AI-Powered Bank Statement Analyzer

99% Accurate Bank Statement Fraud Detection in Seconds

Stop Losing Money to Fraudulent Bank Statements

Our advanced bank statement analyzer uses AI to instantly detect fraudulent documents, tampering attempts, and suspicious patterns in financial statements.

Highest Accuracy

Real-Time Results

AI-Powered Analysis

Trusted by 10,000+ Businesses Around the World

Why Organizations Choose Our Bank Statement Analyzer

Streamline your verification process while protecting your organization from fraudulent documents.

Reduce Fraud Risk

Detect fraudulent bank statements before acceptance, protecting your organization from potential losses and liabilities.

Accelerate Processing

Automate bank statement verification and fraud detection, reducing manual review time and accelerating your workflow.

Strengthen Compliance

Meet regulatory requirements with comprehensive fraud detection audit trails and documentation.

Improve Recovery

Early fraud detection helps prevent losses and increases the chances of recovery in case of fraudulent activities.

Scale Operations

Handle more document verification without increasing headcount. AI-powered analysis scales with your business.

Real-Time Decisions

Get instant fraud analysis results, enabling quick decisions on document verification and faster processing.

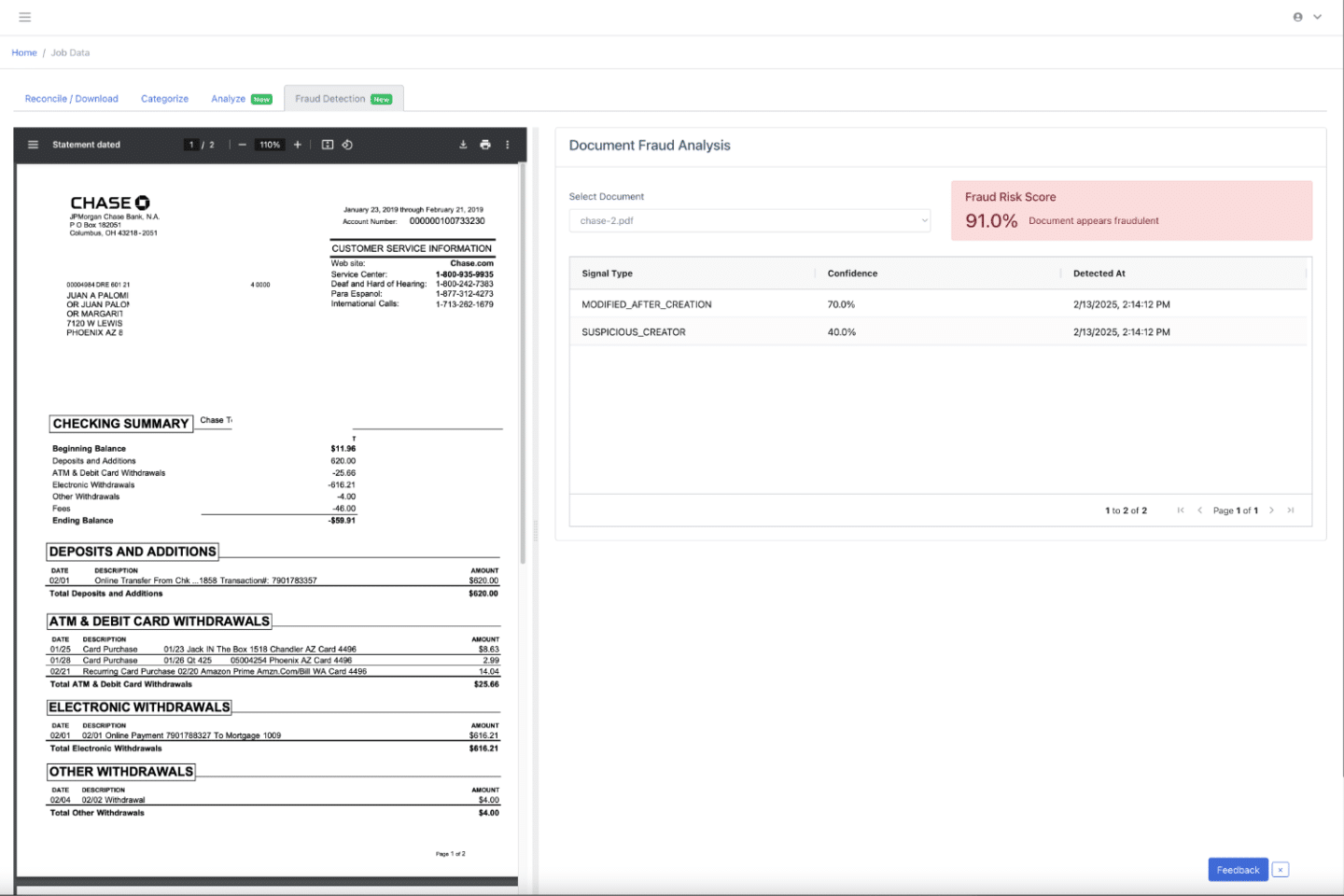

Analyze Bank Statements in Just 3 Simple Steps

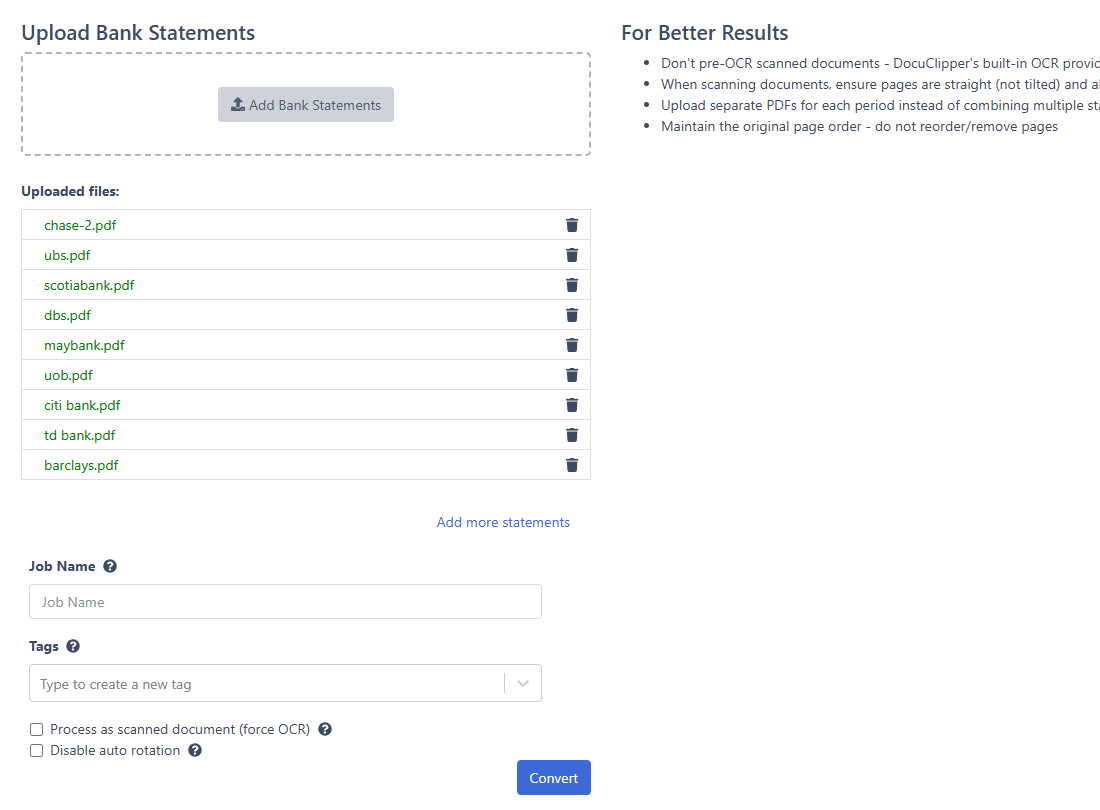

Quick and Secure Document Upload

Simply drag and drop your bank statements. Our secure system handles the rest, protecting your data with enterprise-grade encryption throughout the process.

