Finding the right alternative to Veryfi can enhance your invoice processing and document automation workflow. Several AI-powered tools offer invoice data extraction, OCR capabilities, and seamless integrations with accounting and ERP systems.

Whether you’re looking for improved automation, higher accuracy, or more budget-friendly options, there are plenty of solutions available.

In this guide, we compare the top Veryfi alternatives based on key factors like accuracy, automation, integration, pricing, and ease of use. Explore these leading platforms to find the best fit for your invoice data extraction and document processing needs in 2025.

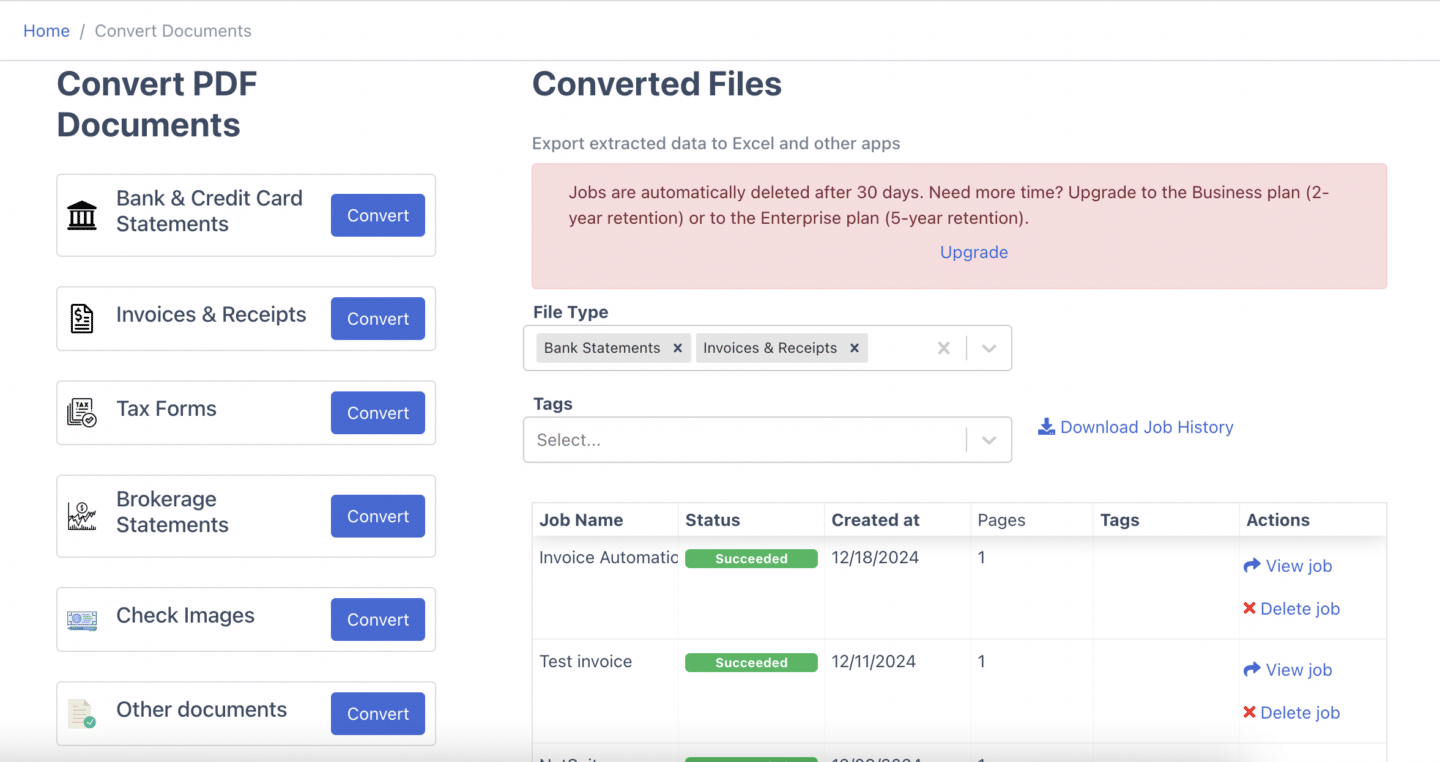

1. DocuClipper

DocuClipper is a powerful invoice data extraction tool that converts invoices, receipts, and financial statements into Excel, CSV, and QBO formats. Automating invoice data capture and organization eliminates manual entry and minimizes errors.

Equipped with advanced OCR technology and specialized financial document algorithms, DocuClipper delivers high accuracy and fast processing.

Whether you’re managing daily invoices or bulk statements, it automates extraction, making your workflow smoother and more efficient while enhancing data accuracy.

Pros

- Intuitive Web Platform: DocuClipper’s browser-based interface is user-friendly, making invoice data extraction quick and hassle-free.

- Budget-Friendly Pricing: Unlike competitors that charge per line item, its page-based pricing structure provides a cost-effective option for small businesses.

- Highly Accurate OCR: Using advanced OCR technology, DocuClipper precisely extracts invoice data and converts PDFs into Excel, CSV, or QBO with minimal errors.

- Rapid Processing Speed: The platform efficiently processes hundreds of invoices within minutes, significantly reducing manual data entry time.

- Secure Cloud Storage: Financial data is encrypted and safely stored, ensuring compliance and data protection.

Cons

- No Mobile App: DocuClipper lacks a mobile application with built-in camera scanning, requiring invoices to be converted into PDFs before processing.

- Limited Direct Integrations: While it integrates seamlessly with Sage, Xero, and QuickBooks, connecting to other accounting platforms requires API configuration.

Pricing

- Starter: $39/month for 200 pages per month.

- Professional: $74/month for 500 pages per month.

- Business: $159/month for 2000 pages per month.

- Enterprise: Custom pricing for a custom number of pages per month. Contact DocuClipper for more details.

