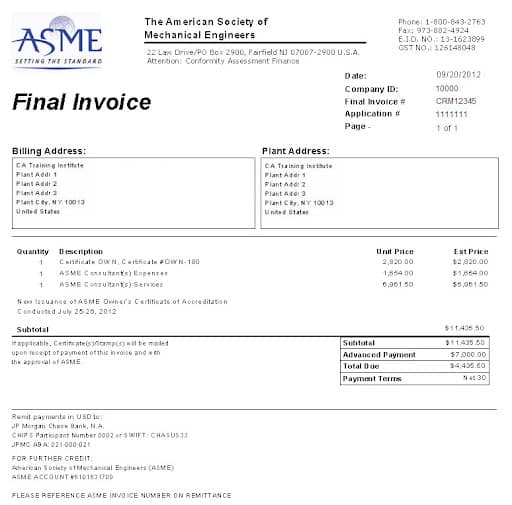

12. Final Invoice

A final invoice is issued at the completion of a project or service to request payment for all work done. This detailed invoice provides a comprehensive summary of the project’s costs, including the breakdown of services, items, and any deductions from previous interim or retainer invoices.

It serves as the last billing document in the project cycle and confirms the total amount owed by the client. Final invoices typically include standard invoice fields such as payment terms, invoice creation date, and the total after accounting for prior payments.

Use cases with examples:

- Construction project: A contractor sends a final invoice to summarize all work done and request the remaining payment after completing a building project.

- Freelance work: A freelancer issues a final invoice to a client after finishing a design project, listing all deliverables and final costs.

- Event planning: An event planner sends a final invoice detailing the total amount owed after executing an event successfully.

13. Past Due Invoice

A past-due invoice is a standard invoice that has not been paid by the due date. This document serves as a reminder to the client that payment is overdue and often includes additional charges, such as late fees or interest.

Past-due invoices retain all the details of the original invoice, including the service description and payment terms. Businesses typically send these invoices immediately after the payment deadline has been missed to prompt the client to settle the outstanding balance.

Use cases with examples:

- Service provider: A marketing agency sends a past-due invoice to a client who has missed the payment deadline for a completed project.

- Retail business: A store issues a past-due invoice with late fees for a customer who failed to pay for goods on time.

- Subscription service: A SaaS company sends a past-due invoice to a subscriber who has not made their monthly payment.

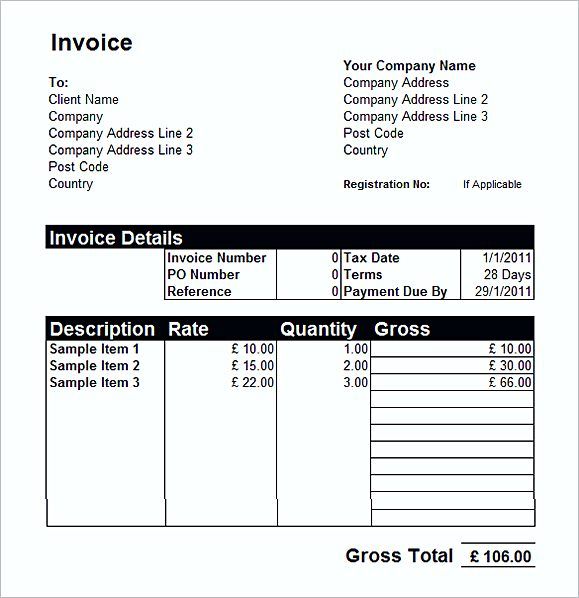

14. Gross Invoice

A gross invoice reflects the total cost of a product or service, including taxes such as VAT, without itemizing the individual charges. It shows the full price that a customer is expected to pay before any deductions, discounts, or returns are applied.

Gross invoices are commonly used in retail and service industries where a straightforward presentation of the total cost is sufficient. These invoices ensure that the final amount includes all relevant charges, making it clear to the customer what they owe.

Use cases with examples:

- Retail purchase: A store issues a gross invoice that includes the total cost of items purchased, along with sales tax, without breaking down the individual taxes or fees.

- Service industry: A contractor provides a gross invoice to a client for completed work, showing the full amount owed, including labor costs and taxes.

- Product sales: An online retailer sends a gross invoice for the full price of products, including VAT.

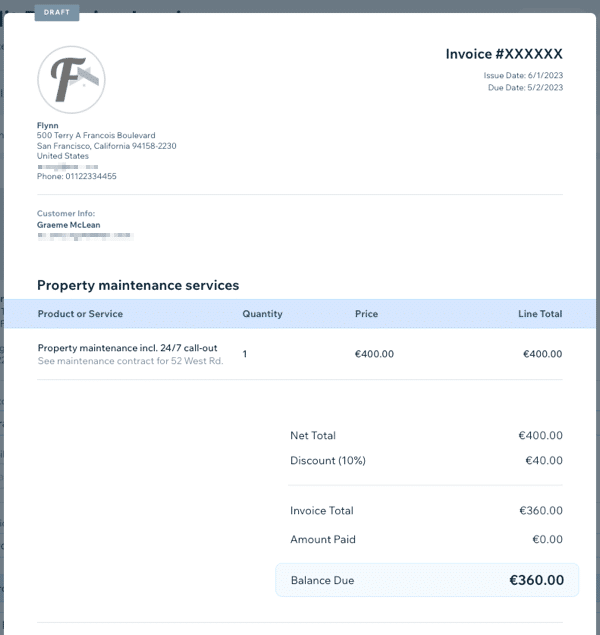

15. Dummy Invoice

A dummy invoice is a made-up invoice often used as a template or basis for training purposes, system testing, or drafting sample transactions.

