Transform Loan Underwriting with AI-Powered Document Analysis

Reduce processing time by 80% while improving accuracy and compliance

DocuClipper automates the extraction and analysis of financial documents, turning hours of manual review into minutes of automated precision. Our platform handles bank statements, credit card statements, and tax forms so your team can focus on making decisions, not data entry.

| Date | Description | Amount |

|---|---|---|

| 01/03 | Direct Deposit - Payroll | $3,245.67 |

| 01/05 | ATM Withdrawal | -$200.00 |

| 01/08 | Mortgage Payment | -$1,542.33 |

| 01/12 | Grocery Store | -$156.78 |

| 01/15 | Car Insurance | -$98.45 |

| 01/17 | Online Transfer | $500.00 |

| 01/18 | Restaurant | -$68.42 |

-

Amazon.com01/05/2025$124.99

-

Starbucks01/07/2025$8.45

-

Walmart01/08/2025$67.32

-

Gas Station01/10/2025$45.78

-

Netflix01/15/2025$14.99

-

Restaurant01/17/2025$78.50

Trusted by 10,000+ Businesses Around the World

Challenges & Solutions

See how DocuClipper transforms the most challenging aspects of loan document processing into streamlined, efficient workflows.

Lender Challenges

Manual Data Extraction from Statements

Loan processors spend countless hours manually extracting transaction data from PDF bank and credit card statements.

Document Fraud Risk

Detecting altered or falsified bank statements is difficult and time-consuming, creating fraud vulnerabilities in the underwriting process.

Diverse Statement Formats

Each financial institution uses different PDF formats for statements, making automation difficult and creating processing bottlenecks.

Tax Form Data Entry

Manual extraction of financial data from tax forms is error-prone and creates delays in the verification process.

Processing Bottlenecks

Document processing becomes a critical bottleneck during high-volume periods, slowing down the entire lending operation.

DocuClipper Solutions

Automated Transaction Extraction

Convert PDF bank statements into structured transaction data in seconds, eliminating manual data entry and speeding up the underwriting process.

Bank Statement Fraud Detection

Automatically identify potentially altered or fraudulent bank statements with advanced analysis that detects tampering and inconsistencies.

Universal Format Processing

Process statements from any financial institutions regardless of their format, extracting transaction data with high accuracy.

Tax Form Data Extraction

Automatically extract key data points from tax documents, eliminating manual data entry and accelerating the verification process.

Scalable Document Processing

Handle unlimited documents without processing delays, maintaining consistent quality and speed regardless of volume.

Streamline Your Underwriting Process & Protect Your Business

| Date | Description | Amount |

|---|

Bank & Credit Card Statement Converter

Transform unstructured PDF statements into organized, machine-readable data in seconds. Our advanced OCR and AI technology automatically extracts transaction details from bank and credit card statements from any financial institutions.

- Automatic Conversion for Any PDF Bank Statements Drag and drop your bank or credit card statements into DocuClipper, and it automatically converts them into Excel, CSV, or QBO formats in seconds.

- Supports Both Scanned and Digital PDF Versions You can upload both scanned and digitally generated PDF bank statements to DocuClipper, and it will accurately extract the data from either type.

- Seamless Integrations Connect DocuClipper with your preferred accounting software, such as QuickBooks, Xero, and Sage, to directly import the converted bank statements.

- Bank Statement Reconciliation DocuClipper automatically reconciles your bank statements by comparing the transaction totals with the summary information.

- Automatic Multiple Account Detection Upload a bank statement with multiple accounts, and DocuClipper will automatically detect and separate the transactions for each account.

Multi-Layer Document Verification System

Our AI performs comprehensive analysis across structural, transactional, and metadata layers, comparing against thousands of verified templates from financial institutions to ensure bank statement authenticity.