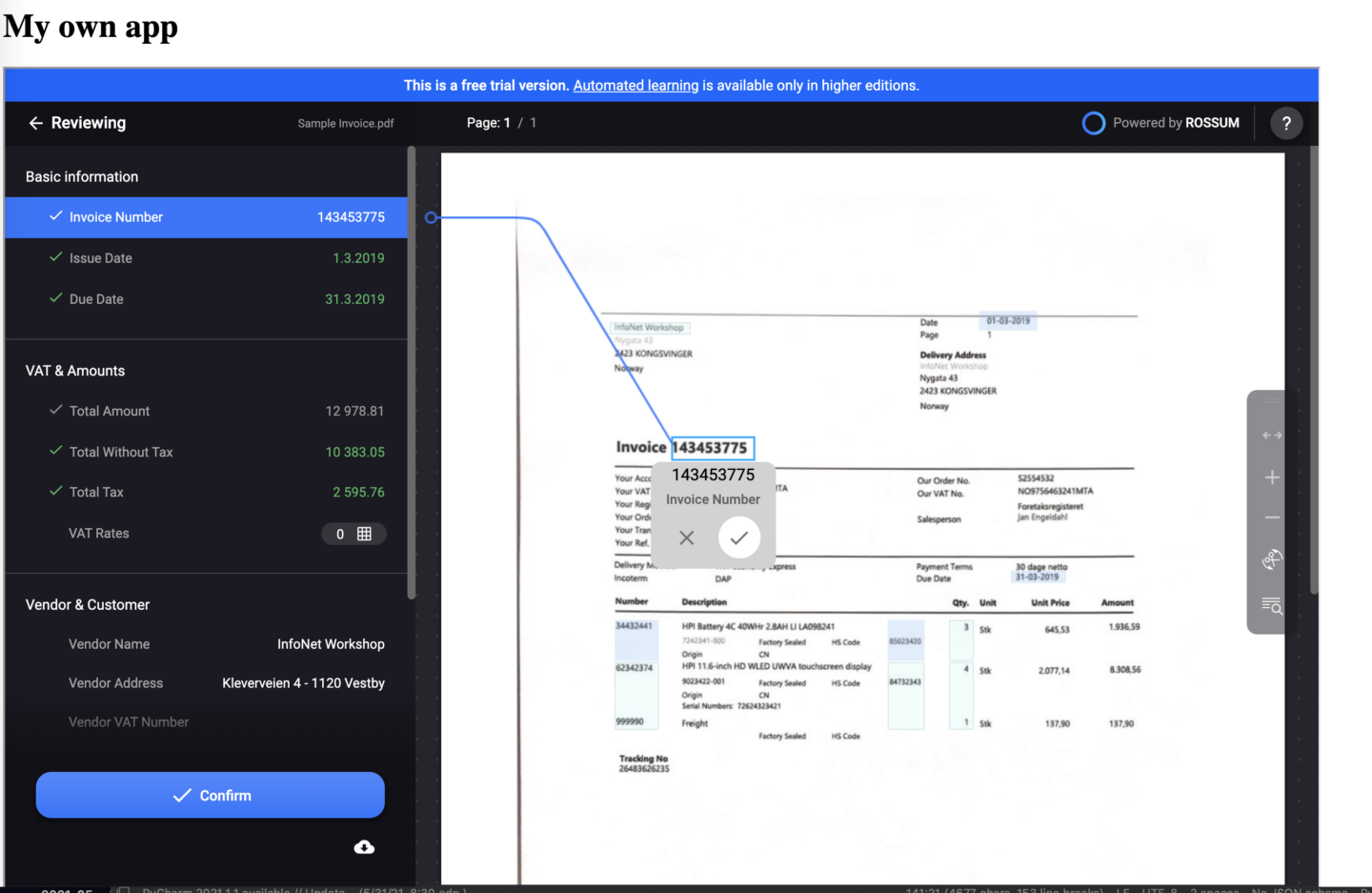

2. Rossum

Rossum is an AI-driven document processing platform that automates invoice extraction, reducing manual effort and improving efficiency. Using machine learning, it captures data from multiple sources, accelerates processing, and manages exceptions with interactive validation.

With seamless integrations, Rossum ensures smooth data transfer to financial systems, minimizing errors and enhancing workflow automation.

Pros

- User-Friendly Interface: Rossum’s intuitive design simplifies invoice data extraction, making it accessible even for non-technical users.

- Seamless Integration: Open APIs and extensions enable effortless connectivity with accounting and ERP systems.

- AI-Powered Accuracy: The platform continuously enhances data extraction precision by learning from past invoices.

- Dedicated Support: Users benefit from a dedicated account manager for smooth implementation and troubleshooting.

Cons

- Limited Data Extraction: Works well for invoices and purchase orders but struggles with other document types.

- Slow Support Response: Assistance beyond the dedicated account manager can take time, delaying issue resolution.

- US Support Limitations: Businesses in the US may face delays due to timezone differences.

- Basic Reporting Tools: Lacks advanced analytics, making it difficult to generate detailed invoice insights.

- Lengthy AI Training: Requires extensive training to optimize accuracy, delaying full implementation.

Pricing

- Starter Plan: $18,000/year – Supports unlimited users and includes email, API, and manual upload ingestion, Rossum Aurora Document AI, validation interface, 12-month archive, and API access.

- Business Plan: Adds custom data extraction, master data matching, duplicate detection, intelligent mailbox, webhooks, reporting, and integrations with SAP, Coupa, Workday, and Oracle.

- Enterprise Plan: Expands with SSO, sandbox testing, extended master data matching, cloud location options, signature onboarding, and custom branding.

- Ultimate Plan: Designed for high-volume enterprises, featuring all Enterprise capabilities plus multi-document transaction support and advanced automation.