Start Now

Automated Analysis in Seconds

Watch as our AI instantly processes your documents, checking for over 50 fraud indicators and patterns. No manual review needed - our system does all the heavy lifting.

See How It Works

Clear Results at a Glance

Get straightforward risk assessments with highlighted concerns and detailed explanations. Make informed decisions quickly with our easy-to-understand reports.

Try for Free Now

Get Comprehensive Bank Statement Analysis

Multi-Layer Document Verification System

Our AI performs comprehensive analysis across structural, transactional, and metadata layers, comparing against thousands of verified templates from financial institutions to ensure bank statement authenticity.

P.O. Box 12345

Columbus, OH 43201

1-800-935-9935

| DATE | DESCRIPTION | AMOUNT |

|---|---|---|

| 01/03 | Direct Deposit - ACME CORP | $2,450.00 |

| 01/15 | ATM Withdrawal | -$999.99 |

| 01/25 | Transfer to External Account | -$500.00 |

| 01/32 | ATM Withdrawal | -$300.00 |

| 01/22 | POS Debit - Walmart | -$156.78 |

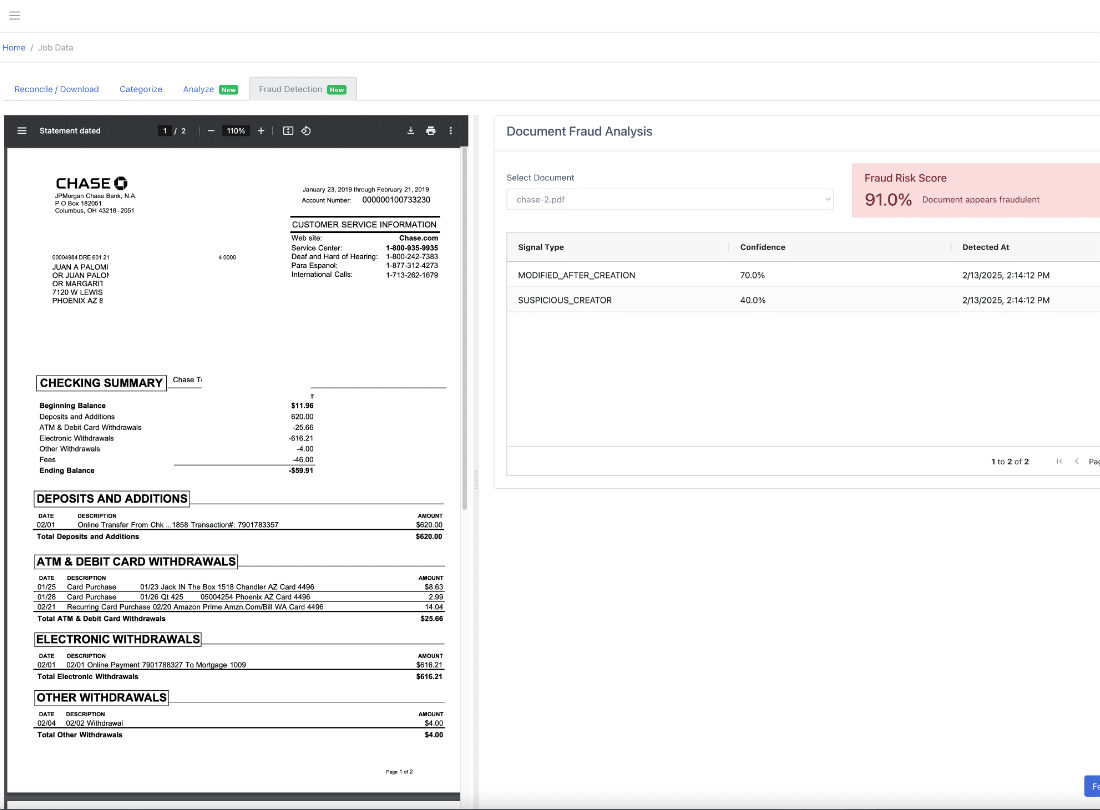

Get a Quick Overview of Fraud Risk Score

Know exactly how risky a bank statement is in seconds. Our AI analyzes many data points to give you a clear fraud risk score, so you can make lending decisions with confidence and stop fraud before it impacts your bottom line.

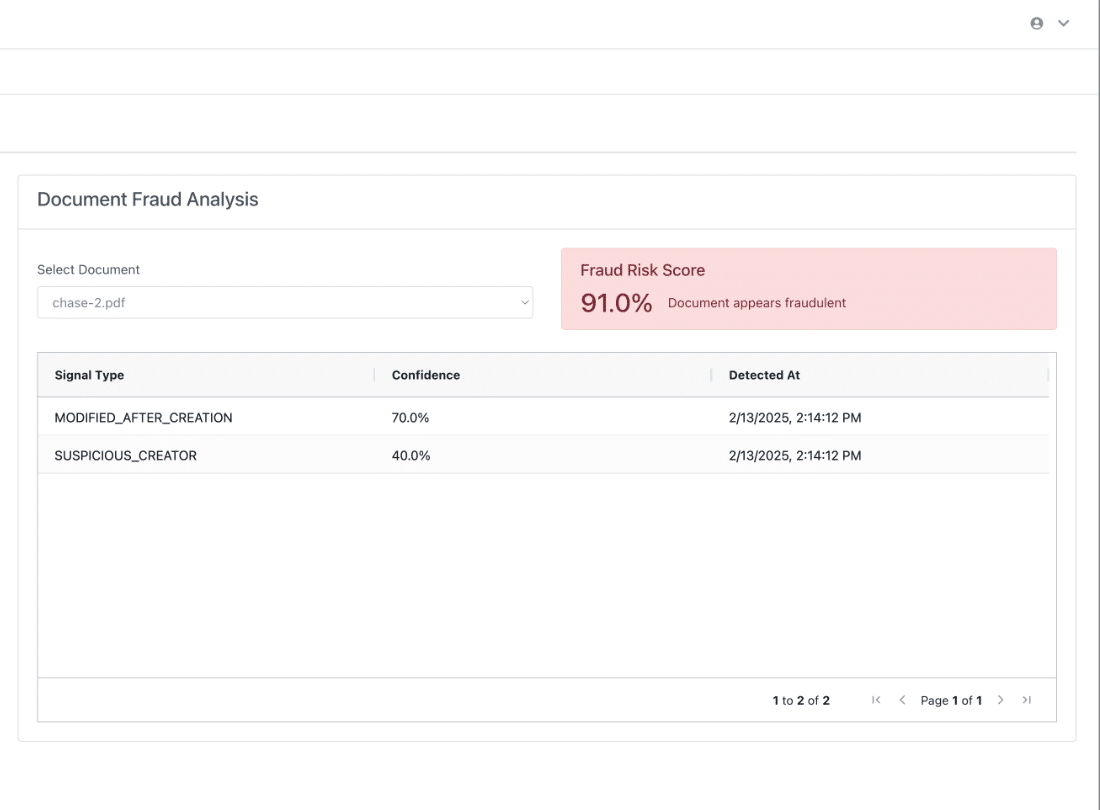

Detect Document Tampering with Precision

Our advanced AI analyzes multiple fraud signals to give you a comprehensive view of document authenticity. Each signal is analyzed with a confidence score to help you make informed decisions.