P.O. Box 12345

Columbus, OH 43201

1-800-935-9935

| DATE | DESCRIPTION | AMOUNT |

|---|---|---|

| 01/03 | Direct Deposit - ACME CORP | $2,450.00 |

| 01/15 | ATM Withdrawal | -$999.99 |

| 01/25 | Transfer to External Account | -$500.00 |

| 01/32 | ATM Withdrawal | -$300.00 |

| 01/22 | POS Debit - Walmart | -$156.78 |

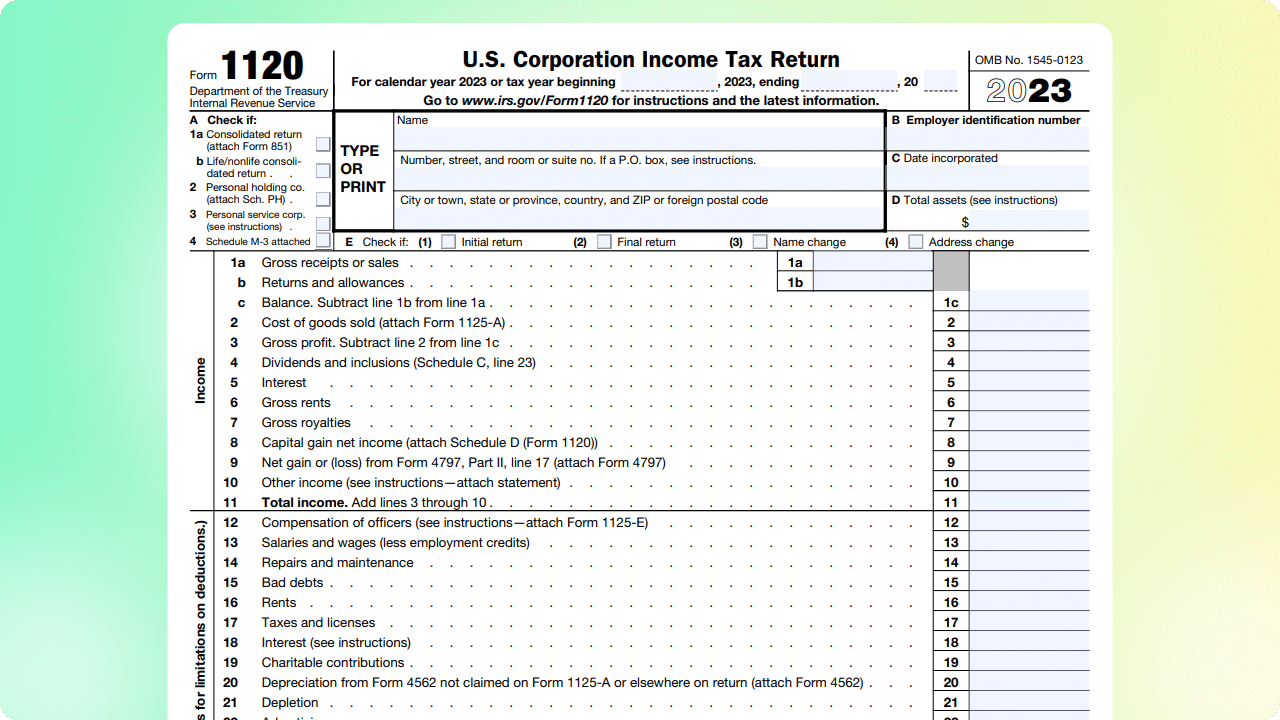

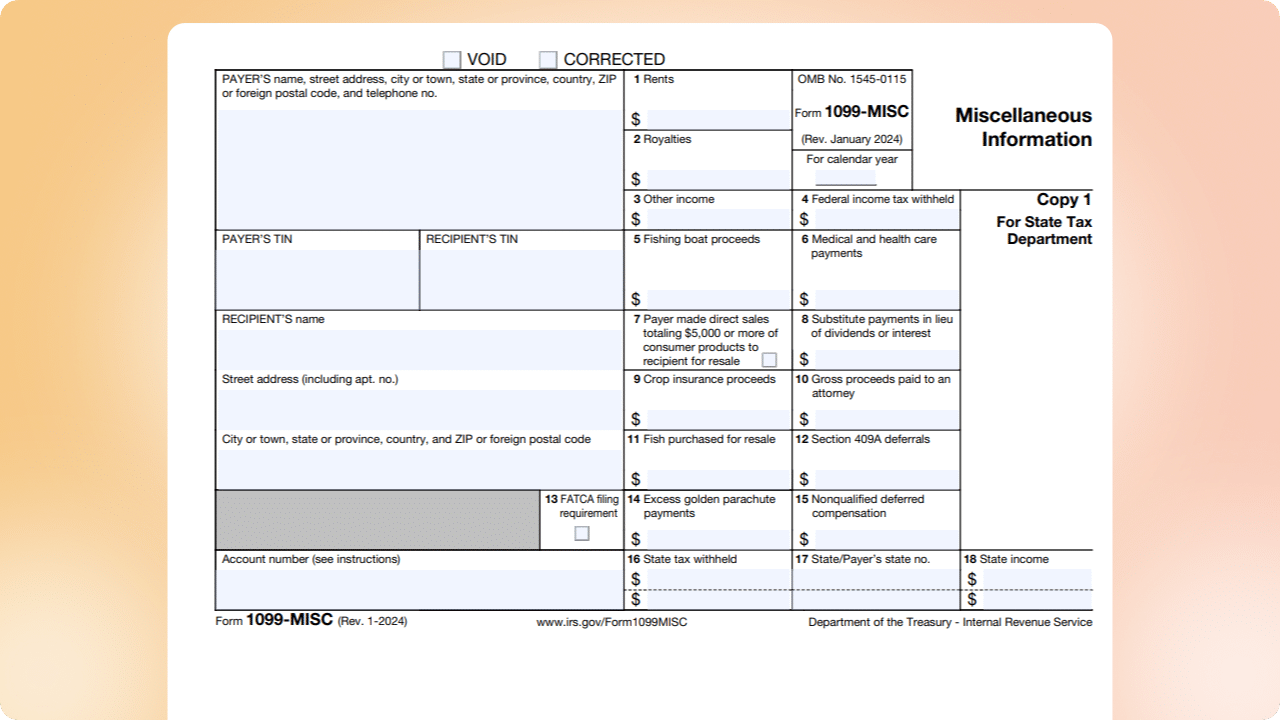

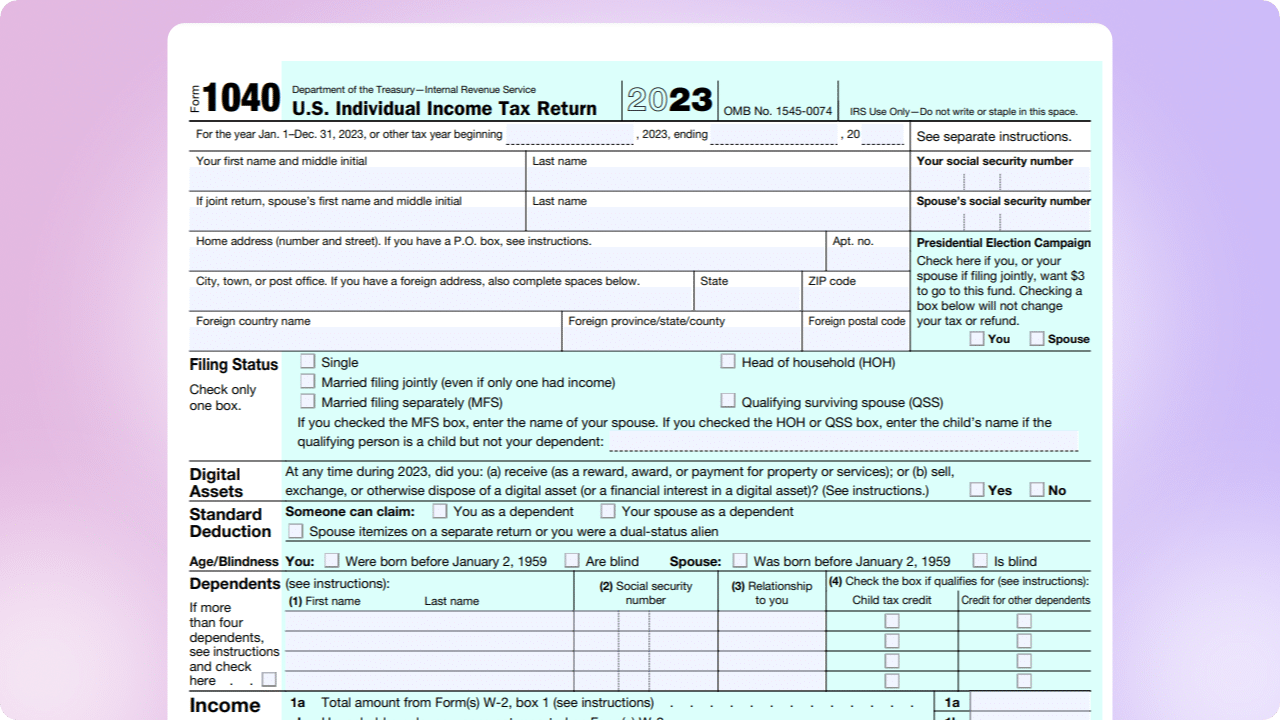

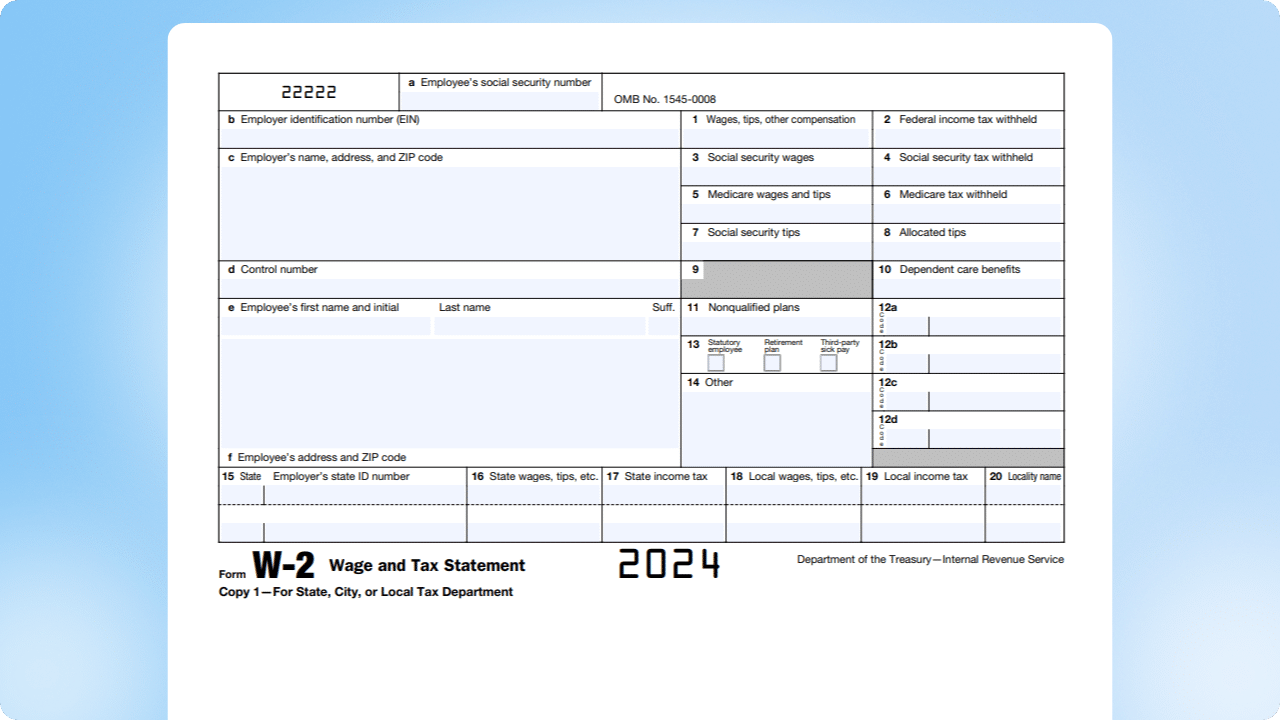

Automatically Extract Data from IRS Tax Forms

Simplify your tax document processing with DocuClipper’s advanced OCR technology. Automatically extract and convert key data from IRS tax forms, including 1120, 1040, 1099, and W2, ensuring accuracy and compliance. Export the data into Excel, CSV, or seamlessly integrate it into your accounting and tax software.