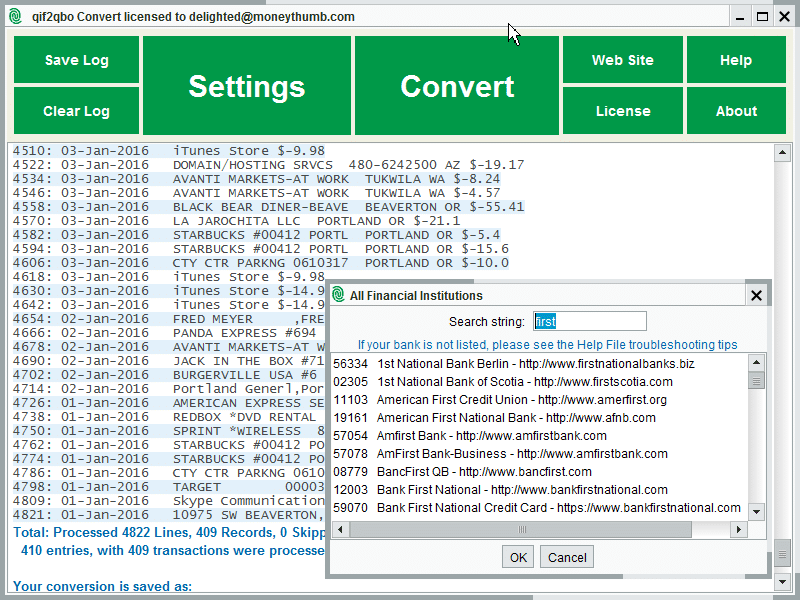

3. MoneyThumb

MoneyThumb is a bank statement conversion tool that transforms PDFs into CSV, QBO, and QFX formats, ensuring compatibility with accounting platforms like QuickBooks, Quicken, and Xero. It simplifies financial data transfer, reducing manual entry and improving workflow efficiency.

While MoneyThumb has been a reliable solution for businesses and individuals worldwide, recent feedback suggests a decline in platform updates and feature development. Many users have noted that the company has been slow to enhance its offerings, making it less competitive compared to newer alternatives.

Pros

- Efficient PDF Conversion: MoneyThumb simplifies the process of converting PDF statements into accounting-friendly formats, significantly reducing manual data entry.

- High Accuracy: The platform ensures precise data extraction, minimizing errors that typically occur with manual input.

- Multi-Format Support: It offers flexibility by supporting conversions between multiple file formats, including CSV, QBO, and QFX.

- Time-Saving: Automates transaction entry, streamlining financial workflows and eliminating the need for manual input.

Cons

- High Cost: MoneyThumb’s pricing may not be ideal for small businesses or individuals with limited budgets.

- Learning Curve: New users may need time to fully understand and navigate the platform’s features.

- Compatibility Issues: Some banking or credit card PDFs may not convert properly, leading to potential errors in accounting software.

- Lack of Updates: The platform has seen fewer updates and feature enhancements, which may affect performance and competitiveness.

Pricing

MoneyThumb does not disclose pricing for all its products publicly. For detailed costs, you need to contact the company directly. However, its QuickBooks converter pricing is as follows:

- Individual Plan: $24.95/month for 5 conversions ($5.00 per conversion).

- Standard Plan: $49.95/month for 20 conversions ($2.50 per conversion).

- Pro Plan: $99.95/month for 60 conversions ($1.67 per conversion).