| Signal Type | Confidence | Detected At |

|---|---|---|

| MODIFIED_AFTER_CREATION | 70.0% | 2/13/2025, 2:14:12 PM |

| SUSPICIOUS_CREATOR | 40.0% | 2/13/2025, 2:14:12 PM |

| METADATA_MISMATCH | 85.0% | 2/13/2025, 2:14:12 PM |

| BALANCE_INCONSISTENCY | 92.0% | 2/13/2025, 2:14:13 PM |

| FONT_MISMATCH_DETECTED | 78.0% | 2/13/2025, 2:14:13 PM |

| TRANSACTION_MANIPULATION | 95.0% | 2/13/2025, 2:14:13 PM |

| LAYOUT_ANOMALY | 63.0% | 2/13/2025, 2:14:14 PM |

| PDF_STRUCTURE_ALTERED | 88.0% | 2/13/2025, 2:14:14 PM |

Bank Statement Analysis for Every Industry

From financial institutions to property management, our analyzer adapts to your specific verification needs with enterprise-grade fraud detection.

Financial Institutions & Banking

Streamline document verification processes and enhance fraud detection across all banking operations.

- Account opening verification

- Transaction fraud detection

- Regulatory compliance checks

Forensic Accounting

Power your financial investigations with AI-driven document analysis to uncover manipulations and irregularities.

- Document tampering detection

- Historical statement verification

- Pattern anomaly identification

Audit & Compliance

Enhance audit efficiency with automated bank statement verification and comprehensive fraud detection.

- Automated statement validation

- Audit trail documentation

- Compliance reporting support

Insurance Providers

Verify claims and assess risk with accurate bank statement analysis and fraud prevention.

- Claims verification

- Financial history validation

- Risk assessment automation

Property Management

Streamline tenant screening and rent payment verification with automated bank statement analysis.

- Tenant income verification

- Payment history validation

- Rental deposit confirmation

Lending Operations

Make confident lending decisions with comprehensive bank statement verification and fraud detection.

- Income verification automation

- Fraud risk assessment

- Payment capacity analysis

Start Detecting Bank Statement Fraud Today

Join leading lenders, credit unions, auditors, forensic accountants, and financial institutions who trust our AI-powered bank statement analyzer to protect their portfolios and streamline operations.

FAQs about Bank Statement Analyzer

What is a bank statement analyzer?

A bank statement analyzer is an AI-powered software that automatically verifies and analyzes bank statements for authenticity, fraud signals, and financial patterns. It helps lenders make faster, more confident lending decisions.

How do you analyse a bank statement?

DocuClipper AI analyzer examines multiple aspects including document metadata, layout patterns, transaction consistency, and balance calculations. It automatically flags suspicious patterns and provides a comprehensive fraud risk score.

Is there an app that analyzes bank statements?

Yes, DocuClipper provides a web-based bank statement analyzer that works instantly without any installation. Simply upload your statement and get fraud detection results in seconds.

Can ChatGPT read bank statements?

While ChatGPT can read text, it can’t verify document authenticity or detect fraud. DocuClipper’s specialized AI is specifically trained on millions of bank statements for accurate fraud detection.

Why would a banker need to Analyse financial statements?

Bankers analyze financial statements to verify income, assess creditworthiness, detect potential fraud, and ensure regulatory compliance. Our analyzer automates this process, saving hours of manual review

What is document fraud detection?

Document fraud detection is the process of identifying manipulated or falsified documents through AI analysis of metadata, content consistency, layout patterns, and other technical markers of authenticity.

Why is bank statement analyzer important?

Bank statement analyzers prevent lending losses by detecting fraudulent applications early, reduce manual review time by 75%, and help maintain regulatory compliance through automated verification processes.

How to identify fraud in a bank statement?

With DocuClipper, you can identify fraud by checking for document tampering, inconsistent fonts, modified metadata, balance irregularities, and suspicious transaction patterns – all automatically within seconds.