However, in some cases, it can be exploited for fraudulent activities, such as tax evasion, money laundering, or financial manipulation.

Dummy invoices might misrepresent the details of goods or services, inflate or deflate values, or even be entirely fictitious.

While legitimate uses of dummy invoices exist, such as testing invoicing software or creating templates, they are sometimes employed for illegal activities, including manipulating financial records or deceiving stakeholders.

Use cases with examples:

- Training purposes: A company uses a dummy invoice to train new employees on how to process invoices.

- Fraudulent activity: A business issues a dummy invoice to falsely increase sales figures and deceive investors.

- System testing: A dummy invoice is used to test a company’s invoicing software before implementing it with actual clients.

Digital vs. Paper Invoices

A digital invoice is typically a PDF or Word file and can even be a scanned copy of a paper invoice. Digital invoices are easy to understand and share electronically, reducing manual data entry and human errors. Digital invoices are easier to manage, allowing for automation and faster payments.

According to Xero, businesses using digital invoicing tools are paid 33% faster than those relying on paper invoices. Additionally, electronic invoicing can reduce costs by as much as 60%, as reported by GXS.

Paper invoices, as the name suggests, are physical documents printed on paper. This traditional method of sending out invoices has been used for decades. However, they require manual data entry, which is prone to human error and inefficiencies.

Thus, to simplify the process of converting paper invoices into digital formats, businesses can use tools like the Image to Text Converter. It can extract text from scanned invoices quickly and efficiently.

Processing paper invoices is labor-intensive and involves tasks such as printing, mailing, and storing, all of which contribute to higher operational costs.

Additionally, the time it takes for paper invoices to be delivered and processed can slow down payment cycles, making it harder for businesses to maintain a steady cash flow.

What is the Purpose of an Invoice?

The primary function of an invoice is to document the sale of goods or services and request payment from the buyer on behalf of the vendor or seller.

It serves as an official record of the transaction, outlining the products or services, pricing, and payment terms.

Additionally, it acts as a legal agreement, supports financial record-keeping, and helps ensure timely payments.

Why Invoices are Important for Businesses?

There are several reasons that businesses consider invoices as an important part of their accounting:

- Ensure Timely Payments: Invoices clarify the services rendered, amounts owed, and deadlines, reducing the risk of late payments and disputes.

- Track Business Income: Invoices document every sale or service, ensuring accurate financial records and assisting with tax preparation.

- Enhance Client Trust: Clear, detailed invoices build client trust by providing transparency in billing and establishing long-term relationships.

- Prevent Payment Disputes: Properly outlined invoices reduce misunderstandings and disputes over services or costs.

- Ensure Tax Compliance: Invoices help document sales, expenses, and taxes, making tax filing easier and compliant with regulations.

- Streamline Operations: Automating invoicing reduces manual errors and speeds up payment collection, allowing businesses to focus on growth.

How DocuClipper Can Help with Processing Invoices

DocuClipper is a powerful tool that simplifies invoice data extraction by converting all types of invoices in PDF format into Excel, CSV, and QBO files.

These formats can be easily imported into your ERP system, and with DocuClipper’s API integration, the entire process can be automated.

For QuickBooks users, the tool seamlessly syncs invoice data without the need for manual uploads. DocuClipper also allows direct extraction of invoice data from email attachments, eliminating extra steps.

Adding a QR code to an invoice enables clients to quickly scan and access payment options, streamlining the payment process.

Beyond invoices, it processes receipts, bank and credit card statements, and brokerage statements with 99.5% accuracy. Its transaction categorization feature helps organize and track financial data efficiently, improving both accuracy and workflow.

FAQs about Invoice

Here are some frequently asked questions about invoices:

What is 3-way invoice matching?

3-way invoice matching is a process used in accounting to ensure payment accuracy. It involves comparing three documents: the purchase order, the receipt of goods, and the supplier’s invoice. The goal is to confirm that the details match before approving payment, preventing overpayment and reducing errors.

What are the 2 types of invoices on hold?

The two types of invoices that are often placed on hold are those with discrepancies and those pending approval. Discrepancy holds occur when there is a mismatch in the invoice details, while approval holds happen when invoices require further review before processing, typically due to budget or managerial confirmation.

What is the invoicing method?

The invoicing method refers to the approach a business uses to bill clients, whether manually or through automated systems. It includes generating and sending invoices for goods or services rendered, often specifying payment terms and deadlines to ensure timely transactions between the business and its customers.