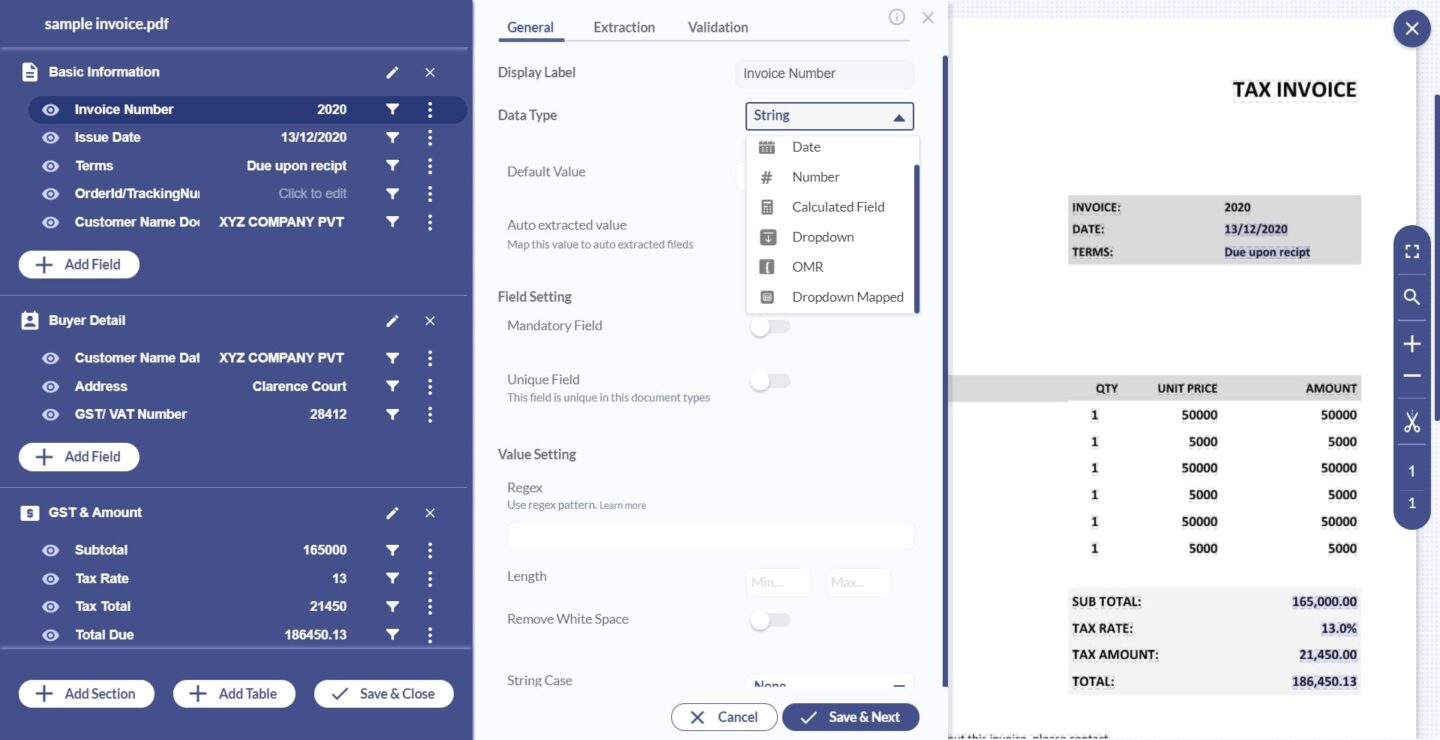

4. Docusumo

Docsumo is a smart document processing platform built for SMB lenders, insurers, commercial real estate firms, and investors. Initially focused on invoice automation, it has expanded into a comprehensive data extraction tool, optimizing financial document processing across multiple industries in the USA.

Pros

- Robust Backend System: Docsumo’s advanced infrastructure supports various use cases, enabling businesses to efficiently scale document processing.

- Responsive Customer Support: The support team provides hands-on assistance during integration and optimization for a smooth experience.

- User-Friendly Interface: The platform is designed for ease of use, making document processing accessible to users with varying technical expertise.

- Seamless API Integration: Docsumo offers flexible API connectivity, ensuring smooth integration with existing workflows and financial systems.

Cons

- Requires Technical Knowledge: Some customization features may be challenging for non-technical users to configure.

- Time-Consuming Setup: Implementing models can take longer, especially for businesses handling various document formats.

- Limited Keyboard Shortcuts: Users find navigation less efficient due to a lack of keyboard-friendly controls.

- AI Retraining for Small Changes: Even minor adjustments require retraining the AI model, slowing workflow improvements.

Pricing

- Free Plan: 100 pages/month for individual users at no charge.

- Starter Plan: 1,000 pages/month at $299, suitable for up to 3 users.

- Growth Plan: 3,000 pages/month at $799, designed for teams of up to 5 users.

- Business Plan: 10,000 pages/month at $2,499, supports up to 10 users.

- Enterprise Plan: Custom pricing for larger needs, available upon request.

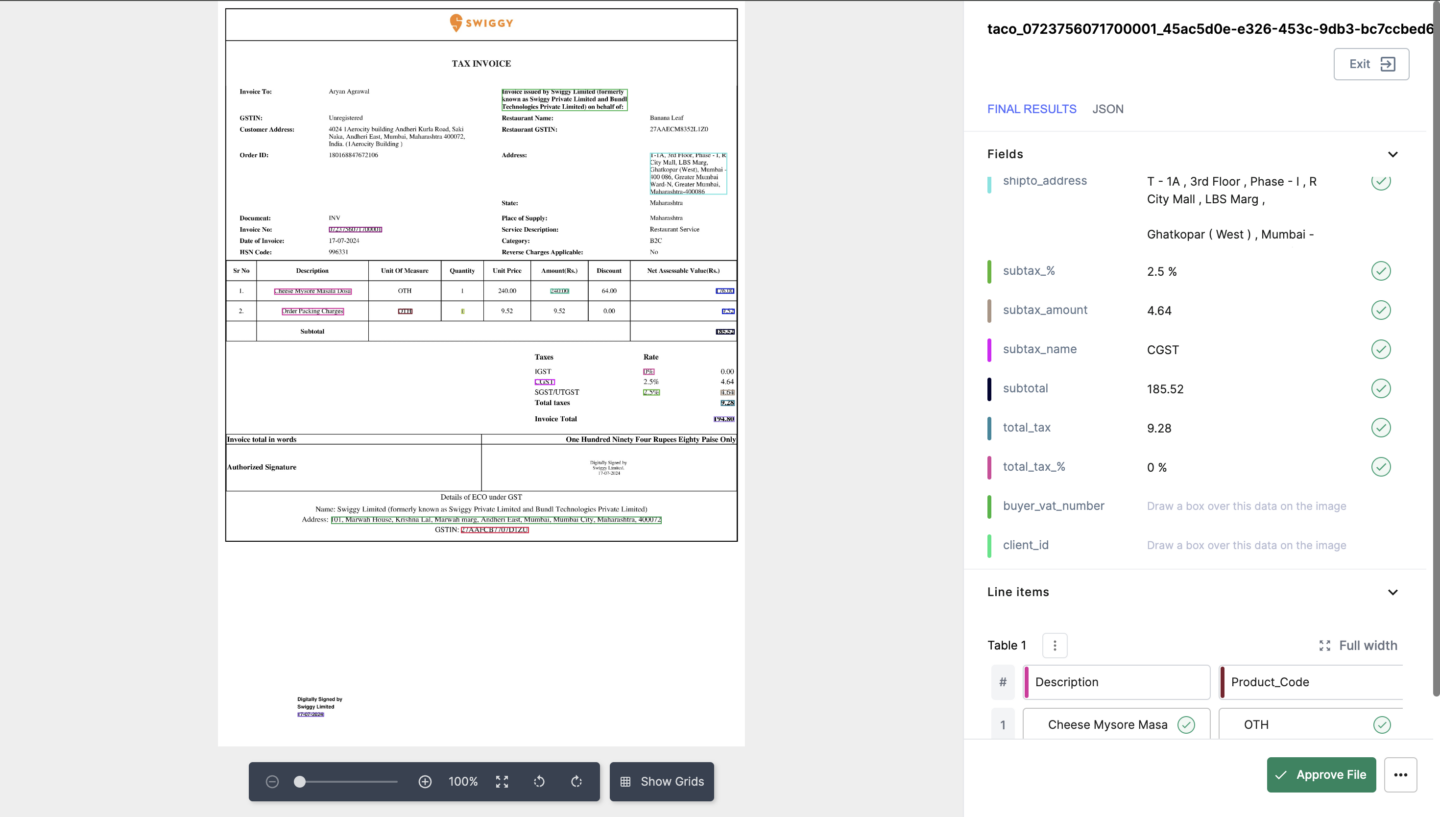

5. Nanonets

Nanonets is an AI-powered invoice data extraction tool that automates financial document processing. By leveraging advanced OCR and deep learning, it accurately captures key invoice details and converts unstructured data into structured formats.