Top Features:

- Automatic Conversion for Any IRS Tax Forms Quickly and accurately convert any IRS tax form to Excel, CSV, or other formats.

- Supports Both Scanned and Digital PDF Versions Efficiently process both scanned and digital PDF versions of IRS tax forms.

- Seamless Integrations Easily integrate extracted data into your existing accounting and tax software.

- Accurate Data Extraction for All Tax Form Fields Ensure precise extraction of all relevant fields from various IRS tax forms.

Easily Import Your Data to Any ERP or Accounting Software

DocuClipper seamlessly integrates with QuickBooks and allows you to export your data into several format types so you can easily import your processed documents into any of your accounting or ERP software.

- One-Click QuickBooks Import Connect DocuClipper with your QuickBooks account to automatically upload data from invoices, receipts, and bank statements directly into QuickBooks.

- Specialized Export Options DocuClipper offers specialized export options for Xero, Sage, Quicken, and other accounting software, ensuring seamless data integration.

- Wide Export Options Export your data to CSV, Excel, QBO, QIF, and other file types, facilitating easy import into any accounting or ERP software.

Transform Your Lending Business

See how DocuClipper delivers tangible business outcomes for mortgage, business, and consumer lenders

Accelerate Loan Approval Cycles

Close loans faster by eliminating document processing bottlenecks. Reduce the time spent reviewing financial statements so your team can focus on making lending decisions, not data entry.

Minimize Fraud-Related Losses

Catch fraudulent applications before approving them. Automatically detect manipulated bank statements that manual reviewers might miss, protecting your portfolio from bad loans.

Accept Statements From Any Bank

Never turn away qualified borrowers because you can't process their bank statements. Handle documents from any financial institution regardless of format, expanding your potential customer base.

Reduce Costly Underwriting Errors

Make better lending decisions based on accurate data. Eliminate manual data entry errors that can lead to improper risk assessments, ensuring your underwriting is based on factual information.

Handle Seasonal Application Surges

Maintain consistent service levels during high-volume periods without adding staff. Process any volume of applications without delays, keeping your customers happy and your costs predictable.

Enhance Borrower Experience

Delight customers with faster decisions and fewer document requests. Reduce the back-and-forth of manual document verification, creating a smoother loan process that keeps borrowers coming back.

See Why Finance Professionals Love DocuClipper

Cut loan processing time by 80% while detecting fraudulent applications

Try for Free

Start your 14-day free trial today and see how our bank statement and credit card analyzer transforms your underwriting process.

FAQs about OCR for Lenders

What is OCR in underwriting?

OCR technology converts financial documents into machine-readable data. In lending, it automatically extracts account information and transaction details from bank statements and tax forms, eliminating manual data entry in the underwriting process.

How OCR helps lenders?

OCR reduces document processing time by 70-80%, eliminates human data entry errors, and ensures consistent analysis. This allows faster loan approvals, lower operational costs, and the ability to scale operations during high-volume periods.

How do lenders use AI to process bank statements?

Lenders use AI to extract transaction data, categorize financial activities, identify income patterns, and detect potential fraud. This automation converts unstructured PDF statements into organized digital data ready for underwriting analysis.

Can bank statement OCR solutions detect fraudulent documents?

Yes, advanced OCR systems detect potentially fraudulent documents by identifying visual inconsistencies, unusual formatting, suspicious transaction patterns, and metadata irregularities that human reviewers might miss, reducing fraud risk significantly.

How do small lenders compete with large banks' document processing?

Small lenders can leverage cloud-based OCR solutions with per-document pricing models, eliminating the need for massive IT investments while achieving comparable efficiency and accuracy to larger competitors.

What are the risks of manual data entry in loan underwriting?

DocuClipper stands out as the best bank statement converter due to its highest accuracy, fastest processing, compatibility with all bank and credit card statements, affordability, and top-notch security.

How much can lenders reduce underwriting costs with automation?

Lenders typically reduce underwriting costs by 40-60% through automation by decreasing labor expenses, minimizing errors, and improving operational efficiency. Most see positive ROI within 6-12 months of implementation.