Designed to streamline accounts payable, invoice reconciliation, and financial workflows, Nanonets significantly reduces manual data entry. With seamless API integration, it connects effortlessly with accounting and ERP systems, cutting manual effort by up to 90%.

Offering high accuracy, scalability, and automation, it helps businesses enhance efficiency while minimizing costs.

Pros

- Accurate and Scalable OCR: Nanonets provides high-precision invoice extraction that adapts to businesses of all sizes.

- Reliable Support: The customer service team actively helps users optimize workflows, providing setup guidance and troubleshooting.

- Customizable Workflows: Nanonets allows businesses to fine-tune data extraction and processing to fit their specific needs.

- Superior OCR Performance: Users report higher accuracy, faster processing, and better integration compared to competing solutions.

Cons

- Delayed Support Response: Earlier users reported slow response times, though support has since improved.

- High Cost for Low-Volume Users: The pricing model may not be ideal for businesses processing a small number of invoices.

- Limited File Processing Control: Managing large batches lacks an efficient tracking system, requiring manual reprocessing of invoices.

- Complex Setup: Configuring automation and invoice processing can be time-consuming and may require technical expertise.

- Unclear Pricing: The cost structure isn’t always transparent, making it harder for small businesses to evaluate affordability.

- Manual Verification Needed: Some extracted invoice data may still require manual review, reducing overall efficiency.

Pricing

- Starter Plan: Pay-as-you-go at $0.30 per page with no fixed monthly fee, ideal for individuals or small teams.

- Pro Plan: $999/month for 10,000 pages, with additional pages at $0.10 each. Includes team collaboration, custom AI data capture, and integrations with Microsoft Dynamics, Salesforce, and SAP.

- Enterprise Plan: Custom pricing for high-volume processing, offering dedicated account management, flexible data retention, and personalized onboarding.

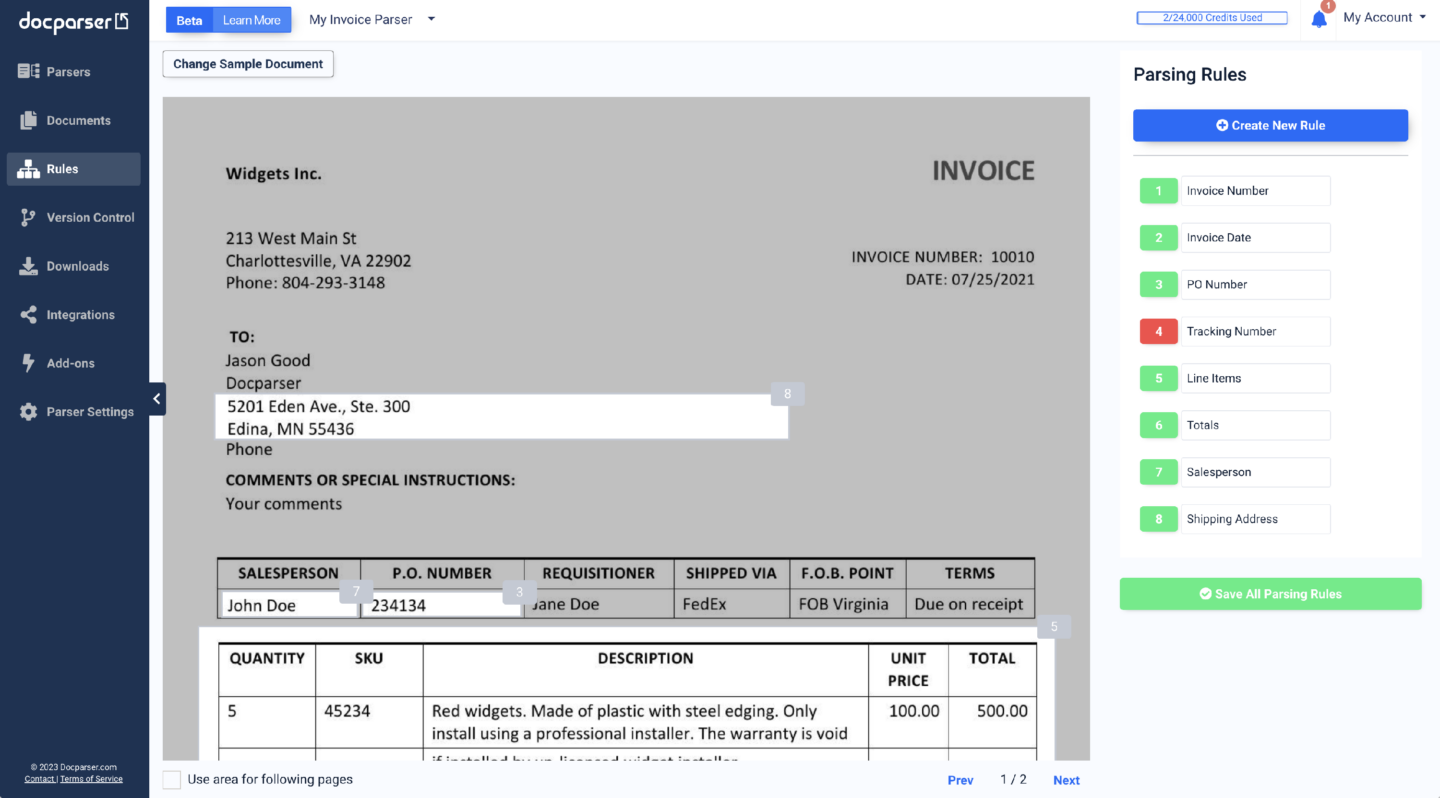

6. Docparser

Docparser is an automated data extraction tool that simplifies invoice processing and eliminates manual data entry. With an intuitive interface and advanced OCR capabilities, it enables businesses to efficiently extract key details from invoices, receipts, and other financial documents.

Supporting multiple file formats such as PDF, DOCX, CSV, and XLS, Docparser ensures accurate data extraction for seamless integration with accounting systems. Whether processing invoices, bank statements, or shipping documents, it enhances efficiency and reduces errors.

Pros

- Ease of Use: Docparser offers an intuitive interface, allowing users to extract invoice data accurately. Parsing rules can be customized to fit specific requirements.

- Seamless Automation: The platform integrates with tools like Zapier, automating document uploads and minimizing manual data entry errors.

Cons

- Complex Document Setup: Configuring parsing rules for complex invoices can be time-intensive and may require manual formatting adjustments.

- Bulk Upload Challenges: Processing large volumes of documents has posed issues, though some workarounds have been introduced.

- Learning Curve: The platform offers extensive customization, but non-technical users may find onboarding overwhelming without prior experience.

- Limited User Guidance: A more structured tutorial or guided setup could improve navigation and ease of use.

- Workflow Complexity: Setting up parsing rules involves multiple steps, requiring users to switch between screens, which could be streamlined.

Pricing

- Starter: $39/month – 100 credits per month. Suitable for individuals needing basic document extraction. Supports PDF, Word, and image files with exports to Excel, CSV, JSON, and XML. Includes Google Sheets integration and third-party tool access.

- Professional: $74/month – 250 credits per month. Designed for professionals requiring advanced automation. Includes all Starter features, plus multifactor authentication, team management, free parsing setup, and version control.

- Business: $159/month – 1000 credits per month. Ideal for businesses handling large-scale document processing. Adds multi-layout parsing, priority support, and priority parsing access.

- Enterprise: Custom pricing. Provides unlimited parsing, extended document retention, white labeling, and enterprise-level features. Contact sales for details.

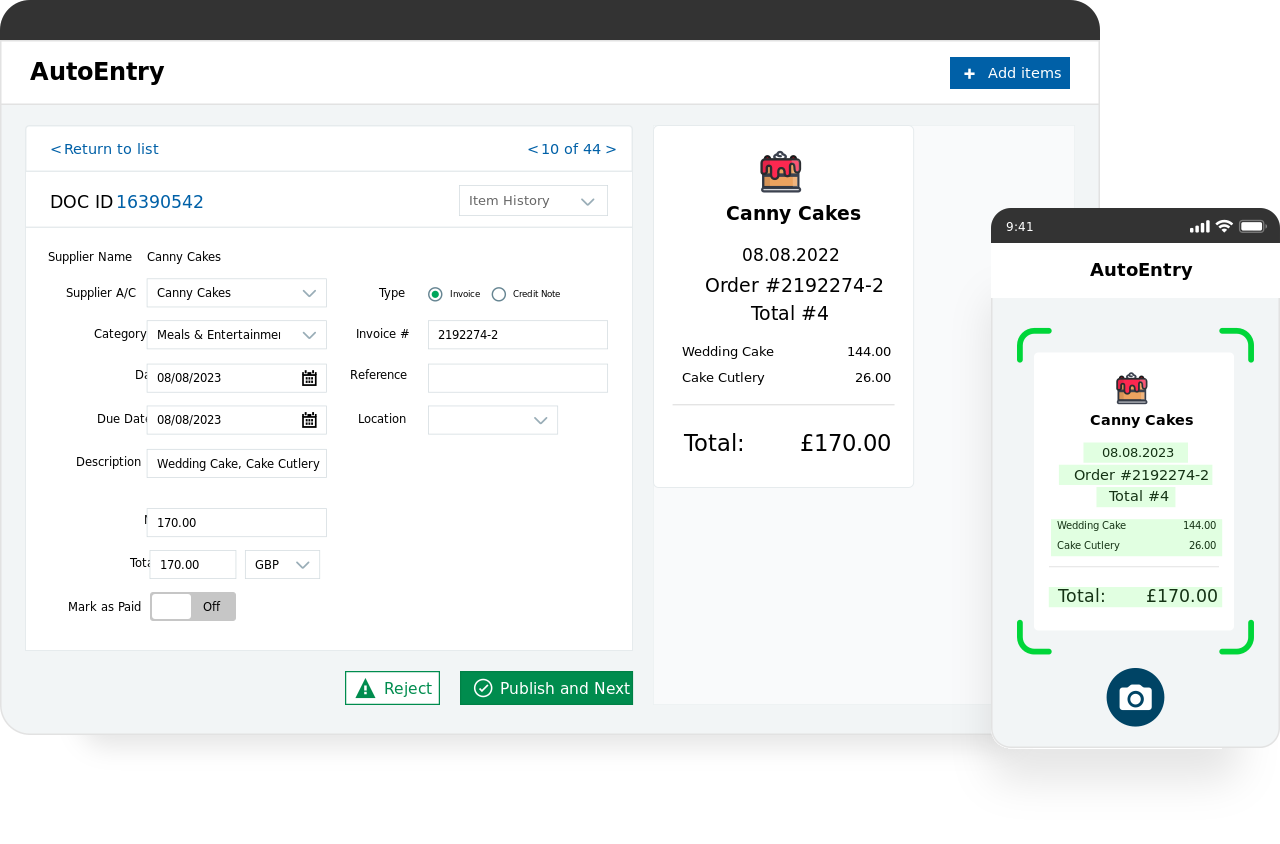

7. AutoEntry

AutoEntry is an invoice data extraction tool that automates accounting data entry. It allows you to scan, email, or upload invoices, receipts, and statements, which are then processed and published directly into accounting platforms like Xero, Sage, and QuickBooks.

With features like mobile scanning, seamless integrations, and auto-publishing, AutoEntry helps businesses save time and minimize manual data entry errors. Its flexible, usage-based pricing eliminates the need for long-term contracts, allowing you to pay only for what you use.

Pros

- Line Item Extraction: AutoEntry captures detailed invoice data, including individual line items, improving expense tracking.

- Seamless Integration: Compatible with Sage 50, Xero, QuickBooks, and other accounting platforms for smooth data transfer.

- User-Friendly Interface: The platform is intuitive, allowing quick document retrieval and easy invoice management.

- Responsive Customer Support: Users praise the support team for prompt issue resolution and helpful guidance.

Cons

- No Lookup Table Uploads: Users cannot upload lookup tables, restricting data customization.

- Invoice Rejection Issues: Requires support assistance to resolve rejected invoices due to a non-functional ‘Move to Inbox’ feature.

- Limited PO Integration: Lacks purchase order integration with AccountsIQ, potentially affecting workflow.

- Slow Invoice Processing: Some users experience delays when syncing invoices with Xero and other accounting platforms.

- Software Stability Issues: Occasional glitches cause upload failures, requiring manual intervention.

- Customer Support Concerns: Reports of inconsistent support, ongoing charges after cancellation, and refund challenges.

Pricing

AutoEntry offers flexible, usage-based pricing with no long-term contracts, allowing users to cancel anytime without hidden fees. Each plan includes all standard features.

Plans:

- Bronze: 50 credits – £13/month (£0.26 per credit).

- Silver: 100 credits – £23/month (£0.23 per credit).

- Gold: 200 credits – £43/month (£0.22 per credit).

- Platinum: 500 credits – £99/month (£0.20 per credit).

- Diamond: 1500 credits – £275/month (£0.18 per credit).

- Sapphire: 2500 credits – £430/month (£0.17 per credit).

Credit Usage:

- 1 credit – Single invoice, bill, or receipt.

- 2 credits – Invoice or receipt with line items.

- 3 credits – Single page of bank statements.

New users receive 25 free credits to explore the platform.

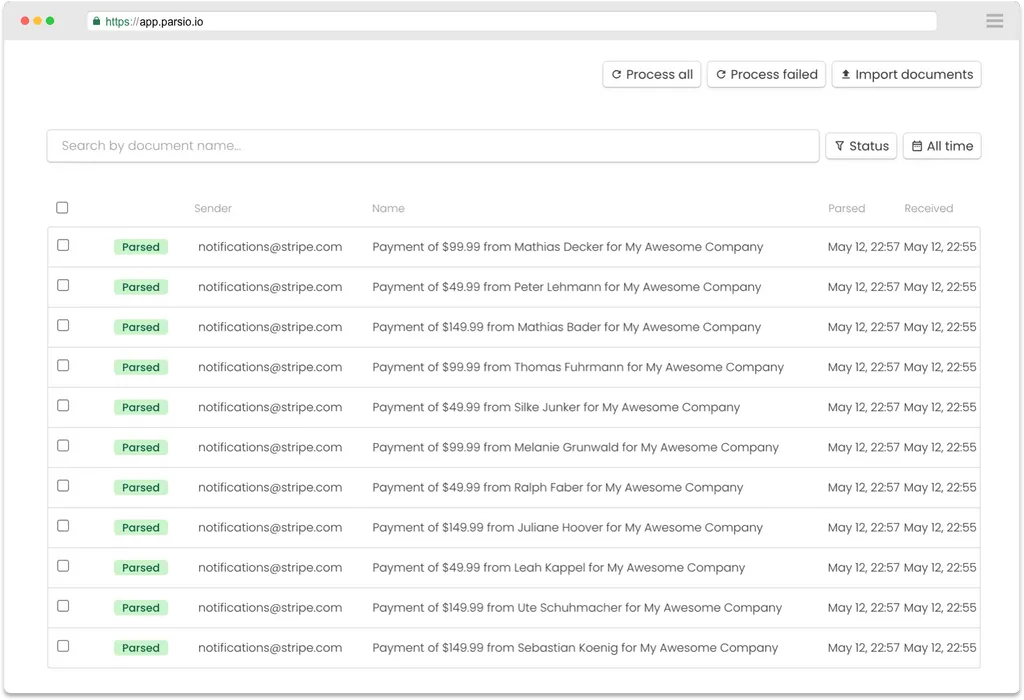

8. Parsio

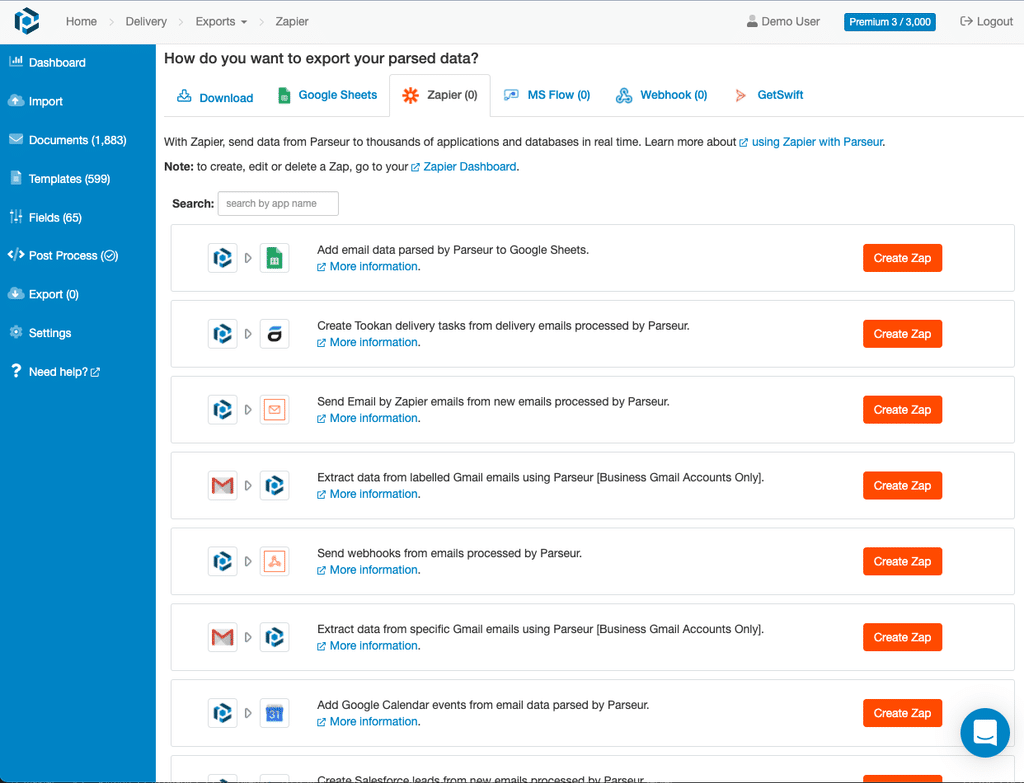

Parsio is an automated data extraction tool designed to capture information from emails and attachments, including PDFs, HTML, XML, and XLSX files. By selecting the data you want to extract, Parsio automatically processes similar incoming emails, reducing manual effort.

The extracted data can be downloaded in Excel, CSV, or JSON formats. Parsio also integrates with Google Spreadsheets, webhooks, and over 4,000 applications via Zapier, Pabbly Connect, Integrately, Integromat, and KonnectzIt.

Pros

- Great for Automation: Ideal for extracting data from emails and PDF attachments, especially when integrated with Zapier, Integromat, Integrately, Konnectzit, or Pabbly Connect.

- Intuitive Interface: The platform is user-friendly, making it quick and easy to navigate.

- Excellent Customer Support: Responsive support team helps with setup and troubleshooting.

- Effortless Setup: Simplifies automation, reducing the need for manual data entry.

- Seamless Integrations: Connects smoothly with Webhooks, Zapier, and Google Sheets for streamlined workflows.

Cons

- UI Issues for Some Users: The interface could be more refined for better usability.

- Complex Template Setup: Configuring advanced templates can be challenging, though support is available.

- High Cost: Pricing may be steep for small businesses, limiting accessibility.

Pricing

- Starter: $49/month – 1,000 credits/month, ideal for individuals and small businesses. Includes OCR, AI, and GPT-powered parsers, 90-day data retention, unlimited integrations via Zapier and Make, webhooks, API, and all Sandbox features.

- Growth (Most Popular): $149/month – 5,000 credits/month, suitable for growing businesses. Includes all Starter features.

- Business: $299/month – 12,000 credits/month, designed for larger teams. Includes all Growth features, 180-day data retention, and dedicated support.

9. Parseur

Parseur is a document processing solution designed for small and medium-sized businesses, helping to eliminate manual data entry with its advanced Zonal and Dynamic OCR engines. It efficiently extracts data from PDFs and emails, automating workflows and reducing processing time.

The extracted data can be seamlessly integrated with various applications and databases, including Excel and Google Sheets, streamlining operations for businesses handling high volumes of documents.

Pros

- Enhances CRM: Integrates smoothly with platforms like Pipedrive, improving customer relationship management.

- Time-Saving: Automates data extraction, significantly reducing manual effort and processing time.

- Excellent Support: Responsive customer service team that assists users effectively.

- User-Friendly Design: Intuitive interface with thoughtful features to simplify document processing.

Cons

- Limited Parsing Adjustments: Offers minimal flexibility for refining parsing rules when extraction results are inaccurate.

- Lack of Detailed Instructions: Users may struggle with setup due to insufficient guidance beyond basic functionality.

- Email Limit Alerts: No clear notifications when nearing the email processing limit, leading to potential disruptions.

Pricing

Pay as You Grow: Flexible pricing model.

Cost: $0.33 per page.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about Veryfi alternatives:

What factors should I consider when choosing a Veryfi alternative?

When selecting a Veryfi alternative, consider key factors such as OCR accuracy, automation capabilities, integration with accounting software, and pricing. Look for tools that support multiple document formats, offer seamless API connections, and ensure compliance with industry standards. Additionally, evaluate ease of use, customer support, and scalability to match your business’s invoice processing needs.

Are these alternatives suitable for small businesses?

Yes, many Veryfi alternatives are suitable for small businesses. Solutions like DocuClipper, AutoEntry, and Nanonets offer cost-effective pricing, easy setup, and automation features that reduce manual data entry. These tools streamline invoice processing, improve accuracy, and integrate with accounting software, making them accessible for businesses without requiring extensive technical expertise or large budgets.

Do these tools support multiple languages?

Yes, many Veryfi alternatives support multiple languages. Platforms like Rossum, ABBYY FlexiCapture, and Nanonets offer multilingual OCR capabilities, allowing businesses to process invoices and financial documents in different languages. However, language support varies by platform, so it’s best to check with the provider to ensure compatibility with your specific needs

Can these platforms integrate with existing enterprise systems?

Yes, most Veryfi alternatives offer integration with enterprise systems through APIs, webhooks, and direct connections. Solutions like Rossum, Nanonets, and Stampli support ERP and accounting software such as SAP, QuickBooks, Xero, and Oracle. However, integration capabilities vary, so it’s important to verify compatibility with your existing workflow before choosing a platform.

Is training required to use these document processing tools?

Most document processing tools are designed to be user-friendly, but some level of training may be required, especially for advanced features like custom data extraction and workflow automation. Platforms with AI-driven learning need minimal setup, while others may require manual configuration. Many providers offer tutorials, documentation, or customer support to assist with onboarding and ensure a smooth implementation process.